The informal meeting of European leaders began on 10 March 2022 and will continue today (11 March 2022).

This time the meeting is held in Versailles and is attended by the heads of state and government of the European Union.

The topic of the meeting is Russia's military aggression against Ukraine and its consequences.

The EU leaders condemned the Russian military invasion of Ukraine, which constitutes a flagrant violation of international law and threatens European security, while praising the courage of the Ukrainian people in defending their homeland.

EU leaders continue to discuss how to strengthen European sovereignty and reduce dependence on Russia.

In this context, the following important topics are also discussed

The day before the EU leaders' meeting (9 March 2022), the EU Council adopted further measures, which are also directed at Belarus, which is participating in the invasion of Ukraine.

Measures taken include

More on the EU's response to the Russian invasion

https://www.consilium.europa.eu/cs/policies/eu-response-ukraine-invasion/

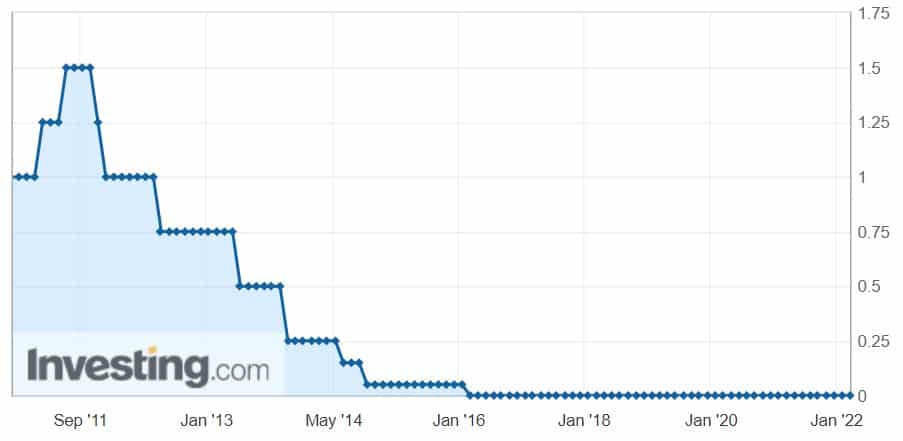

The European Central Bank left its current key rates unchanged at the meeting. Practically nothing else could be expected.

As we can see in the chart, the ECB has not raised rates since 2016 and they are currently still at zero.

However, the European Central Bank surprised the markets by trying to end the stimulus earlier than planned!

The statement said that the ECB would end its bond-buying programme in the third quarter if the economy allowed. But the ECB also added that it was ready to reconsider the decision if the outlook changed.

A couple of minor changes accompany the announcement that the European Central Bank is slowly and surely moving away from the rhetoric that key rates could be lower than they currently are.

That's not surprising. No one would have expected a rate cut below 0% to happen yet.

The surprise move comes amid growing fears that the eurozone economy could soon experience stagflation. Consumer prices in the 19 countries that use the euro have climbed to record highs for four consecutive months, most recently reaching 5.8% in February.

The President of the European Central Bank, Christine Lagarde, mentioned at her press conference that an increase in key rates could come after the end of quantitative easing (QE).

The prospect of a rate hike is certainly good news for the bulls. But Lagarde later warned that inflation could be much higher in the near future and the euro became rather bearish.

The euro is still under pressure after Wednesday's strengthening, as all diplomatic efforts in the negotiations between Russia and Ukraine are almost fruitless.

Keep following our news to stay up to date!

Sources