We have had a rather interesting trading week. Let's recap together the highlights of our focus.

EUR

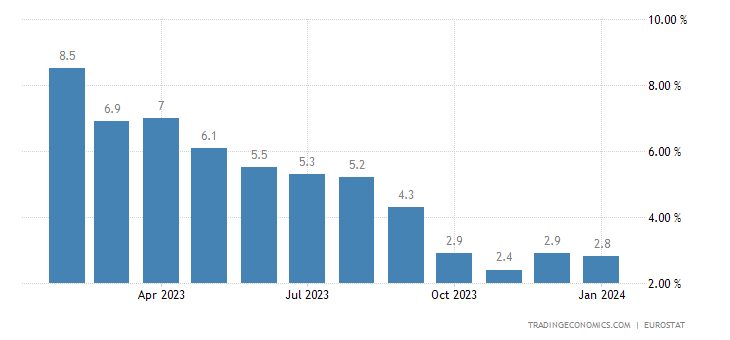

The core inflation rate in the euro area fell to 2.8 % in January. Similarly, we could see a slight reduction in core CPI to 3.3 %. Nothing surprising, all as estimated. It will be some way to go for the ECB to get core inflation into the target range. Negative for the EUR.

Furthermore, according to preliminary estimates, we could observe a slight decrease in the manufacturing sector (PMI) to 46.1 points. Industrial production has declined for the 11th month in a row, which is not good. The positive news was services, which rose to 50 points. This represents an expansion in the sector and is the highest reading in 7 months.

Other currencies we had in our sights: USD, CAD, NZD...

What's in store for us this week?

Monday 26 February: scheduled speeches by the Bank of England and ECB President Christine Lagarde

Tuesday 27 February: inflation rate in Japan

Sources: