Last week was really rich in data. The market focused mostly on the Fed meeting and the US labour market, thanks to which we could see volatility on the USD. Let's recap the highlights, whatever you're in for this week...

CZK

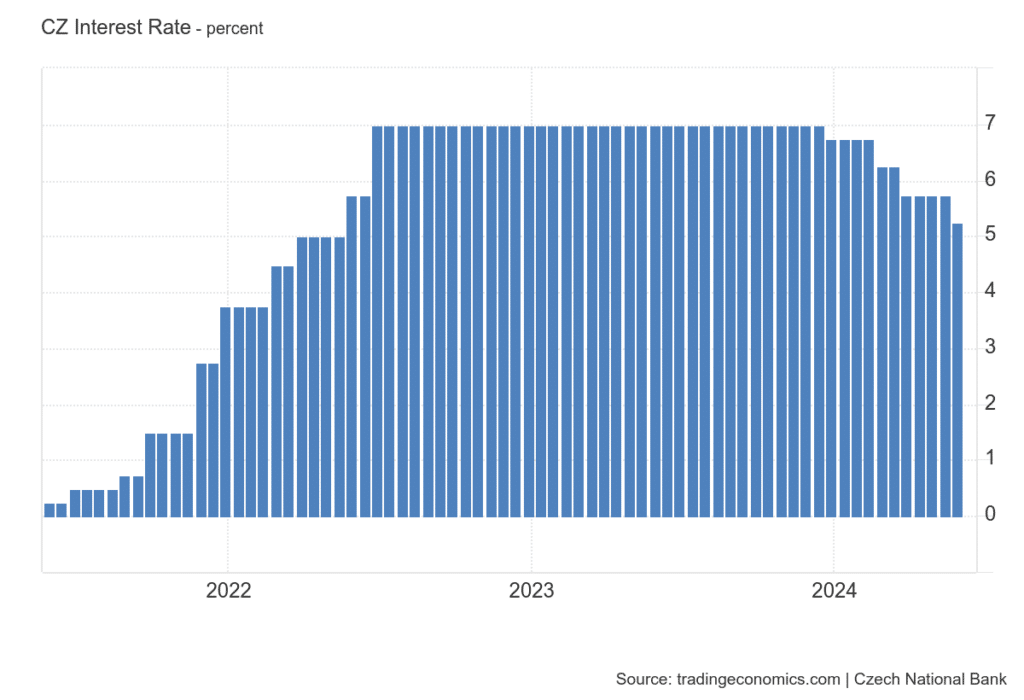

The Czech National Bank cut the rate by 50 basis points on Thursday, which was in line with market expectations. The move marked the third 50 basis point cut in a row. The CNB has met its inflation target of 2 % in the past 2 months. However, the Czech koruna strengthened during the press conference as the Board mentioned that it continues to see moderate inflation risks. Their fulfilment would mean that inflation would again reach the upper boundary of the target band. This is leading the central bank to persist with tighter monetary policy and will approach further rate cuts very cautiously.

What's in store for us this week?

Tuesday: RBA meeting and Australian retail sales (AUD), Swiss unemployment rate (CHF)

Sources: