Monday's recap is out! Last week's main event was the Bank of Canada meeting. Join us for a refresher on its decisions, and what the impact was on the Canadian dollar.

USD

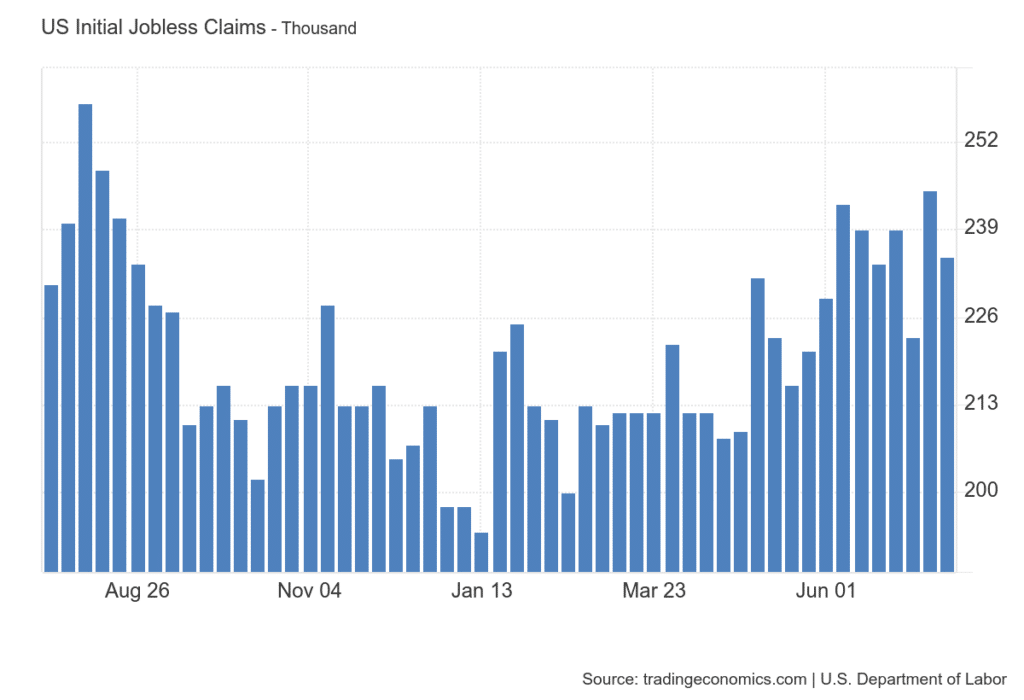

On Thursday, we were waiting for data from the US labour market and GDP, which were positive for the USD. Unemployment claims fell to 235k, which was below market expectations. Despite this decline, the number of claims remained well above this year's average. Although still historically tight, the US labour market has eased since its post-pandemic peak.

In terms of GDP, the US economy grew by 2.8 % according to the preliminary estimate, another smaller surprise than estimated and contributing to the positive labour market report for the USD.

What's in store for us this week?

Monday: German Retail Sales (EUR)

Tuesday: Japanese unemployment rate (JPY), Australian retail sales (AUD), Spanish inflation rate (EUR), German inflation rate (EUR), Eurozone GDP (EUR)

Wednesday: Australian inflation rate (AUD), Bank of Japan meeting (JPY), German labour market (EUR), Eurozone inflation rate (EUR), Canadian GDP (CAD)

This week looks like it will be packed with important fundamentals again. Among the main fundamentals we will be focusing our attention on will be Wednesday's Bank of Japan meeting, Thursday's Bank of England meeting and Friday's US labour market (NFP). We will also be watching CPI data during the week.

Sources: