Monday's recap is here! Last week we had the Fed's monetary policy meeting in the spotlight. Join us as we recap the highlights and what's ahead this week.

GBP

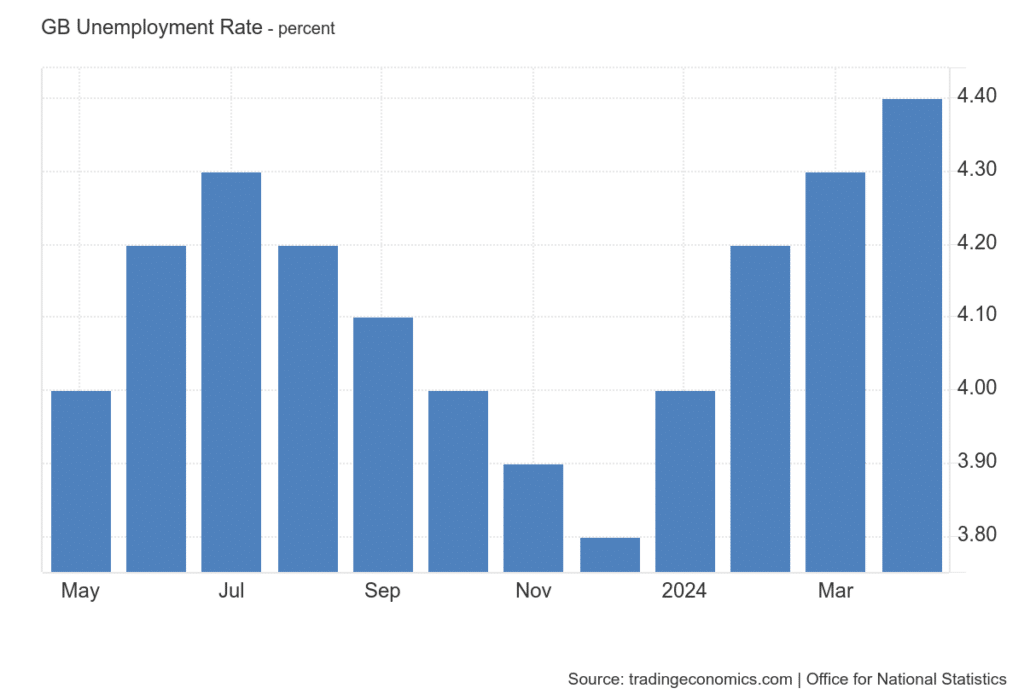

From the UK we only got labour market data on Tuesday, which was negative for the pound. The unemployment rate unexpectedly rose to 4.4 % in April. This was the highest reading since September 2021. Employment fell by 140k, which was also well below estimates. The data confirmed to us that labour market conditions are softening and this is adding to the Bank of England's concerns.

What's in store for us this week?

This week we have three central bank meetings. The RBA is expected to leave the rate unchanged at 4.35 % on Tuesday. The Bank of England is also expected to leave rates unchanged. Things could get more interesting from the SNB, where the option of either cutting rates or leaving them on the table.

Sources: