Last week was nourishing from a fundamental position. Let's look back at the highlights.

EUR

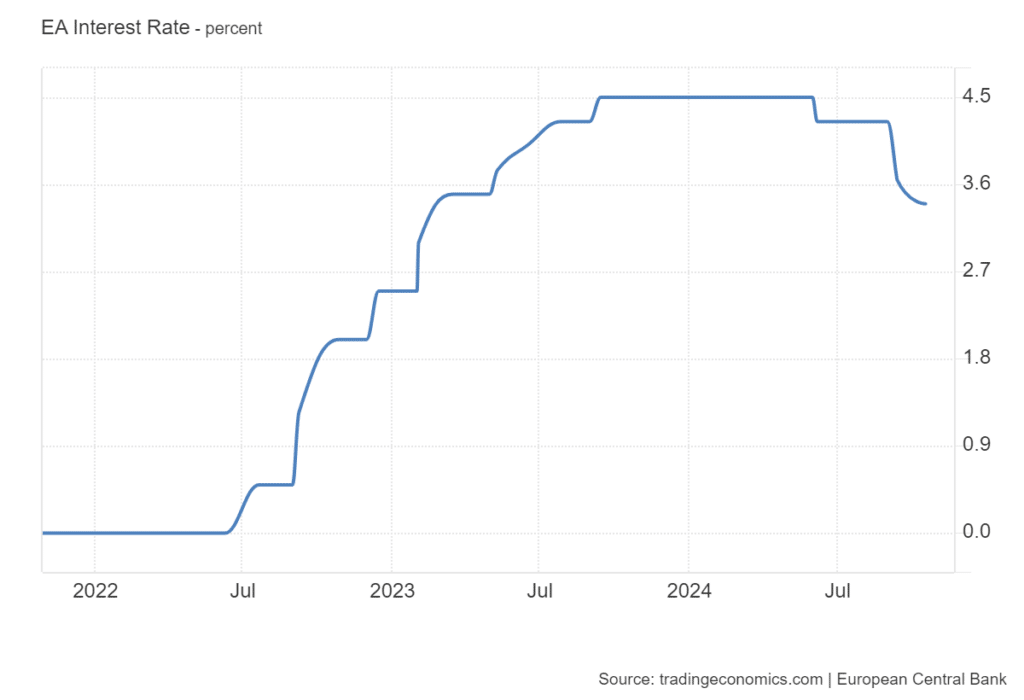

At Thursday's meeting, the ECB cut rates by 25 bp. This decision is based on an updated inflation assessment, which suggests that disinflation is progressing successfully. In September, inflation in the euro area fell below the ECB's 2% target for the first time in more than three years. Although inflation is expected to rise moderately in the short term, it should fall back towards the 2% target in 2025. The European Central Bank has faced criticism for staying behind the curve and not responding sufficiently to warning signs of slowing growth and low inflation in the eurozone. Although ECB President Christine Lagarde acknowledged the risks of weak growth at a press conference, she did not suggest any steps to help improve the situation. In this case, the ECB is rather sleepwalking towards the Fed, which is already taking action, and as a result this stance could have long-term negative effects on the economy. The EUR started to weaken on this data as there is a possibility that the ECB may be forced to cut interest rates more aggressively in the future, for example by 50 basis points. The market is now pricing in this expectation, which is adding pressure to the currency.

What's in store for us this week?

Monday: PPI in Germany

Tuesday: -

Wednesday: meeting of the Bank of Canada

Thursday: PMI (US, Eurozone, UK, Australia, Japan), US Unemployment Claims

Friday: Tokyo inflation rate

Sources: