We have had another week in which central banks played a big role. Let's recall together an important event.

EUR

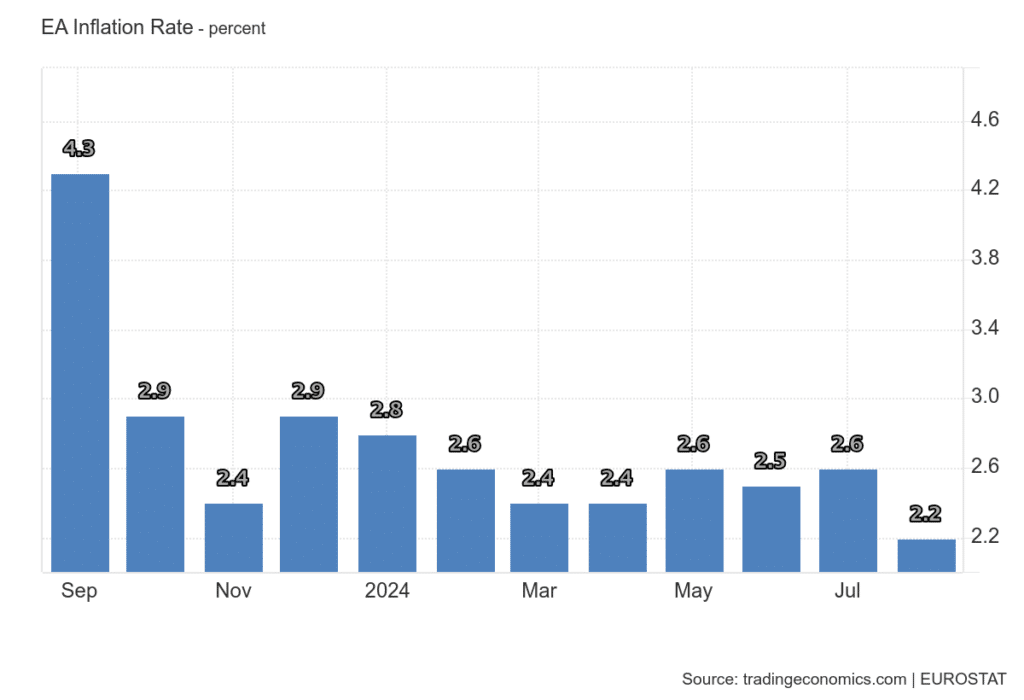

On Tuesday, we got inflation data from the eurozone, which was negative for the euro. The core inflation rate fell to 2.2 % year-on-year, the lowest since July 2021. Core inflation slowed slightly to 2.8 %. The data was broadly as estimated, so no surprises. The ECB announced that it will pause rate cuts in October while it assesses the expected increase in price pressures. At the moment I would take this as negative news for the euro through the downturn, but the ECB will still be on the lookout to meet its inflation target.

What's in store for us this week?

Monday: Eurozone, Australia, UK, US PMI

Tuesday: Japan PMI, Bank of Australia meeting

Wednesday: CNB meeting, inflation rate in Australia

Thursday: GDP and jobless claims in the US, SNB meeting

Friday: Eurozone, Japan and Canadian GDP inflation rates

Sources: