The whole of last week was mostly about monetary policy meetings of central banks, where we got some surprising information. Come along with us for a recap of the highlights to get you up to speed for the new trading week!

GBP

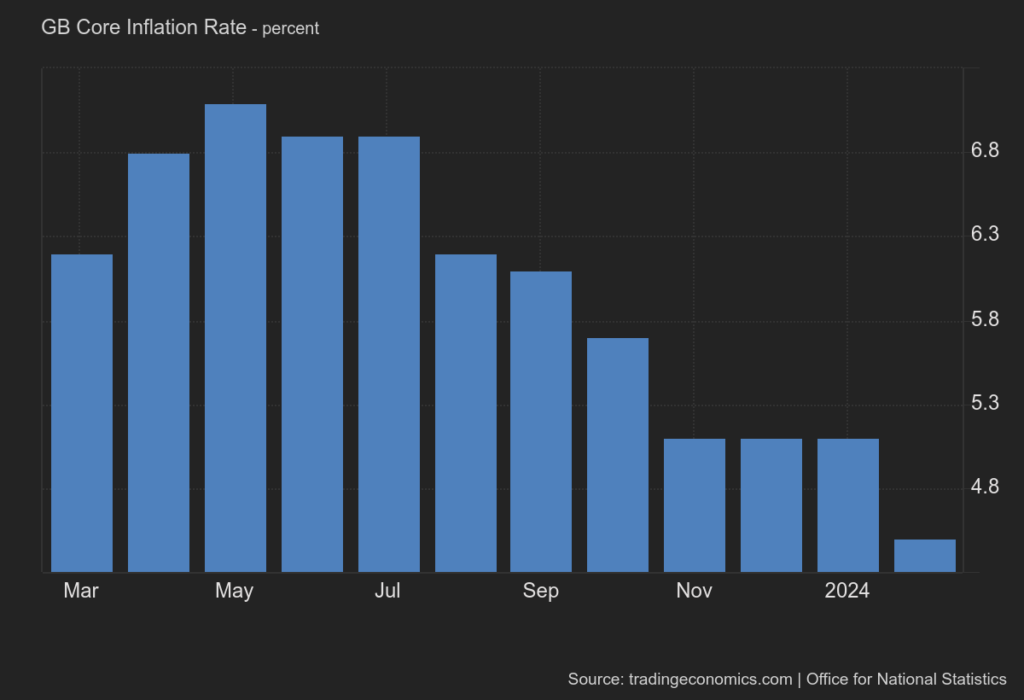

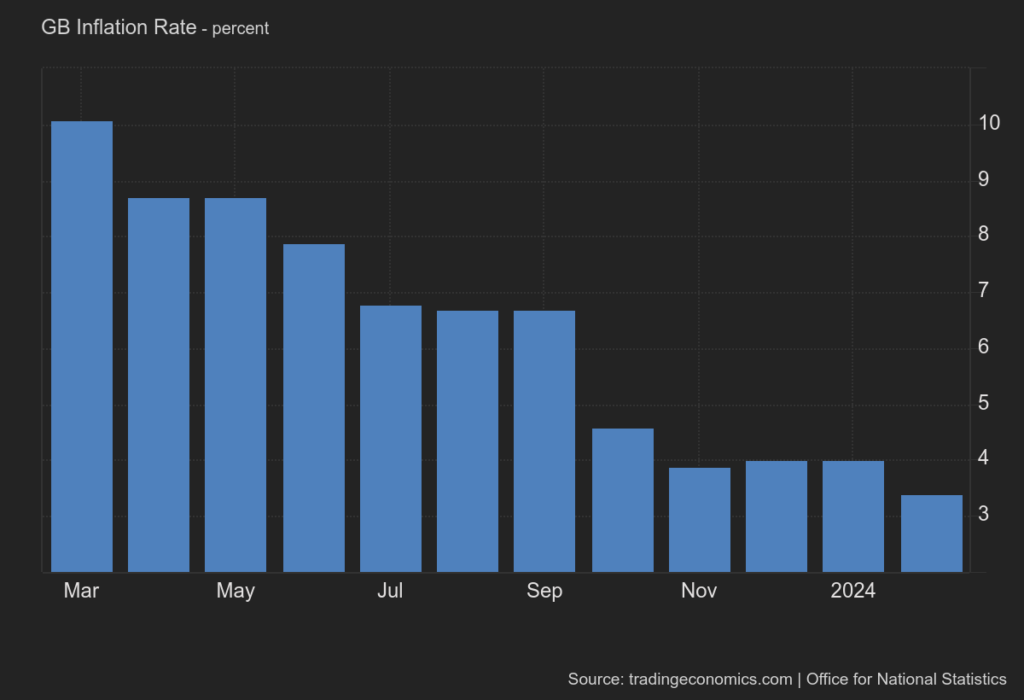

Wednesday's UK inflation rate also showed a decline. The core inflation rate fell to 3.4 % year-on-year in February, taking it to its lowest level since 9/2021. Core inflation fell to 4.5 %, taking it to its lowest level since 1/2022. This is negative news for the pound.

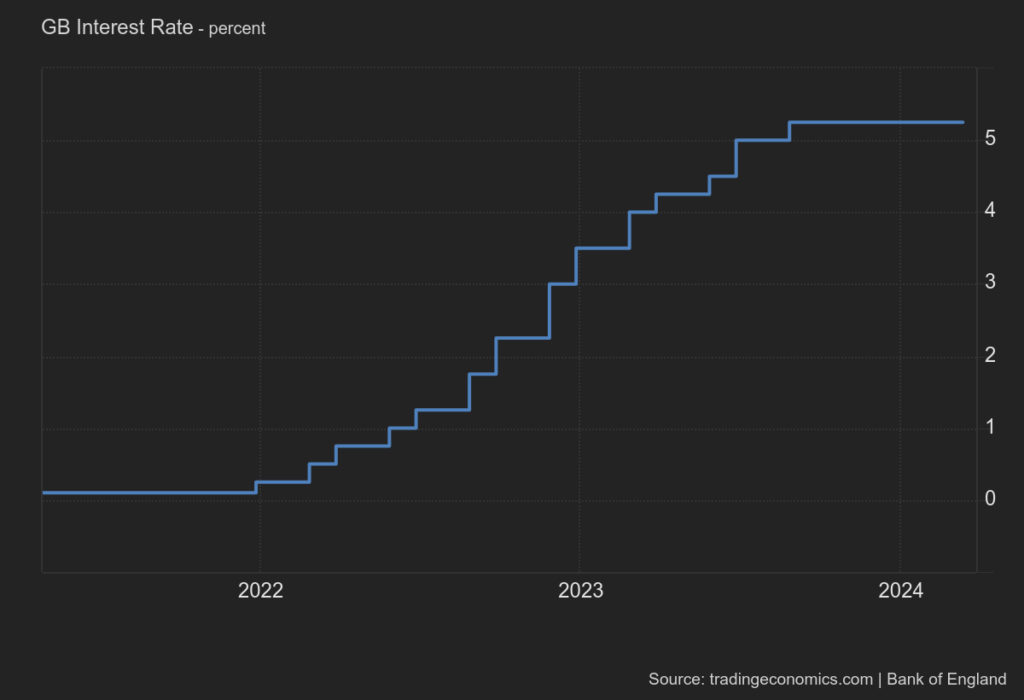

However, we focused more attention on Thursday's meeting of the Bank of England, which is estimated to have left rates unchanged at 5.25 %. One policymaker voted for a 25bp rate cut. BoE Governor Bailey said conditions were favourable for the central bank to start cutting interest rates. So here we could see a dovish stance and it is negative for the pound. Add to that falling inflation and the pound has not had a good week.

What's in store for us this week?

Tuesday: GDP - Spain (EUR)

Wednesday: inflation - Spain (EUR)

Sources: