The weekly recap is here! Join us for a recap of what happened in the last trading week, and what we'll focus on in the current one.

CAD

The Canadian dollar has had a week of worse data.

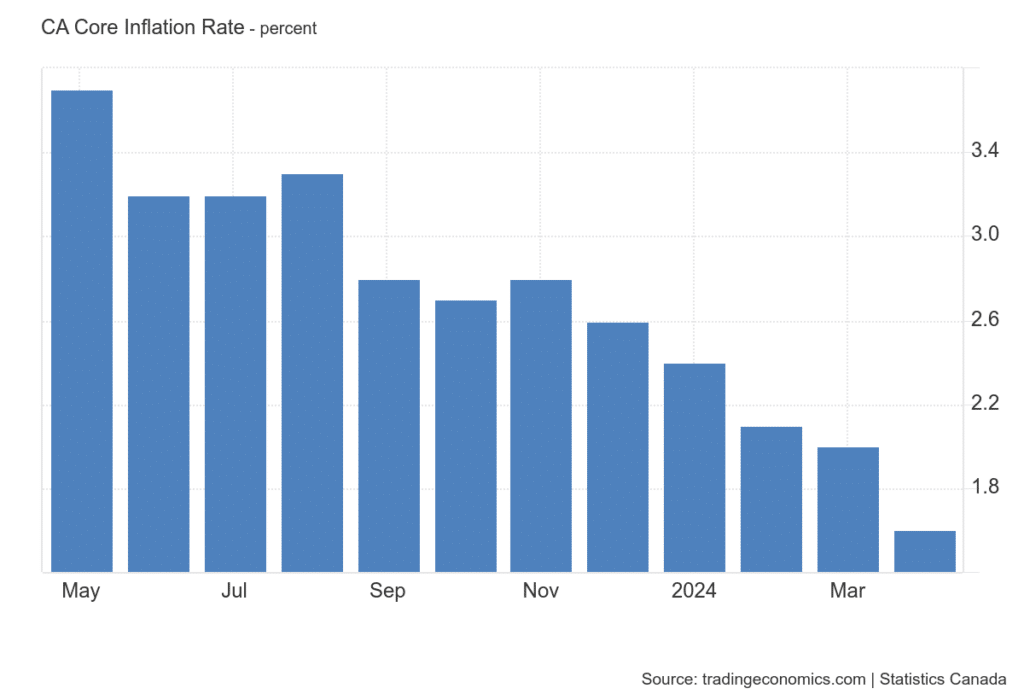

On Tuesday, the core inflation rate came out and declined to 2.7 % year-on-year, marking the mildest pace of growth since 3/2021. Core inflation slowed to 1.6 %, the lowest level in 3 years. The data signal that the start of rate cuts is imminent.

We got the retail data at the end of the week. Month-over-month retail sales came in slightly worse than expected and worse than the prior period, marking the third straight decline, revised from the preliminary stagnation reading. The decline was largely due to a drop in core retail sales, which also came in worse, specifically at -0.6 % versus -0.2 % in the previous period.

What's in store for us this week?

Monday: the United Kingdom (GBP) and the United States (USD) holiday

Tuesday: Australian Retail Sales (AUD)

Wednesday: spanish retail sales + inflation in Germany and the feds (EUR)

Sources: