Welcome to reading the regular Monday Fundamental Summary that we followed during the last trading week.

Last week was particularly rich in statistical data, which came mainly in the second half of the week.

Read on to find out more!

GBP

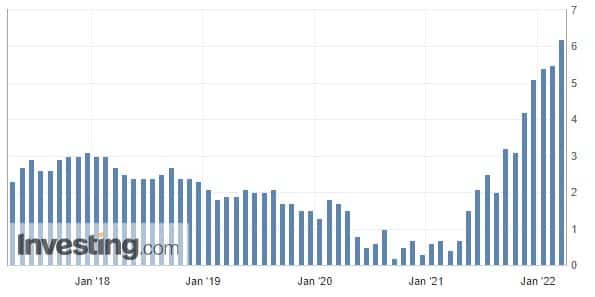

On Wednesday, data from the UK came in regarding the year-on-year change in Consumer Price Index (CPI). The index measures the change in the price of goods and services from the consumer's perspective, making it one of the key indicators of inflation. The index is thus once again reaching all-time highs, which will only continue to put pressure on the Bank of England (BOE) to start tightening policy again in the coming months.

At the end of the week, changes in UK retail sales came in for the UK currency. These turned out to be rather more pessimistic than expected (actual: -0.3 %, previous: 1.9 %).

It looks like the "cost of living crisis" is becoming more apparent.

USD

On Wednesday, we saw comments from Fed Chairman Jerome Powell, who addressed the topic of digital currencies. Powell mentioned that there will have to be new rules and laws to deal with digital currencies, as the existing regulations are not ready for this. This is rather preliminary and general information for now and there is nothing new going on. For now, the Fed is exploring the benefits that digital currency could bring.

Later that day, Loretta Mester, the president of the Cleveland Fed, spoke, advocating a more aggressive policy. In her view, it was better to be more aggressive now because it would happen later anyway. So the mood here is that the Fed is going to prepare for further rate increases and up to 50 base points are in play.

JPY

The Japanese currency weakened for the second week in a row against other currencies traded on the forex market. The decline came when the Bank of Japan decided earlier this month to leave rates unchanged. However, the Japanese currency was not helped by the earthquake that struck northeastern Japan in the Fukushima area two weeks ago.

You can read more in the last release of the most interesting economic events.

Gōshi Kataoka (BOJ board member) said in his speech on Thursday that the risks to the Japanese economy are skewed to the downside. The downward pressure on it is increasing.

Kataoka also said that the BOJ is prepared to take appropriate action as needed in light of the pandemic's impact on the economy.

Full minutes of the March meeting:

https://www.boj.or.jp/en/announcements/release_2022/k220318a.pdf

What's in store for the current trading week?

This week will again be richer in statistical data. On Tuesday, we will expect results on February retail sales in Australia. In the middle of the week, we will have data from the US, which will mainly concern the US GDP.

The second half of the week will bring interesting GDP data coming out of the UK and Canada.

The most interesting will be the end of the week, when we will expect changes in the Eurozone Consumer Price Index (CPI) and the change in the US unemployment rate, accompanied by the change in the number of people employed during the previous month, excluding agriculture (Nonfarm payrolls).

Thus, we expect that the current trading week may also bring quite high volatility on the aforementioned currencies.

So keep an eye on our regular issues to keep track!

Sources