Another Monday recap is out. Let's recap the highlights from last week together to keep us in the loop.

CAD

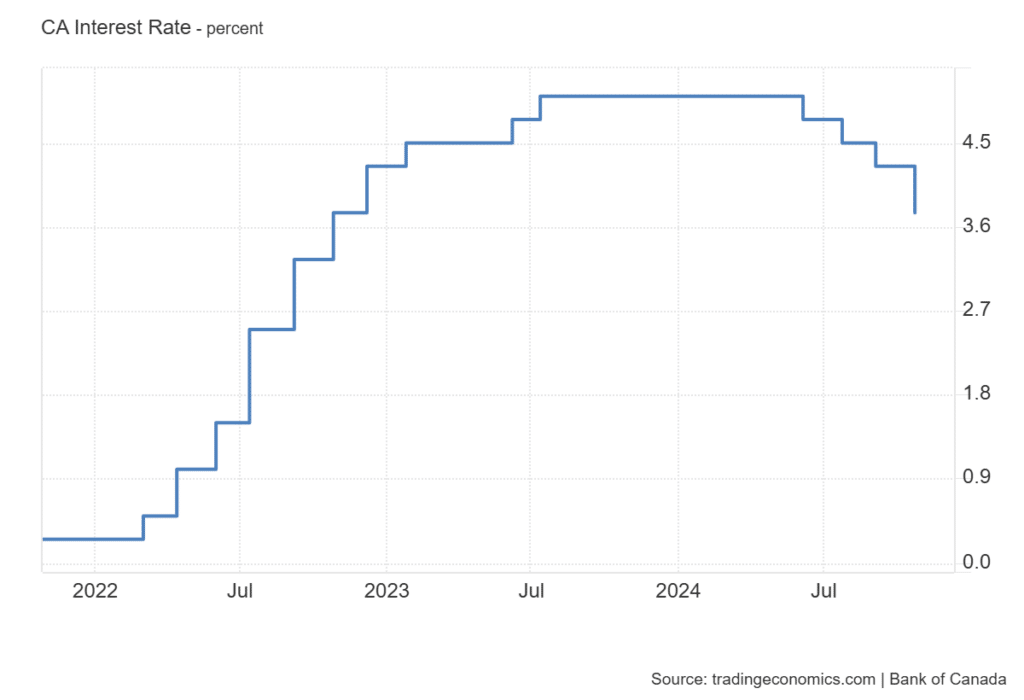

Last week's most important event was Wednesday's meeting of the Bank of Canada, which cut its benchmark interest rate by an estimated 50 basis points. With data suggesting a slowdown in Canadian inflation, the central bank reacted correctly. The central bank expects inflation to be near the target range in the near term. The BoC mentioned that if the economy develops roughly in line with the latest forecast, it expects to cut the key interest rate further. This is a negative for the CAD.

What's in store for us this week?

Monday: the Spanish retailers

Tuesday: unemployment rate in Japan,

Wednesday: Inflation rate in Australia, GDP in France, inflation rate in Spain, labour market, GDP and inflation rate in Germany, GDP in the Eurozone, GDP in the US

Thursday: Retail sales in Japan, retail sales in Australia, Bank of Japan meeting, Eurozone and French inflation rates, US unemployment claims, Canadian GDP

Friday: Australian PPI, Swiss inflation rate, US labour market (NFP)

Sources: