Last week, we waited for the central bank meeting and we got unexpected events from Japan. Let's recap the highlights.

JPY

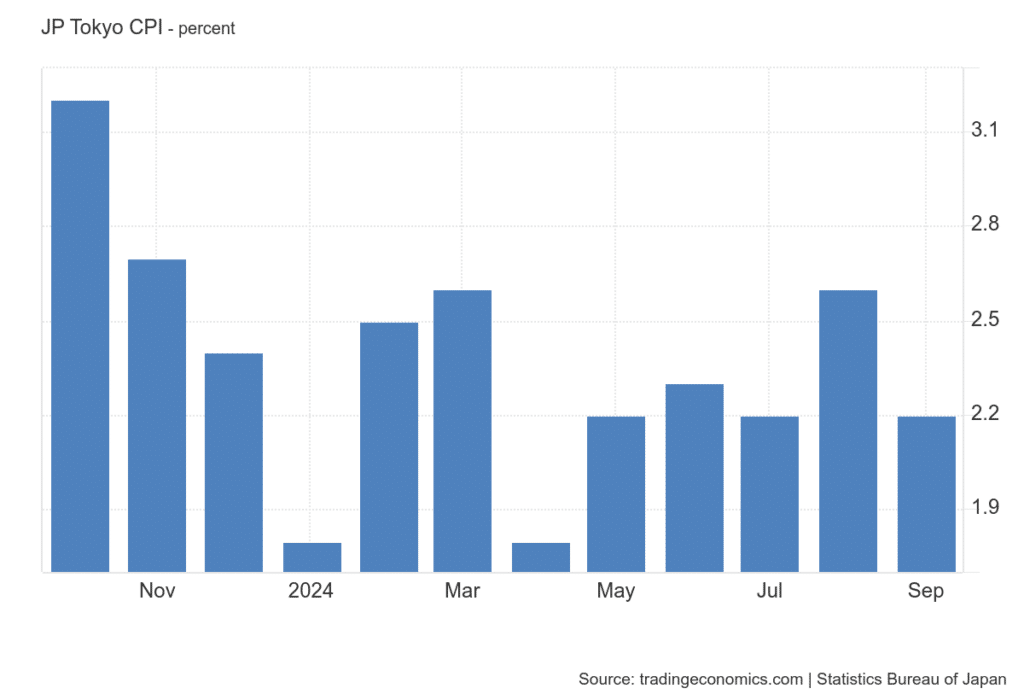

Tokyo's year-on-year consumer price index in Japan fell to 2.20 % in September 2024 from 2.60 % in August, returning to July's level and surprising markets that had expected a decline to 2.4 %. The core index rose 2 % year-on-year in September, ending four months of accelerating price growth and slowing sharply from August's 2.4 % rise, which was in line with expectations. This result is also in line with the Bank of Japan's price stability target of 2 %, supporting the central bank's cautious approach to monetary policy. This is negative news for the JPY.

Anyway, on Friday, unexpected news came from Japan, which resulted in the JPY strengthening. Shigeru Ishiba won the second round of the LDP leadership election and will become the next Japanese Prime Minister. Ishiba received 215 votes in the second round, while Takaichi received only 194 votes. This is good news for investors betting on the Japanese yen, as it was Takaichi who was the one who loudly criticized the Bank of Japan for raising interest rates too quickly. So Ishiba's victory at least partially eases that pressure.

What's in store for us this week?

Monday: Japanese retail sales, UK GDP, German inflation rate, US PMI

Tuesday: PMIs (US, Canada, Australia, Eurozone, Switzerland and UK), Eurozone inflation, retail sales in Australia and Switzerland

Wednesday: Eurozone labour market

Thursday: PMI (Australia, Japan, Eurozone, UK, US), inflation in Switzerland, PPI index in Eurozone, US jobless claims

Friday: US labour market data (NFP), inflation in Switzerland, PMI index in (Canada, UK, Eurozone)

Sources: