We have had a week in which central bank and US dollar data played a major role. Let's recap together what the key takeaways were.

EUR

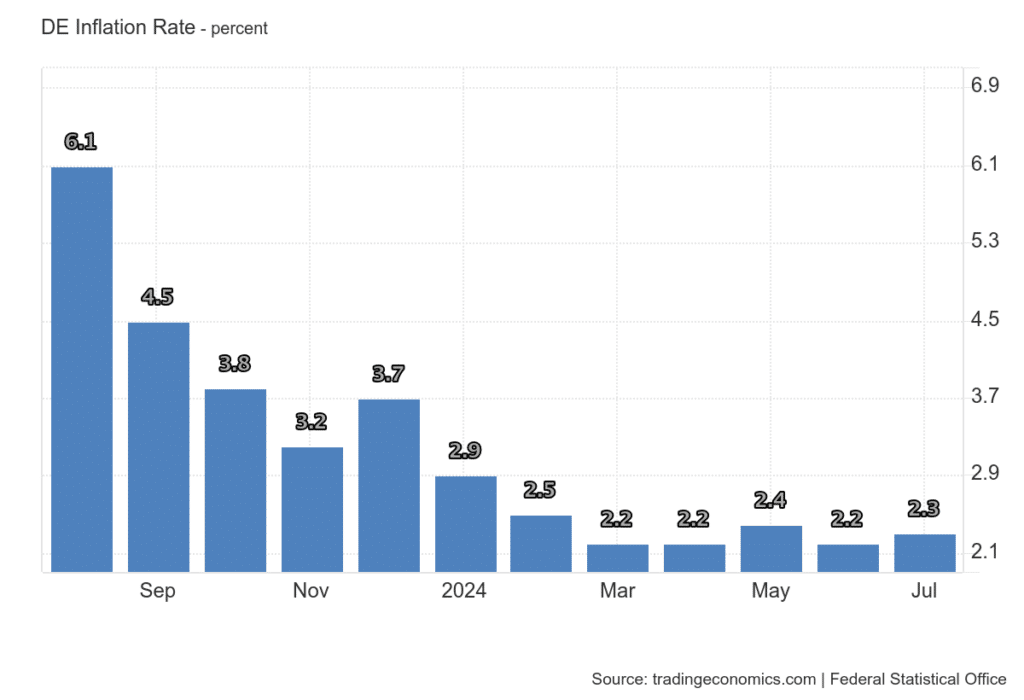

On Tuesday we got data on German inflation, which unexpectedly rose to 2.3 %. On a month-on-month basis, there was an increase of 0.3 %. All data was above market expectations. This was positive for the euro.

A day later we got headline inflation in the eurozone, which also unexpectedly rose to 2.6 %. Core inflation, on the other hand, remained at 2.9 % compared to estimates. This means that a September rate cut is not certain. Meanwhile, the probability of a cut is expected to be 67%. Positive for the euro.

What's in store for us this week?

Monday: Idex PMI from Australia, Japan, Eurozone, US and UK, (AUD, JPY, EUR, USD, GBP), Eurozone PPI (EUR)

Tuesday: meeting of the Reserve Bank of Australia (AUD), Swiss Unemployment Rate and Retail Sales (CHF), Index

This week will be weaker than the previous one, but we will still focus on a few important events. The most important fundamental to watch is Tuesday's RBA meeting.

Sources: