Monday's recap is here! Join us as we recap what happened last week and what we'll focus on this week.

NZD

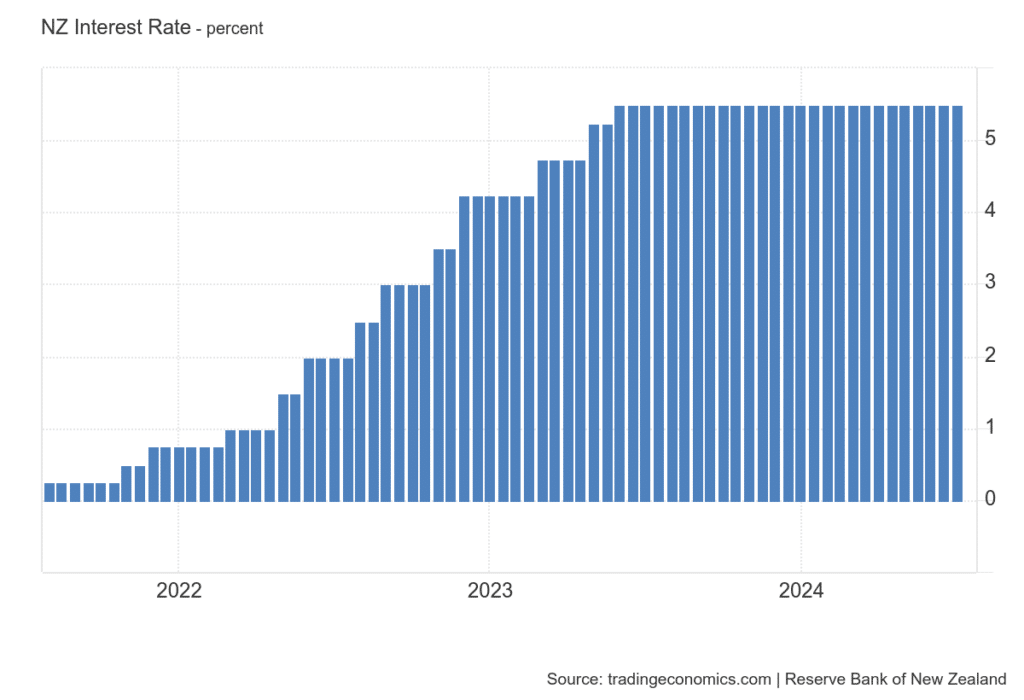

On Wednesday, we turned our attention to the meeting of the Reserve Bank of New Zealand. As expected, it decided to leave interest rates unchanged at 5.5 %. The central bank said that monetary policy has significantly reduced inflation and is expected to return to the target range of 1-3 % by the second half of the year. economic activity and the labor market are showing a slight slowdown, consistent with the current restrictive stance. This statement was the opposite of what was said at the last meeting when the RBNZ was hawkish. The NZD weakened on this data as it was expected that the RBNZ would remain hawkish, which did not happen.

What's in store for us this week?

Monday: Swiss PPI (CHF), J. Powell speech (USD)

Tuesday: US Retail Sales (USD), Canadian Inflation Rate (CAD)

Looks like this week is going to be a busy one. The most important news will be Thursday's ECB meeting, which is estimated to leave rates unchanged at 92 %.

Sources: