A new trading week is here and we bring you a regular summary of the key trading events of the past week.

The markets experienced more volatility again this week. This is because of the upcoming economic data from the Eurozone, the US and Canada.

CAD

The first thing we saw on Wednesday was the Canadian dollar's reaction to the Bank of Canada's (BOC) rate decision for October 2021. The CAD strengthened strongly on news that the Bank of Canada was prematurely ending its quantitative easing (QE) program and limiting its purchases to $0 per month. Indeed, it was widely expected to shrink to USD1bn/week from USD2bn/week. The Bank is ending quantitative easing (QE) and moving into a reinvestment phase during which it will purchase Canadian government bonds for the sole purpose of replacing maturing bonds.

JPY

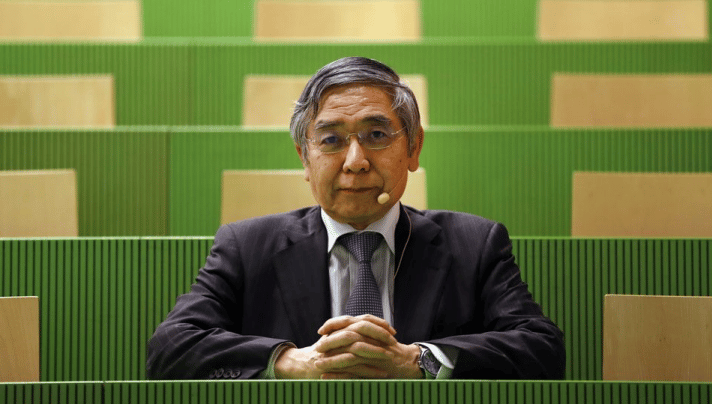

The Japanese yen (JPY) fared slightly worse. Thursday morning saw the announcement of interest rate changes in Japan, with the Bank of Japan leaving its key plans unchanged, as was also expected. Bank of Japan Governor Haruhiko Kuroda said in his press conference that he would ease monetary policy further if needed, without hesitation. The BOJ's quarterly report shows that, Japan's economy is likely to recover once the impact of the pandemic wears off. However, the economy continues to remain in serious condition but is trending higher.

EUR

On the same day, it also raised the ECB interest rate decision, which it left unchanged as expected. However, of far greater importance for the euro was the press conference where Christine Lagarde mentioned that the economy would jump above pre-pandemic levels by the end of the year. THAT resulted in a slight strengthening of the Euro.

What's in store for the current trading week?

The current trading week will again bring data from central banks, which will issue their decisions on interest rate changes. Tuesday will bring us this data from Australia and Wednesday from the US. Therefore, we expect increased market volatility again on these days.

Sources:

In the photo: Governor of the Bank of Japan, Haruhiko Kuroda

Photo source: https://www.forexlive.com/