Welcome to our regular Monday recap of the most important fundamentals.

Last week, we focused mainly on the incoming data from the euro area and the US, which were surprising.

Read on to keep up to date!

Last Thursday, we turned our attention to the preliminary inflation numbers from the euro area, which came in below.

The end of the week closed with the US labour market numbers, on which the US dollar strengthened.

This week we will focus mainly on central bank meetings.

The Reserve Bank of Australia meets on Tuesday at 6:30am, where the market expects a pause in rate hikes.

Sources:

Welcome to Monday's regular recap of the fundamentals that brought volatility in the past trading week.

The biggest surprises came from the Reserve Bank of New Zealand and the United Kingdom.

Read on to keep up to date!

According to the preliminary estimate, the HCOB Composite PMI fell to a three-month low in May 2023.

On Wednesday, we focused on the incoming inflation data from the UK, which was surprising.

Tuesday's US PMI data came in above market estimates.

The main event of last week was the meeting of the Reserve Bank of New Zealand, which brought volatility to the market with its rhetoric, and in response the New Zealand dollar began to weaken.

The start of the week is likely to be weak in the UK and the US through the holidays.

Welcome to our regular Monday recap of the most important fundamentals we've been following over the past week.

Read on to keep up to date!

On Wednesday, we got the current inflation rate figures for the euro area, which offered no surprises.

Tuesday's data from the UK labour market made the market slightly nervous.

The end of the week closed with Fed President Jerome Powell's speech, who kept to the topic of inflation.

Tuesday's Canadian inflation numbers surprised markets when they showed a rise.

In the current trading week, Wednesday will be the most crucial for us, where we will focus our attention on the meeting of the Reserve Bank of New Zealand, which is expected to raise its base interest rate by 25 basis points.

Sources:

Last trading week was quite modest for the incoming data. A few more interesting events came only from the UK and the US.

Read on to keep up to date!

On Thursday, the Bank of England raised its base rate by 25 basis points, as expected.

On Wednesday, the market focused on the incoming inflation data from the US, which was rather negative for the US dollar.

We do not expect any central bank meetings this week. The market's attention will be focused mainly on Tuesday's UK labour market data, due at 8am.

Sources:

Welcome to our regular Monday recap of the most important fundamentals we've been following over the past week.

The latter was marked by central banks that surprised the markets to some extent.

Read on to keep up to date!

The European Central Bank raised its key interest rate by 25 basis points at its May meeting, signalling a slowdown in the pace of policy tightening.

At its Wednesday meeting, the Fed raised interest rates by 25 basis points, as the market expected.

Along with the US, the Canadian labour market numbers came in on Friday, which, like the US ones, were positive/bullish for the CAD.

At its meeting on Wednesday, the Czech National Bank left its key interest rate unchanged, as expected.

This week will bring less data. Still, some will be important for us.

On Wednesday, we will be interested in data on the US inflation rate, which will come at 14:30.

Sources:

Welcome to our regular Monday recap of the most important events we focused on in the last trading week.

The latter was somewhat dead on new incoming data, but a few things happened anyway that are good to remember.

Read on to keep up to date!

The week kicked off with a speech by ECB Executive Board member Isabel Schnabel, who mentioned that a 50bp rate hike is not off the table at the central bank's next meeting.

US GDP data showed us last week that the US economy grew by an annualised 1.% in Q1 2023, according to a preliminary estimate.

Wednesday's inflation in Australia showed us a decline, which in itself is negative news for AUD.

On Friday, we turned our attention to the Bank of Japan meeting, which did not bring any change as expected.

The current trading week will be a bit more varied for incoming data.

On Tuesday morning (6:30) we have the RBA meeting, which is expected to pause, as we mentioned above.

Sources:

Welcome to the quarterly F.X.C.G. news!

Since the beginning of the year, we have been working hard to bring our trading expertise to you more effectively and to a greater extent to simplify your path to full-time trading.

Let's review together what we have achieved since the beginning of 2023.

We've started operating on our Trading Flooru in Moravany! The goal of our Trading Floor is to provide our community of traders with the best possible facilities and system that will benefit them in the long term.

At Trading Floor we meet every day through trading and fun!

The following are currently underway:

Do you want to be part of our community or learn from the best? Check out our types of membership and use the Trading Floor as your accelerator!

We have expanded our mentoring team with new successful traders! As a result, we are able to help more students who need more individual attention to make sure they are doing what they have learned in our courses the right way. The mentoring program is also great preparation for getting funded accounts.

Find out more about personal mentoring here.

We have improved our market analysis and outlook group! We started this group to help you more from the fundamental analysis side, and to keep you up-to-date and informed about what is happening in the world and what can currently affect our trading. We have now added to this group our technical outlooks of trading opportunities, which go hand in hand with fundamental analysis and are complemented and systematic management of open positions. The whole jigsaw has thus fallen into place and we are able to bring you more of our know-how and show you how we view the markets.

You want to know what's going on? Click here to take a look!

We are delighted that more and more students are writing to us after taking our courses to say that we have changed their perspective on trading and more and more of you are filling funded accounts. That's why we've decided to expand outside the country and are heading abroad with our courses! We believe this will allow us to provide more quality content not only here but also abroad.

We have done a lot of work and there is still a lot of work to do. Thank you for your trust and we look forward to hearing more of your stories.

Welcome to our regular Monday recap. Last week, the markets delivered mainly inflation data, which is where we focused our attention.

Read on to keep up to date!

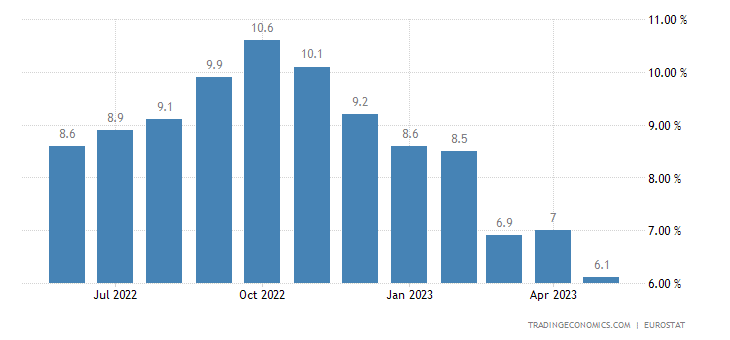

On Wednesday, we focused our attention on inflation in the euro area. Headline annual inflation delivered its fifth consecutive month of decline and is at its lowest level since February 2022. Still, it remains high...

We also got inflation numbers from the UK on Wednesday, which were not positive on the face of it, but with headline inflation still in double digits, it's building up for the Bank of England.

The latest inflation data also came from Canada, where the annual headline inflation rate fell to 4.3 %, the lowest since August 2021.

Last but not least, on Thursday we turned our attention to New Zealand inflation data, which disappointed the market a bit.

There will be much less of that this week.

On Wednesday, we turn our attention to inflation in Australia (3:30), where lower numbers are expected.

Sources:

Welcome to our regular Monday recap of the most important fundamentals that influenced our trading last week.

He brought us some data, especially from the USA and Canada.

Read on to keep up to date.

From the euro area, last week we received only the month-on-month retail sales data, which came in as expected.

Last week's Australian labour market numbers surprised the market significantly.

The Bank of Canada (BOC) left its key interest rate unchanged on Wednesday, meeting market expectations.

Last week's expected news was the current inflation rate in the US, which brought lower numbers and the USD weakened in response to the data.

This week will bring us mainly inflation data. On Tuesday at 14:30 the latest Canadian inflation data will be released.

Sources:

Welcome to the Easter recap of an important fundamental we focused on last business week.

Two central banks were meeting and we could learn something from each of them.

Read on to keep up to date!

Last week we only got PMI data from the eurozone, which was mostly positive for the euro except for the manufacturing sector.

We also got PMI data from the UK which, unlike the Eurozone, showed lower numbers and an overall negative for the British Pound.

The Reserve Bank of Australia left rates unchanged as expected at its April meeting.

In contrast, the Reserve Bank of New Zealand surprised the markets on Wednesday.

The start of the current trading week will be slow through the Easter holidays.

Interesting data that we will focus on will come on Wednesday from the USA and Canada.

Sources: