Welcome to our regular Monday recap, where you will find a summary of the most important news that affected our trading in the past week.

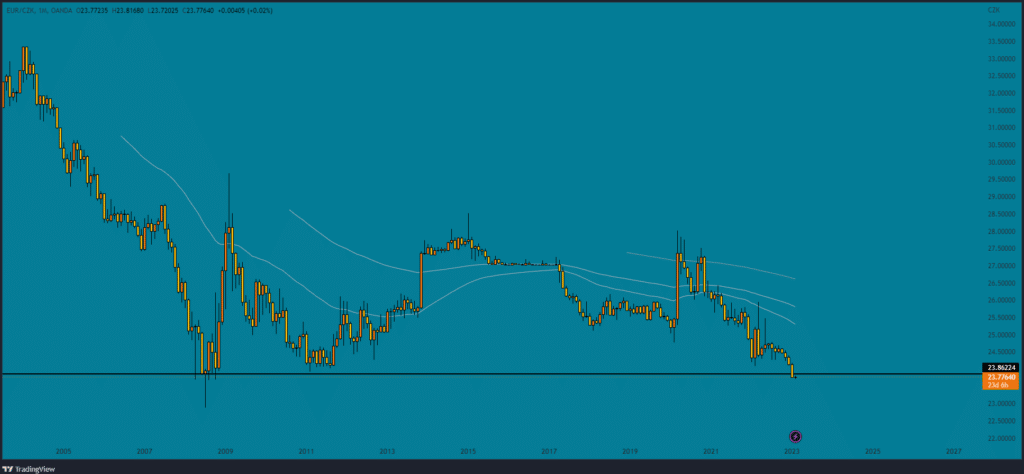

In the summary, you will also find a description of our outlook for the EUR/CAD currency pair, which we sent to the group during the week, and our outlook for the current trading week.

Read on to keep up to date!

At the end of the week, preliminary inflation data in the euro area were released, which the market had been waiting for all week. Prior to the data, we were able to watch ECB Chief Economist Philip Lane's comments that rates in the Eurozone need to rise.

We didn't get much from the US either. More interesting data came at the end of the week. In the last 3 months of 2022, the US economy grew by 2.6 %.

On Wednesday, the Czech National Bank left the base interest rate at its current level of 7 %.

TIP: watch the recording of the CNB press conference

This week will again be much richer in incoming data that could bring volatility to the market.

On Tuesday, we'll turn our attention to the RBA meeting, which comes at 6:30am.

Sources:

Welcome to Monday's review of the most important fundamental that has been with us over the past week.

It was packed with central banks and we could expect a few surprises.

Read on and stay up to date!

Not much data came out of the euro area last week. On Friday, we waited only for the release of the preliminary PMI numbers, which came out mostly positive for the euro except for manufacturing.

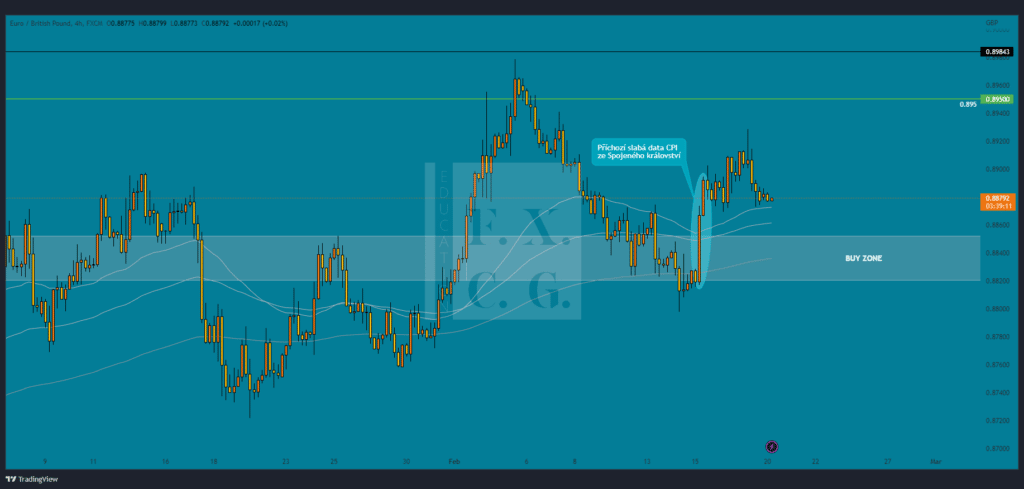

On Wednesday, the day before the BOE meeting, UK inflation data was released, which positively surprised markets but created more pressure on the Bank of England.

The biggest event last week that we focused our attention on was Wednesday's Fed meeting, which decided to raise the benchmark interest rate by an estimated 25 bp.

At its meeting on Thursday, the Swiss National Bank raised its key interest rate by 50 basis points to 1.5 %, according to market estimates.

The current trading week will be much weaker in terms of fundamentals. At least as far as scheduled data releases are concerned.

The first Australian inflation numbers we will focus on will come on Wednesday morning (1:30).

Sources:

Welcome to our regular Monday recap of the most important fundamentals we've been following over the past week. And this week will also be an interesting one for the data coming up.

Read on and stay up to date!

On Thursday, the European Central Bank (ECB) raised its key interest rate by 50 basis points, as expected.

The US dollar remained volatile throughout the week and weakened significantly through the problems of some US banks.

The banking crisis continued to deepen, and after the problems with the US banks, we learned that the first European bank is also in trouble.

Banking problems are always a very risky business because they do not cast a good light on the financial and banking system, which is losing stability.

This week will be a bit more colourful again through the upcoming central bank meetings, on which we will turn our attention.

Tuesday will see the latest Canadian inflation data at 13:30 and a day later on Wednesday inflation from the UK (8:00).

Follow our group to stay up to date!

Sources:

Welcome to the regular Monday recap, which is extraordinary for an unexpected event that shocked the markets at the end of the week.

Read on to keep up to date!

The week started with positive retail sales data in the euro area.

The US dollar experienced volatility last week for the first time in a while. Late in the week, the markets were hit by news of the collapse of the 16th largest US bank! California banking regulators closed Silicon Valley Bank's parent company, SVB Financial Group, on Friday.

In the second half of the week, we watched the Bank of Canada meeting and incoming Canadian labour market data, to which the Canadian dollar weakened.

Earlier in the week, the Reserve Bank of Australia (RBA) raised its base rate by 25 basis points, which was also in line with market expectations.

In the current trading week, we will definitely turn our attention to the developments regarding the collapse of the US bank SVB.

Sources:

Welcome to our regular Monday recap of the most important fundamentals we focused on in the last trading week.

Included is an outlook of events we can expect to see this week.

Follow us to stay in the loop!

On Thursday, we focused on the incoming data from the Eurozone regarding inflation and unemployment, which was broadly positive for the euro.

We are starting to get somewhat stronger data out of the UK lately and the proof of this is last week's PMIs, which came out surprisingly well.

As far as US data is concerned, the week ended with only PMI data, which was positive for the USD on the whole.

Tuesday's data showed retail sales in Australia rose by 1.9% year-on-year in January 2023, beating market estimates of 1.5%.

On Tuesday we still got the latest data from retail sales in Japan, which rose by 6.3 % in January 2023.

On Tuesday (4:30), we turn our attention to the RBA meeting, where the RBA is expected to raise the base rate by 25 basis points.

There's a bit more to come that could bring volatility to the markets, so we'll be watching the announcement to keep you in the loop!

Sources:

Welcome to our regular Monday recap from last trading week, where we got some surprising data that brought volatility to the markets.

At the end of the week, we focused our attention on the current inflation rate in the euro area, which showed a lighter decline than the market had expected.

On Tuesday, we got surprisingly stronger UK PMI data, to which the British pound strengthened significantly.

The US economy grew by 2.7 % in Q4 2022, slightly less than the preliminary estimate.

The Reserve Bank of New Zealand raised its base rate by 50 bp at its first meeting of the year.

The first half of the week will bring a flurry of Canadian, Swiss and Australian GDP data that we will be waiting for.

Keep an eye on our discord room to stay up to date!

Sources:

Welcome to this week's regular Monday recap and outlook. Let's take a look together at what we've focused on, and what will be critical for us this week.

Read more to stay in the loop!

At the start of last week, we got some weaker data from the euro area, which caused the euro to weaken slightly.

Inflation is still in double digits but reflects a significant decline from the 10.5 % minimum in December. The pound has thus fallen sharply.

On Tuesday, the market was still preparing for US inflation, which was not as surprisingly positive as everyone might have expected.

And what's in store for the current trading week?

This week we are again expecting a bit more data that might surprise us. On Tuesday, we will focus our attention on the current inflation rate in Canada, which will be released at 14:30.

Sources:

Monday's recap is here! Read more about how stronger Canadian labour data impacted the Canadian dollar.

Read more to stay in the loop!

Over the past week we have again received some weaker data from the UK, which continues to reinforce our belief that the UK is heading into recession.

On Tuesday, we focused on Fed President Jerome Powell's speech reacting to the recent positive labour market data. Powell mentioned that he did not expect the data to come out so strong.

On Friday, we got surprising data from the Canadian labour market, which followed the US one the previous week.

The most important event we focused our attention on was Tuesday's RBA meeting, which raised the base rate as expected.

Earlier in the week we get UK labour market data (Tuesday 8:00) and the current US inflation rate (Tuesday 14:30), which could bring volatility to the market, and which we will focus on in detail.

Sources:

We bring you our regular Monday recap of the most important fundamental events that the markets focused on in the past trading week.

And that there was a lot. We had several central bank meetings that brought volatility to the markets.

Read on to find out more!

At Thursday's meeting, the European Central Bank raised interest rates by 50 basis points, as the market expected.

Thursday's meeting of the Bank of England also did not surprise significantly. The central bank voted to raise interest rates by 50 basis points to 4.0 %. This was the tenth rate hike in a row.

The icing on the cake of the week was Wednesday's Fed meeting, which raised the benchmark interest rate by 25 basis points as expected.

The koruna is the strongest against the euro since July 2008.

We won't see as much in the current week, but there are still some interesting events worth waiting for.

Sources:

Welcome to our last January summary of the fundamentals that we used to shape our business plans last week.

The week surprised with a few numbers and we could see higher volatility.

Read more to stay in the loop!

EUR

Last week we got quite positive data from the euro area.

USD

US PMI brought us slightly positive data for the US dollar after a long time.

CAD

On Wednesday, we closely followed the Bank of Canada meeting, which did not surprise us much.

And what's in store for the current trading week?

The current trading week will be marked by central bank meetings, on which we will focus our attention. The most important meeting will be on Wednesday (20:00) when the Federal Reserve (Fed) will meet. The markets are expecting a hike of only 25 basis points.

Sources: