The last trading week was marked by central banks, whose actions brought some volatility back to the market.

Let's see together what is worth remembering.

As expected, the Bank of England raised its main interest rate by 50 basis points at its monetary policy meeting on Thursday.

On Wednesday, we focused our attention on the most important event of the week. The Fed raised the key interest rate as expected to 3.25 %.

The Canadian inflation rate shows us a slight cooling after the interest rate hike.

The Bank of Japan left its key interest rate unchanged on Thursday.

At its meeting on Thursday, the Swiss National Bank raised its key interest rate by 75 basis points.

The current trading week will be much poorer on fundamentals.

On Tuesday, we will focus our attention on the speech by Fed chief Jerome Powell, which will come at 13:30.

Throughout the week, we will also be able to observe a few speeches by central bankers (ECB, FOMC, RBNZ and BOJ).

Sources:

Welcome to our regular recap of the important events we followed last week.

We will be very cautious this week as we have a number of major central bank meetings coming up!

Read more to stay in the loop!

Last week in the euro area, we focused our attention only on inflation data, which had a negligible impact on the market. In any case, the euro started to strengthen slightly in response to this data.

From the start of the week, we could see the latest data on British GDP, which turned out positive. The British economy grew by 0.2 % in July compared to June.

The annual inflation rate fell for the second month in a row in August. Compared with the previous month, consumer prices increased by 0.1 %.

The Fed will be the main focus this week! The meeting will take place on Wednesday at 20:00. But the Fed isn't the only thing we'll be focusing our attention on.

Sources:

Last week we saw decisions from three central banks.

Read on to find out more.

The European Central Bank raised its key interest rate for the second consecutive day. The ECB decided to raise rates as expected by the markets to the current 1.25 % (+75 bp).

The BOC held to its plans and raised the rate by 75 basis points. This is the highest since April 2008.

TIP: You can read the full report here:

https://www.bankofcanada.ca/2022/09/fad-press-release-2022-09-07/

TIP: You can read the full report here:

https://www.rba.gov.au/media-releases/2022/mr-22-28.html

On Tuesday, the Reserve Bank of Australia (RBA) also decided to change the interest rate, which also did not surprise the markets and raised rates by the planned 50 basis points.

The current trading week will be weaker on economic data.

During the week, we will be looking mainly at the latest data on inflation in the euro area, the US and the UK.

Sources:

We expect high volatility this week.

So read on to find out more!

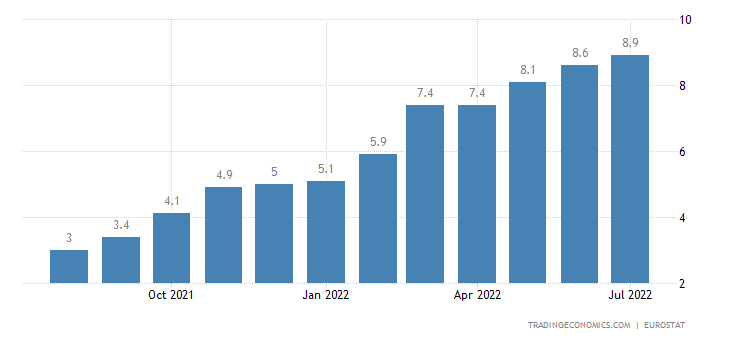

The annual inflation rate in the euro area accelerated to 9.1 %. It thus broke a new record high. The consumer price index increased by 0.5 % compared with July.

On Wednesday, US Federal Open Market Committee (FOMC) member Loretta J. Mester gave a speech, mentioning that she does not expect the Fed to cut rates next year because the battle with inflation will be a long one.

GDP in Canada increased by 0.8 % quarter-on-quarter, matching the growth rate of the previous period and recording four consecutive quarters of growth.

There are many events to focus our attention on this week. And it will be mainly central banks that can give the markets more volatility.

Sources:

Welcome to our regular Monday recap and outlook for the current trading week.

Last week kicked off with PMI data from the euro area, which signalled a deeper economic slump.

The UK private sector approached stagnation in August.

August's PMI data signalled further worrying signs for the health of the US private sector.

TIP: Read the full speech by J. Powell

https://www.federalreserve.gov/newsevents/speech/powell20220826a.htm

No interest rate changes are expected this week either.

Our attention will be focused mainly on Wednesday's data on euro area inflation and Canadian GDP.

Sources:

Welcome to the regular summary of the most important events that interested us during the last trading week.

Inflation in the euro area continues to rise sharply.

For the third time, the unemployment rate in the UK is showing us stable results.

In the first half of the week we could see data on Canadian inflation, which remains high and the market expects a 75bp rate hike at the next Bank of Canada meeting.

Probably the most important event last week was the RBNZ meeting, where the central bank raised rates by 50 basis points.

In the current trading week we will be interested in incoming data from the UK, US and Eurozone

Sources:

Welcome to our regular recap of the most important events of the past week and the outlook for the current one.

The second week of August was very modest in terms of fundamentals. Still, we watched some interesting news worth remembering.

All eyes were on Wednesday's US inflation data.

The annual inflation rate in the US slowed more than expected to 8.5 % in July.

The Swiss unemployment rate thus reached 2 % in July 2022.

Last Wednesday, we also got the latest inflation figures for our country, where we again recorded higher numbers than last time.

The key for us will be Wednesday's Reserve Bank of New Zealand meeting, where the central bank is expected to raise interest rates by 50 basis points. That is, to 3 %.

Sources:

Welcome to the first August recap of the most important events we followed last week.

It was really busy and apart from the classic data we were also expecting three central bank meetings.

Let's see how it turned out.

During the last trading week, we had data coming in from the euro area that didn't come out so brightly.

The Bank of England raised rates by 50 basis points at its Thursday meeting, as the market had expected.

America offered us similar PMI and labour market data last week.

The services sector signalled its sharpest decline since May 2020 and the unemployment rate fell in July to its lowest level since February 2020.

Earlier last week, the Reserve Bank of Australia held its monetary policy meeting and also raised rates by 50bp, as expected.

The CNB left rates unchanged.

This week will be much poorer.

We can expect most of the incoming data to come from the US and the UK, with the latest US inflation numbers and Friday's GDP from the UK due on Wednesday.

Sources:

Last trading week offered us some interesting data worth noting.

This week we expect volatility in the markets again through the central bank meetings.

We didn't get much out of the Eurozone last trading week. It was more interesting at the end of the week when we got the latest GDP and CPI/inflation data.

On Wednesday, we watched the monetary policy meeting of the Fed, which is estimated to have raised rates by 75 basis points.

TIP: Watch the Fed press conference

On Tuesday, the Bank of Japan published the minutes of its last monetary policy meeting in July, at which it again left rates unchanged.

The current trading week is going to be a bit more varied again. Central banks will again be in our focus.

Tuesday: Reserve bank of Australia

Thursday: Bank of Englad, Czech National Bank

Sources:

Image source: https://www.federalreserve.gov/aboutthefed/aroundtheboard/history-buildings.htm

Last trading week offered us a lot.

Let's see together what interesting things happened and what surprised us!

The last trading week offered us appropriate volatility on the euro.

In the afternoon, the ECB decided at its monetary policy meeting to raise the base rate from 0 % to 0.5 %.

On Tuesday, we focused our attention on the labour market numbers. The July unemployment rate held steady and remains at near its lowest level.

Canada offered us inflation and retail sales data in the second half of last week, which turned out to be positive.

The monetary policy meeting of the Bank of Japan shows that the central bank still wants to keep monetary policy extra loose.

The current trading week will offer us a little less.

Our attention will be focused on Wednesday's Fed meeting, where a 75 bps rate hike is expected, accompanied by the FOMC press conference.

Sources: