Welcome to our regular Monday recap of what happened in the last trading week, which brought a number of interesting things.

In the middle of the week came the latest UK GDP data. The UK economy unexpectedly grew by 0.5 % month-on-month in May 2022, recovering from a 0.2 % contraction in April and beating market estimates.

On Thursday we could see an interesting "natural phenomenon" on the EUR/USD currency pair, where a currency parity was created, i.e. that 1 EUR = 1 USD. This parity last occurred in December 2002.

The Bank of Canada surprised the markets on Wednesday by raising its key interest rate by one percentage point (100 bp).

HINT: the full statement can be found here:

https://www.bankofcanada.ca/2022/07/fad-press-release-2022-07-13/

The Reserve Bank of New Zealand also raised rates on Wednesday by 50 basis points, as expected.

The Bank of Japan will meet at 5:00 on Thursday to decide on the current monetary policy settings.

The European Central Bank will also meet on the same day at 14:15, where we expect a 25 basis point rate hike.

Sources:

Welcome to our regular Monday recap and outlook.

There were some interesting events last week that you should not miss.

So read on to keep up to date.

Last week we saw some interesting data from the euro area that are worth noting.

Wednesday's retail services in the euro area showed that spending on food and tobacco products fell for the second month in a row, due to a sharp rise in prices.

We have seen some interesting things from the UK in the last week. The main event of the week was the resignation of British Prime Minister Boris Johnson after more than 50 MPs left the government.

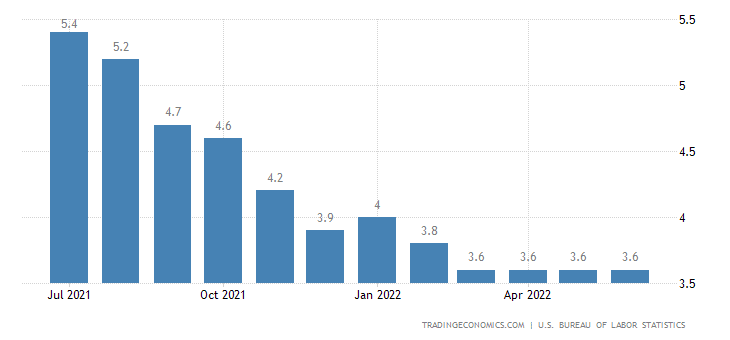

The US unemployment rate was unchanged at 3.6 % in June 2022, the same as in the previous three months.

At its meeting on Tuesday, the Reserve Bank of Australia confirmed market expectations and raised the base rate by 50 basis points.

Apart from the data coming out of the UK (GDP) and the Australian labour market during the week, we will pay attention to the markets especially on Wednesday, when we should see two rate hikes

Sources:

Image source: www.bloomberg.com (photographer: Niklas Halle'n)

Welcome to our regular Monday roundup of the more uninteresting events we focused on in the last trading week.

Last week, the European Central Bank Forum on Central Banking 2022. We focused our attention mainly on Wednesday's panel, where 3 central bank representatives spoke:

Andrew Bailey - BOE Governor, Christine Lagarde - ECB President, Jerome Powell - Fed Chairman.

Here you will find the record:

The slowdown in UK manufacturing continues to be reflected in output growth approaching stagnation and new orders falling.

May retail sales in Australia grew by 0.9 %, the same as those in April. This beat market estimates, which were more in the region of 0.4 %. This was the fifth consecutive month of growth

We also saw retail sales from Switzerland. They fell by 1.6 % year-on-year.

Apart from the fact that today is a holiday in the US, we will focus our attention on Tuesday's meeting of the Reserve Bank of Australia, where a 50bp rate hike is expected.

A day later, on Wednesday, we will be interested in the US FOMC minutes, which will offer the FOMC's stance on monetary policy.

Follow our group to stay up to date!

Sources:

Welcome to Monday's recap of what was interesting in the last trading week, and what we'll be focusing our attention on this week.

The CNB surprised the markets! Perhaps for the last time...

Read on to find out more!

At the end of the week, we got the latest global manufacturing PMI (Purchasing Managers' Index) data, which came in even worse than expected.

Over the past week we have been receiving a number of interesting figures, mostly relating to UK inflation and retail sales.

Consumer inflation increased by 0.7 %. This continues to confirm stronger price pressures. There is nothing here to distract the BOE from further and more persistent policy tightening.

On Wednesday and Friday, Fed Chairman Jerome Powell testified before the Economic Committee in Washington about the economic outlook and recent monetary policy actions.

The most interesting event of last week was the Czech National Bank's interest rate decision.

It surprisingly raised the rate by 125 basis points on Wednesday afternoon.

This week we turn our attention to Wednesday and Thursday's GDP data coming out of the US, UK and Canada.

We can expect an onslaught of speeches by central bank speakers throughout the week or so, who will be in the spotlight.

Follow our telegram group to stay up to date!

Sources:

Time passes like water and we realized that it has been more than a year since we decided to launch our educational project under the brand F.X.C.G. Education.

First of all, let us thank you on behalf of our entire team for your trust and cooperation. You have given us constructive feedbacks throughout the whole time and have shown us daily that we are on the right track.

The result of our work together is an ever-expanding group of students, among whom more and more more full-time traders and numbers obtained by informed accounts at companies such as FTMO.

Working with you fulfills us and your successes drive us forward. It's nice to see your progressive journey that we can be a part of. That's why we decided to summarize what we've done recently and what new things we are currently working on. You can enjoy. It's going to be a blast!

Every one of our students has already experienced that the first building block of our long-term cooperation is the completion of 3 levels of our courses, which we have brought to the necessary level so that the student who has passed them is ready to responsibly take care of his capital on the FX market.

We've simplified the learning process for you by taking much of the face-to-face training online so you can get the information you need from the comfort of your own home. This has also allowed us to consolidate the knowledge of our students into face-to-face courses, which is much more efficient and gives us more time to focus on individual issues.

News for you preparing the next chapters to online coursesthat you will find useful. We want to focus more on the real trades chapter, where we will share trades and their management back to you to make the learning process a bit more efficient again.

We are often asked if it is possible to attend a personal course more than once. We understand that becoming a profitable trader is a long journey and we have good news for you. Soon we will give you the opportunity to repeat our courses! Follow us to be informed about the next dates. Our full-time traders will be available to consult with you on your progress during the refresher courses.

We place great emphasis on long-term cooperation. That's why this year we've selected the very best of our long-term students to help us shape our vision and look after your needs.

Here we present them to you: Daniel Machovský, Jakub Milčák and Tomáš Babušík.

It is a great pleasure to have these students participate in our personal VICI courses and to pass on their experience and insights on trading to you.

Fundamental analysis has long been seen as an often overlooked part of trading among students. That is why we have responded to your request and created a telegram group that deals purely with fundamental market analysis.

By being a member of this group you receive hot news, what is currently happening in the world, and projections of the likely impact on markets. regular Monday summary of what happened in the last trading week and what we're currently looking at.

It usually takes a couple of hours a day to go through the individual reports and fundamentals. That's why we're glad we can save you time so you can do what you enjoy and still be fully up to date!

The super bomb is that the students of the personal course VICI have this access for free!

We want you to do well. Every day we see your interest in progress and improvement. That's why we will soon offer you the opportunity to a personal mentorwho will walk with you through the journey from the very beginning of trading all the way to getting a funded account or managing your own capital!

We are team players and a group of friends who share similar values and interests. That's why we go on holidays together and participate in interesting and fun events with our partners.

One of them is the guys from the company Držvolantwho teach us to drift and help us improve our skills with racing cars. And because we love supersports and it's our hobby, we regularly use the guys from Držvolant for our events with students!

One of our big visions. We decided to build a stable and strong base for us where we can realize ourselves.

What's going on?

We are building a trading floor where we will share our luxurious space with the best traders from us, and you can be one of them! The entire area will be designed to efficiently and adequately meet the daily needs of a trader. In addition to the trading room, where our best students will be seated and have the opportunity to get their funded account from us, you will also find a gym and a relaxation room with gaming consoles and racing simulators.

Above all, it's about community!

Every day we will meet the best of our traders and monitor the markets together to maximize everyone's progress!

There is a lot of hard work behind us and a lot of work still to do.

You can look forward to all this exciting news and much more!

Thanks for your support!

It's Monday, and that means another regular recap of what happened last week.

Last week we saw a big surprise from the central banks!

Read on to keep up to date!

On Thursday, we turned our attention to the BOE's interest rate decision, which the central bank raised by 25 basis points as expected, marking the fifth rate hike in a row.

On Wednesday, the Fed raised rates by 75 basis points. Although it had predicted a 50 bp hike. During the week, the forecasts of major institutions (WSJ, Goldman Sachs, JP Morgan) came out, which to some extent counted on a 75 bp increase. So it was not such a surprise.

Recording of the press conference:

At the end of the week, the Bank of Japan left rates unchanged, as expected.

The big surprise of the week was the Swiss National Bank (SNB) unexpectedly raising rates.

The current trading week will be much weaker. Still, it will bring some interesting data that will be worth mentioning.

The Reserve Bank of Australia will release its minutes of the monetary policy meeting on Tuesday.

The most important event we will focus on is Wednesday's CNB interest rate decision, which is expected to increase by 1 percentage point to 6.75 %.

Follow us to stay in the loop!

Sources:

Welcome to our regular recap of the economic events that brought volatility to the markets last week.

This week will be very interesting too!

Read on to keep up to date!

The European Central Bank left key rates unchanged at its monetary policy meeting last week, as expected.

Services data are the weakest since February. The main impact is a decline in customer demand due to rising price inflation.

The US dollar will also be very interesting this week. We expect a 50 basis point rate hike on Thursday.

The Reserve Bank of Australia (RBA) surprised the markets on Tuesday when it raised the base rate by 50bp to the current 0.85 %.

Rather, markets were expecting an increase of between 25bp and 40bp.

This week is sure to bring volatility to the markets thanks to the increased number of central bank meetings.

UK GDP and unemployment data will kick off the week.

Follow our telegram group to stay up to date!

Sources:

High inflation requires further action by central banks!

Welcome to our regular recap of the important events we followed last week.

Read on to keep up to date

During the last trading week, we followed the data from the euro area, which were mainly related to inflation, PMI and the labour market.

Inflation in the euro area reaches new highs. This is putting increasing pressure on the ECB to act to raise rates to bring inflation under control.

We also saw an interesting fundamental last week in the USA.

Wednesday's manufacturing PMI came in slightly above market expectations. Suppliers see light at the end of the tunnel for resumption of supply of (semiconductor) components. Supply appears to be easing in Q2 and Q3. Prices continue to rise, but at a slower pace. New orders grew at a faster pace.

The Japanese yen weakened significantly again last week. BOJ Governor Kuroda is reportedly expected to appear before the Diet this week to present a report on monetary policy.

We probably won't hear anything significantly different than which way the BOJ is going, but it will be good to watch.

The BOJ thinks there is no need to tighten monetary policy at this point.

On Tuesday, we turn our attention to the interest rate decision in Australia. The market's prediction is that the Reserve Bank of Australia (RBA) will raise the base rate for the second time since November 2010, by a base 25 basis points.

Follow our telegram group to stay up to date!

Sources:

Welcome to our regular Monday summary of economic events worth pondering.

RBNZ confirmed market expectations!

Last week the Eurozone offered us only the latest PMI data, which came in a bit worse than expected:

The UK also offered us the latest Purchasing Managers' Index (PMI) figures last week. And in a very similar vein:

On Wednesday, the minutes of the last Fed meeting, which took place on 3. and 4 May. The minutes show that a majority of Fed members judged that another 50 basis point rate hike was likely to be appropriate at the next few meetings.

The current trading week will bring us plenty of interesting events and data to watch.

The week will start with a special European Council meeting to discuss the evolving situation in Ukraine, defence, energy and security. The week will also see data coming out of the Eurozone on the Consumer Price Index, unemployment and retail sales.

Sources:

Welcome to our regular review of the most important economic events from the last trading week.

Markets globally expect central banks to raise rates to bring inflation under control.

Read more to stay in the loop!

Just on Monday, the European Commission published its economic forecast for 2023, where we could read about a reduction in the economic growth forecast.

Later in the week, the ECB published the minutes of its monetary policy meeting, in which members expressed concern about high inflation.

The British pound strengthened slightly last week, thanks to intensifying global pressure on interest rate hikes and an improving labour market.

Earlier in the week, we watched a speech by FOMC member Williams, who confirmed that a 50 basis point hike is meaningless in the upcoming meetings.

After several record years, housing markets in many parts of Canada have cooled off sharply over the past two months.

On Tuesday we saw the minutes of the BOA meeting on monetary policy.

the meeting shows that the RBA will want to hike by 25 basis points at the next meeting.

The Australian economy was supported by household and business balance sheets and its resilience was particularly evident in the labour market.

Wednesday will be marked by interest rates in New Zealand. It is expected that the RBNZ will want to raise the base rate by 50 basis points This will certainly be encouraging for the NZD and could bring enough volatility to the New Zealand currency.

Follow us to stay up to date!

Sources: