Pojďme si připomenout to nejdůležitější z hlediska fundamentu, co se stalo minulý týden, a co naopak budeme vyhlížet pro aktuální obchodní týden.

Dolar ke konci týdne ale oslabil v reakci na proslov Jerome Powella, který řekl, že současná ekonomická situace nevysílá signály, které by vyžadovaly rychlé snižování úrokových sazeb. Fed pokračuje v přibližování své politiky k neutrálnímu nastavení, ale tempo závisí na příchozích datech a vyhlídkách ekonomiky. Powell věří, že inflace bude dál klesat, i když to může být někdy náročné, a že ekonomická síla USA umožňuje Fedu postupovat opatrně. To je v porovnání s tržním oceněním jestřábí postoj a pravděpodobnost snížení sazeb v prosinci klesla na 67 %.

Monday: -

Úterý: Míra inflace v Eurozóně a v Kanadě

Středa: Míra inflace a PPI ve Spojeném království, index PPI v Německu

Čtvrtek: Žádosti o podporu v nezaměstnanosti v USA, Index PMI v Austrálii

Pátek: Míra inflace a index PMI v Japonsku, maloobchod ve Spojeném království, HDP v Německu, index PMI ve Francii, Německu, Eurozóně, Spojeném království a USA, maloobchod v Kanadě

Tento týden se zaměříme hlavně na údaje ohledně inflace. V úterý nás čeká míra inflace v Kanadě a Eurozóně. Podle odhadů by měla BoC snížit v prosinci sazby o dalších 50 bp, takže nižší data pravděpodobně tento směr potvrdí.

Sources:

Minulý týden jsme měli volby v USA a několik zasedání centrálních bank. Pojďme si připomenout to nejdůležitější pro obchodování v tomto týdnu.

Minulý týden jsme sledovali volby amerického prezidenta. Vítězství Donalda Trumpa podporuje odhady trhu, ve kterých je zřejmé, že by měl USD aktuálně krátkodobě posilovat. Trump obecně chce dělat politiku takovou, aby dolar postavil na nohy.

Později jsme měli zasedání FEDu, který podle odhadu snížil sazbu o 25 bp. Tvůrci politiky zopakovali své předchozí sdělení, že při zvažování dalších kroků budou pečlivě posuzovat příchozí údaje. Jerome Powell ponechal na tiskové konferenci otevřené dveře pro prosincovou pauzu. Zároveň zmínil, že politika se bude rozhodovat podle dat na jednotlivých zasedání. Pokud jde o dopad vítězství Donalda Trumpa, Powell poznamenal, že volby nebudou mít v nejbližší době žádný vliv na politická rozhodnutí. V tuto chvíli je to pro dolar minimálně z krátkodobého hlediska negativní.

Se zvolením Donalda Trumpa a aktuální prací Jerome Powella bychom mohli v čase vidět mírné neshody ve vedení měnové politiky.

Sources:

Let's take a look at the most important events that interested us last week. This week will be a busy one, mainly through the 4 central bank meetings and the US election.

Thursday's U.S. jobless claims fell to 216,000, below market estimates. The drop reinforced the view that the US labour market remains resilient in the face of higher interest rates and that the central bank could refrain from cutting rates.

But that view changed on Friday, as the US economy added only 12,000 new jobs (NFP) in October, well below the revised 223,000. This is the lowest gain since December 2020. The unemployment rate remained at 4.1 % as estimated. Overall wage growth slowed. This could be explained by the impact of the hurricanes, so the market will be forgiving of this data. The market is now pricing in a 99% rate cut in November.

Monday: PMI (Eurozone, Spain, France, Germany, Australia)

Tuesday: the Reserve Bank of Australia (RBA) meeting, Swiss unemployment rate, UK and US PMIs, New Zealand labour market data

Wednesday: PMI (Japan, Eurozone, France, Spain, Germany, UK, Canada), Eurozone PPI index

Thursday: PMI (Eurozone, Germany), Eurozone retail sales, Bank of England meeting, US unemployment claims, CNB meeting, FOMC meeting

Friday: Canadian labour market data

Most of the time, interest rates are the most important thing we should be concerned about. But this week, that won't be entirely true. The market will focus on the US presidential election. That will be the main event of the week. This week will be divided into three phases: pre-election noise, the election and post-election trading.

Sources:

Another Monday recap is out. Let's recap the highlights from last week together to keep us in the loop.

Last week's most important event was Wednesday's meeting of the Bank of Canada, which cut its benchmark interest rate by an estimated 50 basis points. With data suggesting a slowdown in Canadian inflation, the central bank reacted correctly. The central bank expects inflation to be near the target range in the near term. The BoC mentioned that if the economy develops roughly in line with the latest forecast, it expects to cut the key interest rate further. This is a negative for the CAD.

Monday: the Spanish retailers

Tuesday: unemployment rate in Japan,

Wednesday: Inflation rate in Australia, GDP in France, inflation rate in Spain, labour market, GDP and inflation rate in Germany, GDP in the Eurozone, GDP in the US

Thursday: Retail sales in Japan, retail sales in Australia, Bank of Japan meeting, Eurozone and French inflation rates, US unemployment claims, Canadian GDP

Friday: Australian PPI, Swiss inflation rate, US labour market (NFP)

Sources:

Last week was nourishing from a fundamental position. Let's look back at the highlights.

At Thursday's meeting, the ECB cut rates by 25 bp. This decision is based on an updated inflation assessment, which suggests that disinflation is progressing successfully. In September, inflation in the euro area fell below the ECB's 2% target for the first time in more than three years. Although inflation is expected to rise moderately in the short term, it should fall back towards the 2% target in 2025. The European Central Bank has faced criticism for staying behind the curve and not responding sufficiently to warning signs of slowing growth and low inflation in the eurozone. Although ECB President Christine Lagarde acknowledged the risks of weak growth at a press conference, she did not suggest any steps to help improve the situation. In this case, the ECB is rather sleepwalking towards the Fed, which is already taking action, and as a result this stance could have long-term negative effects on the economy. The EUR started to weaken on this data as there is a possibility that the ECB may be forced to cut interest rates more aggressively in the future, for example by 50 basis points. The market is now pricing in this expectation, which is adding pressure to the currency.

Monday: PPI in Germany

Tuesday: -

Wednesday: meeting of the Bank of Canada

Thursday: PMI (US, Eurozone, UK, Australia, Japan), US Unemployment Claims

Friday: Tokyo inflation rate

Sources:

Last week we got a surprise from the BoE that had a strong impact on the British Pound (GBP). Let's recap together the most important news from last week.

On Thursday morning, we received some rather surprising news from the UK. The Governor of the Bank of England hinted at the possibility of more aggressive interest rate cuts than the market was expecting. He mentioned that a quick and decisive cut might be necessary to boost the UK economy in the face of a slowdown.

This was quite a turnaround given that we have been getting relatively good data from the UK recently, so the pound weakened significantly in response to this news.

Monday: Retail Sales in the Eurozone

Tuesday: unemployment rate in the Czech Republic

Wednesday: RBNZ monetary policy meeting, FOMC Meeting minutes

Thursday: PPI in Japan, Inflation in the Czech Republic, Inflation Rate in the USA and US Claims

Friday: UK GDP, German inflation rate, US PPI index, Canadian labour market

Sources:

Last week, we waited for the central bank meeting and we got unexpected events from Japan. Let's recap the highlights.

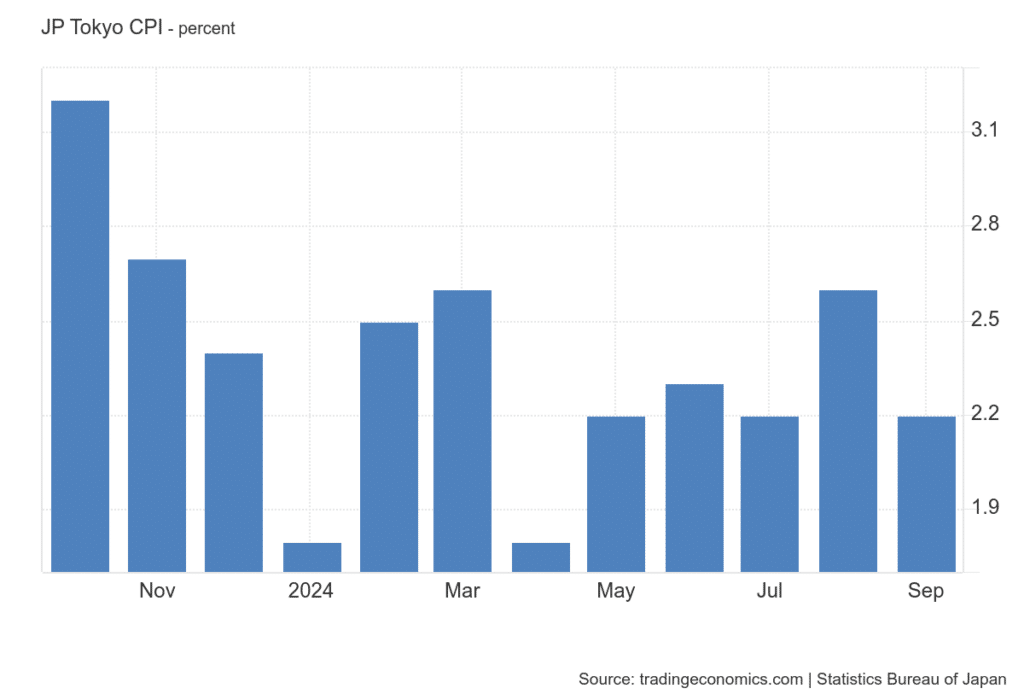

Tokyo's year-on-year consumer price index in Japan fell to 2.20 % in September 2024 from 2.60 % in August, returning to July's level and surprising markets that had expected a decline to 2.4 %. The core index rose 2 % year-on-year in September, ending four months of accelerating price growth and slowing sharply from August's 2.4 % rise, which was in line with expectations. This result is also in line with the Bank of Japan's price stability target of 2 %, supporting the central bank's cautious approach to monetary policy. This is negative news for the JPY.

Anyway, on Friday, unexpected news came from Japan, which resulted in the JPY strengthening. Shigeru Ishiba won the second round of the LDP leadership election and will become the next Japanese Prime Minister. Ishiba received 215 votes in the second round, while Takaichi received only 194 votes. This is good news for investors betting on the Japanese yen, as it was Takaichi who was the one who loudly criticized the Bank of Japan for raising interest rates too quickly. So Ishiba's victory at least partially eases that pressure.

Monday: Japanese retail sales, UK GDP, German inflation rate, US PMI

Tuesday: PMIs (US, Canada, Australia, Eurozone, Switzerland and UK), Eurozone inflation, retail sales in Australia and Switzerland

Wednesday: Eurozone labour market

Thursday: PMI (Australia, Japan, Eurozone, UK, US), inflation in Switzerland, PPI index in Eurozone, US jobless claims

Friday: US labour market data (NFP), inflation in Switzerland, PMI index in (Canada, UK, Eurozone)

Sources:

We have had another week in which central banks played a big role. Let's recall together an important event.

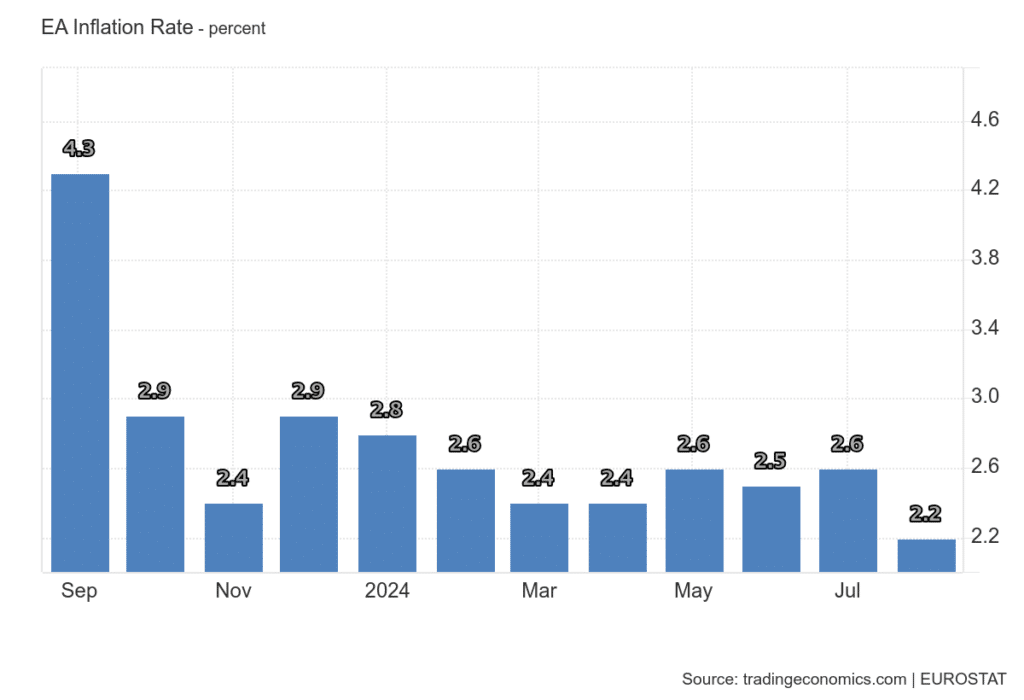

On Tuesday, we got inflation data from the eurozone, which was negative for the euro. The core inflation rate fell to 2.2 % year-on-year, the lowest since July 2021. Core inflation slowed slightly to 2.8 %. The data was broadly as estimated, so no surprises. The ECB announced that it will pause rate cuts in October while it assesses the expected increase in price pressures. At the moment I would take this as negative news for the euro through the downturn, but the ECB will still be on the lookout to meet its inflation target.

Monday: Eurozone, Australia, UK, US PMI

Tuesday: Japan PMI, Bank of Australia meeting

Wednesday: CNB meeting, inflation rate in Australia

Thursday: GDP and jobless claims in the US, SNB meeting

Friday: Eurozone, Japan and Canadian GDP inflation rates

Sources:

Last week we focused mostly on the ECB meeting and data from the US labour market and inflation rate. Let's take a look at them together.

The number of claims for unemployment benefits unexpectedly rose to 230 000 last Thursday. Unemployment claims unexpectedly rose to 230,000 last Thursday. The figure remained well above the average of earlier this year, reinforcing the ongoing trend of a softening labour market. This data also helped to some extent to push gold (XAU/USD) to a new all-time high.

Monday: PPI in Switzerland

Tuesday: US retail sales, Canadian inflation rate

Wednesday: UK and Eurozone inflation rates, Fed monetary policy meeting

Thursday: New Zealand GDP, Australian labour market, BoE monetary policy meeting, US jobless claims

Friday: Japanese inflation rate and BoJ meeting, UK and Canadian retail sales

Looks like a busy week. Apart from inflation and labour market data, we will mainly focus on the three central bank meetings (Fed, BoE, BoJ).

Sources:

Monday's recap is here! Together, let's recap what happened last week, and what we'll be watching for in the current week.

We got a solid batch of PMI data from the Eurozone during the week, from which we could see that the services data was mostly positive. But mostly services are benefiting from the Olympics in France, so this may not be as sustainable as it first looks.

On Friday, we got data from the labour market, which was rather negative. The number of persons employed in the euro area increased by 0.2 % in the three months to June 2024 compared to the previous quarter, confirming the preliminary estimate and matching the market's initial expectations. This growth was slightly lower than the 0.3% increase recorded in the first quarter. In annual terms, employment slowed to 0.8 % in the second quarter from 1 % in the previous period.

Monday: GDP in Japan

Tuesday: UK labour market, German inflation, Czech inflation

Wednesday: UK GDP, US inflation rate

Thursday: PPI index in Japan, Spanish inflation, US welfare claims and PPI, ECB meeting

Friday: French inflation rate

Sources: