The first September recap is here! Let's recap together what happened at the end of the month.

Thursday's U.S. jobless claims fell by 2,000 from the previous week to 231,000 for the period ending August 24, in line with expectations. This slight decline shows improvement, which marks us positive news for the USD for the first time in a while, although claims are therefore still above average.

Monday: PMI (Australia, Japan, France, Germany, Eurozone, UK), Swiss retail sales

Tuesday: GDP and inflation rate from Switzerland, US PMI

Wednesday: Australian GDP, PMI (France, Germany, Eurozone, UK), Eurozone PPI, Bank of Canada meeting

Thursday: Swiss labour market, PMI (France, Germany, UK, US), Eurozone retail sales, US jobless claims

Friday: eurozone, US and Canadian labour markets

This week, the market will focus mainly on Wednesday's BoC meeting, which is estimated to cut the key interest rate by 25 bp. Although a 50bp rate cut cannot be ruled out. Next, we will focus on the US labour market to end the week.

Monday's recap is here! Last week we got mostly inflation data and the US dollar was under fire again. Join us for a recap of the highlights.

The US Dollar was hit by some negative data last week, which weakened it again.

Thursday's jobless claims rose to 232,000, which was in line with estimates. This increase kept claims quite high above average and contributes to the softening US labor market. This supports market bets that the Fed will cut rates at every meeting until the end of the year.

At a conference in Jackson Hole on Friday, Jerome Powell announced that the time has come to adjust monetary policy as his confidence in inflation returning to the 2 % target increases. He noted that the risks to further inflation have diminished while the risks to employment have increased. Powell emphasized the Fed's commitment to maintaining a strong labor market while ensuring price stability. This approach could open up room for a possible interest rate cut. He certainly did not slam the 50bp door here. On the back of these announcements, the US dollar started to weaken significantly as it was more of a dovish rhetoric.

Monday: -

Tuesday: GDP from Germany (EUR)

Wednesday: Monthly inflation indicator in Australia (AUD)

Thursday: German inflation rate (EUR), US jobless claims and GDP (USD)

Friday: Tokyo inflation rate and retail sales (JPY), Australian retail sales (AUD), German retail sales and labour market (EUR), Eurozone preliminary inflation rate and labour market data (EUR), Canadian GDP (CAD)

Sources:

Monday's recap is here! Join us as we recap the highlights of the past week.

The annual inflation rate in the US slowed for the fourth month in a row to 2.9 % in July 2024, reaching its lowest level since March 2021, compared to 3 % in June and below the forecast of 3 %. Core inflation also fell for the fourth month in a row to 3.2 %, the lowest level since April 2021. The decline in inflation relative to previous periods is not significant and therefore the question of a 25 or 50 basis point interest rate cut is still open.

On Thursday, the US dollar strengthened in response and new jobless claims. The number of new claims surprised market expectations and fell to 227 thousand. This was the lowest number of new claims in five weeks, calling into question recent data that reflected a significant slowdown in the US labour market and giving the Federal Reserve some leeway to not ease monetary policy to an extent that would threaten to fight inflation.

Monday: -

Tuesday: inflation in Eurozone (EUR), inflation in Canada (CAD)

Wednesday.

Thursday: PMI in Australia, Japan, France, Germany, Eurozone, UK and US + US jobless claims, Jackson Hole Symposium (USD)

Friday: Retail sales in New Zealand and Canada, inflation rate in Japan (JPY), speech by Jerome Powell, Jackson Hole Symposium (USD)

The first half of the week will bring us inflation rates in Canada and the Eurozone. Starting Thursday, the Jackson Hole Symposium will also get underway with a speech by Fed President Jerome Powell. The Jackson Hole Symposium is hosted annually by the Fed.

Sources:

Monday's recap is here! Last week we experienced the fear and worry that caused the stock indexes to fall. Join us to read what the cause was and what we'll be watching for in the current trading week.

The US dollar had a number of negative fundamentals at the turn of the month, as we wrote in last Monday's summary. Wednesday's Fed decision (July 31, 2024) and subsequent labor market data (unemployment rate and NFP) resulted in a significant weakening of the US Dollar. In response to this poor labour market data, global equity markets saw sharp declines on Monday on fears of a US recession. One of the biggest investors, Warren Buffett, contributed to the relatively bad mood in the markets by making a massive sale of shares through his company Berkshire Hathaway. We could even read economists' speculations that the Fed might do an emergency meeting and cut rates. That hasn't happened yet, but it is evident that there are a number of aspects now pressuring the Fed that will lead the central bank to 100% a rate cut in September.

Monday: Inflation rate in the Czech Republic (CZK)

Tuesday: Japanese PPI (JPY), UK labour market data (GBP), Spanish inflation (EUR), US PPI (USD)

Next week could be quite interesting. The market will focus mainly on data on Wednesday: US CPI and RBNZ.

Sources:

We have had a week in which central bank and US dollar data played a major role. Let's recap together what the key takeaways were.

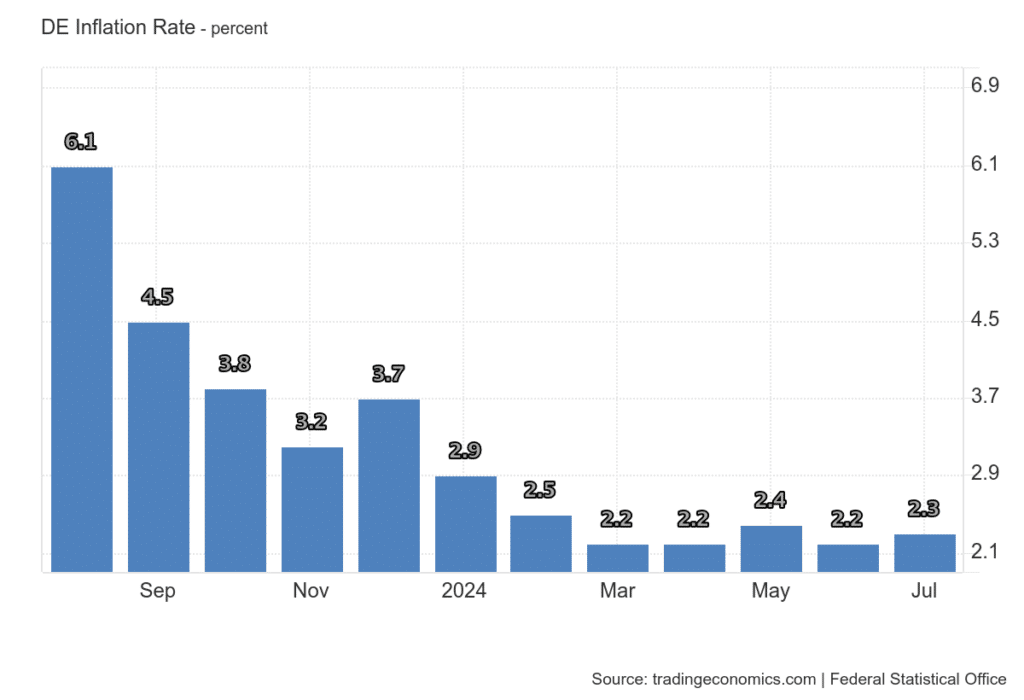

On Tuesday we got data on German inflation, which unexpectedly rose to 2.3 %. On a month-on-month basis, there was an increase of 0.3 %. All data was above market expectations. This was positive for the euro.

A day later we got headline inflation in the eurozone, which also unexpectedly rose to 2.6 %. Core inflation, on the other hand, remained at 2.9 % compared to estimates. This means that a September rate cut is not certain. Meanwhile, the probability of a cut is expected to be 67%. Positive for the euro.

Monday: Idex PMI from Australia, Japan, Eurozone, US and UK, (AUD, JPY, EUR, USD, GBP), Eurozone PPI (EUR)

Tuesday: meeting of the Reserve Bank of Australia (AUD), Swiss Unemployment Rate and Retail Sales (CHF), Index

This week will be weaker than the previous one, but we will still focus on a few important events. The most important fundamental to watch is Tuesday's RBA meeting.

Sources:

Monday's recap is out! Last week's main event was the Bank of Canada meeting. Join us for a refresher on its decisions, and what the impact was on the Canadian dollar.

On Thursday, we were waiting for data from the US labour market and GDP, which were positive for the USD. Unemployment claims fell to 235k, which was below market expectations. Despite this decline, the number of claims remained well above this year's average. Although still historically tight, the US labour market has eased since its post-pandemic peak.

In terms of GDP, the US economy grew by 2.8 % according to the preliminary estimate, another smaller surprise than estimated and contributing to the positive labour market report for the USD.

Monday: German Retail Sales (EUR)

Tuesday: Japanese unemployment rate (JPY), Australian retail sales (AUD), Spanish inflation rate (EUR), German inflation rate (EUR), Eurozone GDP (EUR)

Wednesday: Australian inflation rate (AUD), Bank of Japan meeting (JPY), German labour market (EUR), Eurozone inflation rate (EUR), Canadian GDP (CAD)

This week looks like it will be packed with important fundamentals again. Among the main fundamentals we will be focusing our attention on will be Wednesday's Bank of Japan meeting, Thursday's Bank of England meeting and Friday's US labour market (NFP). We will also be watching CPI data during the week.

Sources:

Hey! Hey! The regular Monday recap is here. Read what happened last week to keep you up to date!

Wednesday's UK inflation rate was positive for the pound. Year-on-year inflation remained flat at 2 % and held at its lowest level. As for core inflation, it remained steady for a second month too and at its lowest level since October 2021. The pound strengthened in response to the data as it appears inflation may be getting stickier. Estimates for a rate cut this year haven't changed much, but will likely wait for further data to see the BOE take a safer approach.

On Thursday, labour market data was released, which was negative for the pound, as the unemployment rate remained at a high of 4.4 %.

Monday: -

Tuesday: -

Wednesday: PMI (Australia, Japan, Eurozone, UK, US), Bank of Canada meeting

Thursday: GDP and Unemployment Claims in the US

Sources:

Monday's recap is here! Join us as we recap what happened last week and what we'll focus on this week.

NZD

On Wednesday, we turned our attention to the meeting of the Reserve Bank of New Zealand. As expected, it decided to leave interest rates unchanged at 5.5 %. The central bank said that monetary policy has significantly reduced inflation and is expected to return to the target range of 1-3 % by the second half of the year. economic activity and the labor market are showing a slight slowdown, consistent with the current restrictive stance. This statement was the opposite of what was said at the last meeting when the RBNZ was hawkish. The NZD weakened on this data as it was expected that the RBNZ would remain hawkish, which did not happen.

Monday: Swiss PPI (CHF), J. Powell speech (USD)

Tuesday: US Retail Sales (USD), Canadian Inflation Rate (CAD)

Looks like this week is going to be a busy one. The most important news will be Thursday's ECB meeting, which is estimated to leave rates unchanged at 92 %.

Sources:

The regular Monday recap is out! Last week was full of labor market data. Join us for a recap!

From Canada, we were mainly interested in the unemployment rate last week, which unexpectedly rose together with the US unemployment rate to 6.4 %. At the same time, employment fell by 1, 000, confirming the BoC's view that higher interest rates are impacting the labour market and strengthening the case for a rate cut. Negative for CAD.

Monday: -

Tuesday: unemployment rate in the Czech Republic (CZK), speech by J. Powell (USD)

This week we will focus mainly on Wednesday's meeting of the Reserve Bank of New Zealand (RBNZ), which is expected to leave rates at their current level.

Sources:

The first Monday recap of July is here! Join us for a recap of the most important things that happened at the end of June.

Thursday's jobless claims in the US fell by 6,000 from the previous week to 233,000, below market expectations of 236,000. The number of claims fell for the second week in a row since reaching a ten-month high of 243 thousand. This was more positive news for the USD.

On the other hand, the US economy grew by 1.4 % in the first quarter of 2024, slightly more than the 1.3 % expected. But this "growth" pointed to the lowest since the first half of 2022.

Monday: PMI in Japan (JPY), PMI in Australia and Retail Sales (AUD), Retail Sales in Switzerland (CHF), PMI from Spain, France, Eurozone (EUR), Inflation Rate in Germany and Federal States (EUR)

Tuesday: eurozone inflation rate (EUR), speech by Jerome Powell (USD)

Looks like a pretty busy week. Our attention will be focused mainly on inflation in Germany, the Eurozone and Switzerland.

Sources: