It's been a busy week for central banks. Join us for a refresher on the most important news we received and what we'll be watching this week!

The Reserve Bank of Australia left rates on hold at 4.35 % on Tuesday morning as estimated. There were no changes in the statement from the previous meeting. The central bank stressed it would be vigilant to inflation risks. The AUD strengthened in response to Governor Bullock's comments when she mentioned that no rate cut was on the table. However, a rate hike was part of the discussion and that was the driver for the Aussie.

Monday: -

Tuesday: Canadian Inflation Rate (CAD), Spanish GDP (EUR)

Wednesday.

Thursday: Retail Sales in Japan (JPY), GDP and US Claims (USD)

Friday: Tokyo inflation (JPY), French inflation, Spanish inflation, German labour market (EUR)

Sources:

Monday's recap is here! Last week we had the Fed's monetary policy meeting in the spotlight. Join us as we recap the highlights and what's ahead this week.

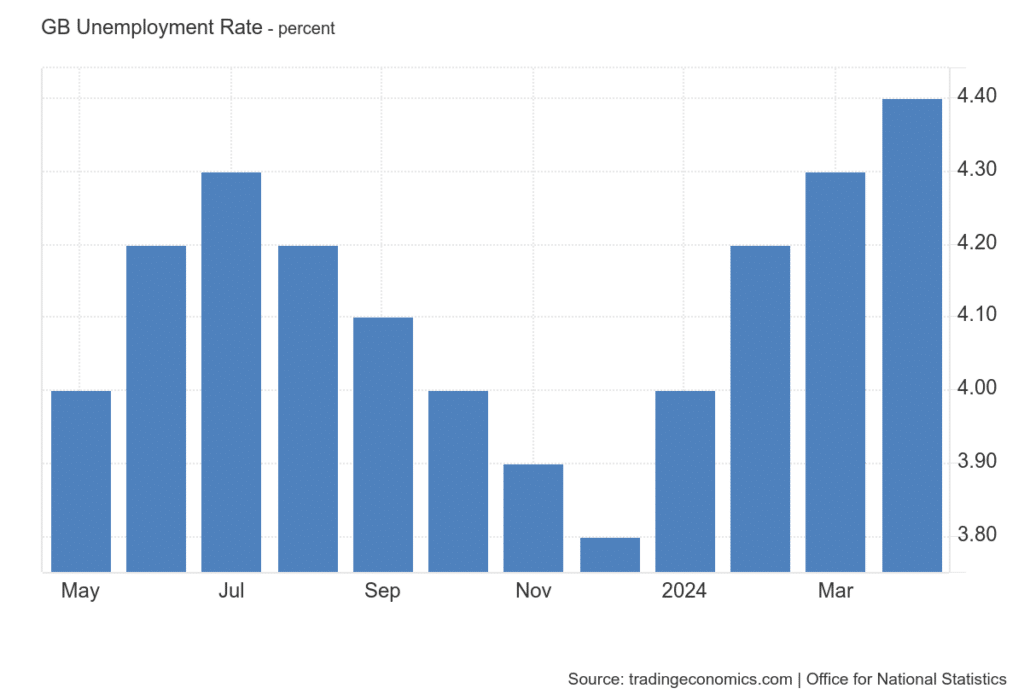

From the UK we only got labour market data on Tuesday, which was negative for the pound. The unemployment rate unexpectedly rose to 4.4 % in April. This was the highest reading since September 2021. Employment fell by 140k, which was also well below estimates. The data confirmed to us that labour market conditions are softening and this is adding to the Bank of England's concerns.

This week we have three central bank meetings. The RBA is expected to leave the rate unchanged at 4.35 % on Tuesday. The Bank of England is also expected to leave rates unchanged. Things could get more interesting from the SNB, where the option of either cutting rates or leaving them on the table.

Sources:

Another week is over. This time, we focused mostly on the ECB meeting and US NFP. Join us for a recap of what was important, and what we'll be interested in this week.

On Tuesday, we were interested in the inflation rate in Switzerland. It was estimated to have remained at 1.4 %. Also unchanged month-on-month. Ahead of the data, we could read that if inflation was higher, the SNB could take steps to strengthen the CHF. Anyway, inflation is similar to April's data, and this should currently give the central bank the green light to ease monetary policy further.

On Thursday, we still got data from the labour market, to which the Swiss franc did not have much of a reaction. The seasonally adjusted unemployment rate in Switzerland was 2.3 % in May 2024, unchanged from the previous month and in line with market estimates. Seasonally adjusted, the unemployment rate in May was 2.4 %, a slight increase. Still, this is not very encouraging news.

Monday: Japanese GDP (JPY), Czech unemployment rate (CZK)

Tuesday: unemployment rate in the UK (GBP), inflation in the Czech Republic (CZK)

Sources:

The weekly recap is here! Join us for a recap of what happened in the last trading week, and what we'll focus on in the current one.

The Canadian dollar has had a week of worse data.

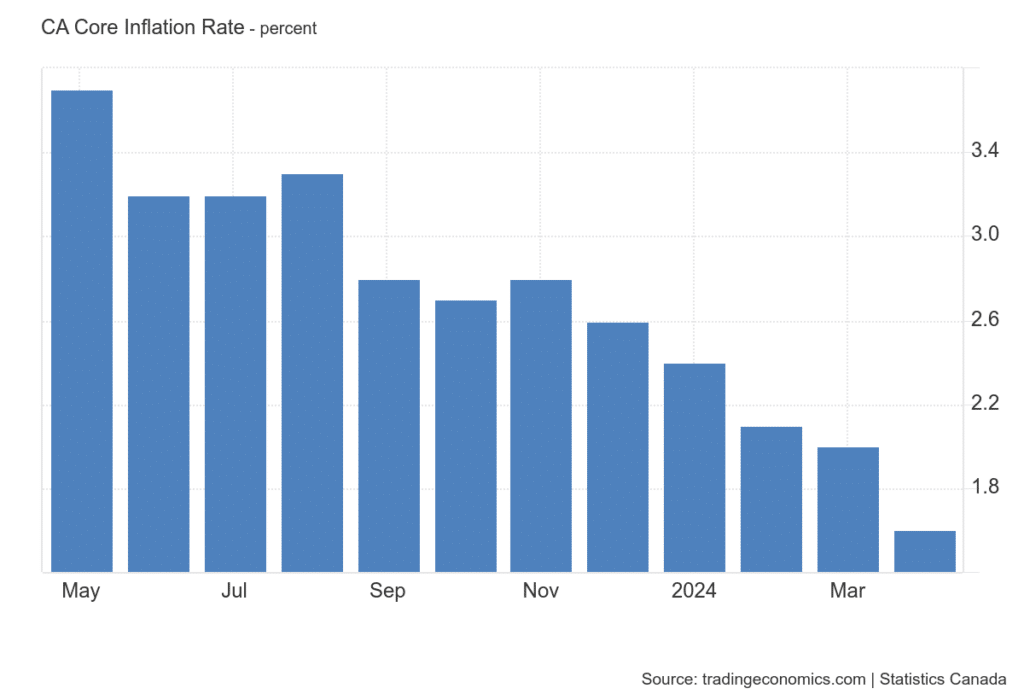

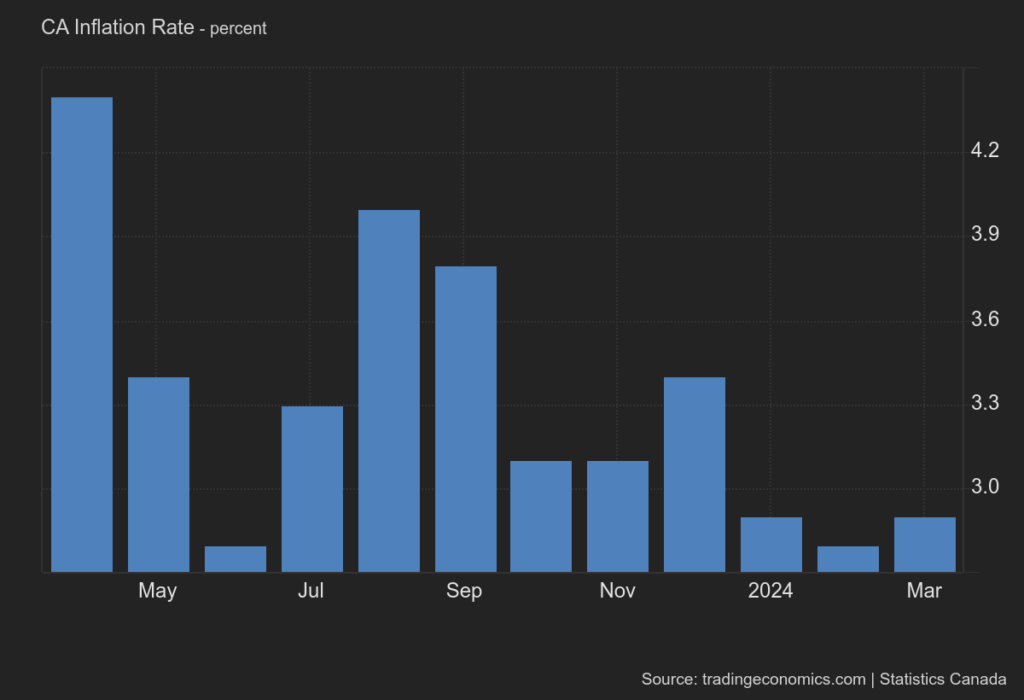

On Tuesday, the core inflation rate came out and declined to 2.7 % year-on-year, marking the mildest pace of growth since 3/2021. Core inflation slowed to 1.6 %, the lowest level in 3 years. The data signal that the start of rate cuts is imminent.

We got the retail data at the end of the week. Month-over-month retail sales came in slightly worse than expected and worse than the prior period, marking the third straight decline, revised from the preliminary stagnation reading. The decline was largely due to a drop in core retail sales, which also came in worse, specifically at -0.6 % versus -0.2 % in the previous period.

Monday: the United Kingdom (GBP) and the United States (USD) holiday

Tuesday: Australian Retail Sales (AUD)

Wednesday: spanish retail sales + inflation in Germany and the feds (EUR)

Sources:

Monday's recap is here! Join us as we recap the highlights of the past week.

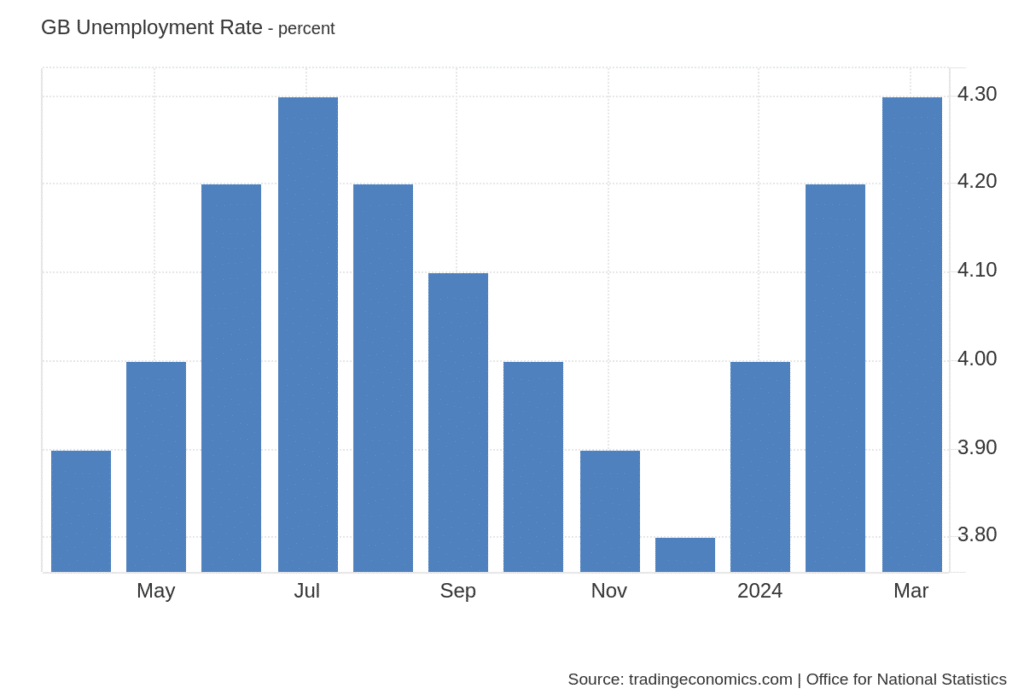

Tuesday's UK labour market data did not bring much optimism. As expected, the unemployment rate rose to 4.3 % and employment fell by another 18,000. This is a negative for the GBP. But the central bank will be more focused on inflation come this Wednesday!

Tuesday: canadian inflation rate (CAD)

Wednesday: monetary policy meeting RBNZ (NZD), UK inflation rate (GBP)

Thursday: new Zealand retail sales (AUD), PMI (Australia, Japan, Eurozone, UK, US), US jobless claims (USD)

Sources:

The weekly recap is here! Join us for a recap of what happened last week, and what we'll be interested in this week.

The Bank of England left the base rate unchanged at 5.25 % on Thursday. The decision was as expected. But the British pound weakened in response and here are a few reasons... 2 committee members were in favor of a 25bp rate cut, or the decision was not unanimous. The central bank took the next step to cut rates as it hinted that a cut could come in June. Governor Bailey announced that the central bank could cut rates more than the markets are currently pricing in.

This week we have labour market data, but the BoE is now focusing more on inflation. So the decision might not be completely dependent on the labour market unless there is a big surprise.

Monday: inflation in the Czech Republic (CZK)

Tuesday: the Japanese PPI (JPY), the UK labour market (GBP), the German and Spanish inflation rates (EUR), the Swiss PPI (CHF), the US PPI (USD), Fed President Powell's speech (USD)

Sources:

Last week was really rich in data. The market focused mostly on the Fed meeting and the US labour market, thanks to which we could see volatility on the USD. Let's recap the highlights, whatever you're in for this week...

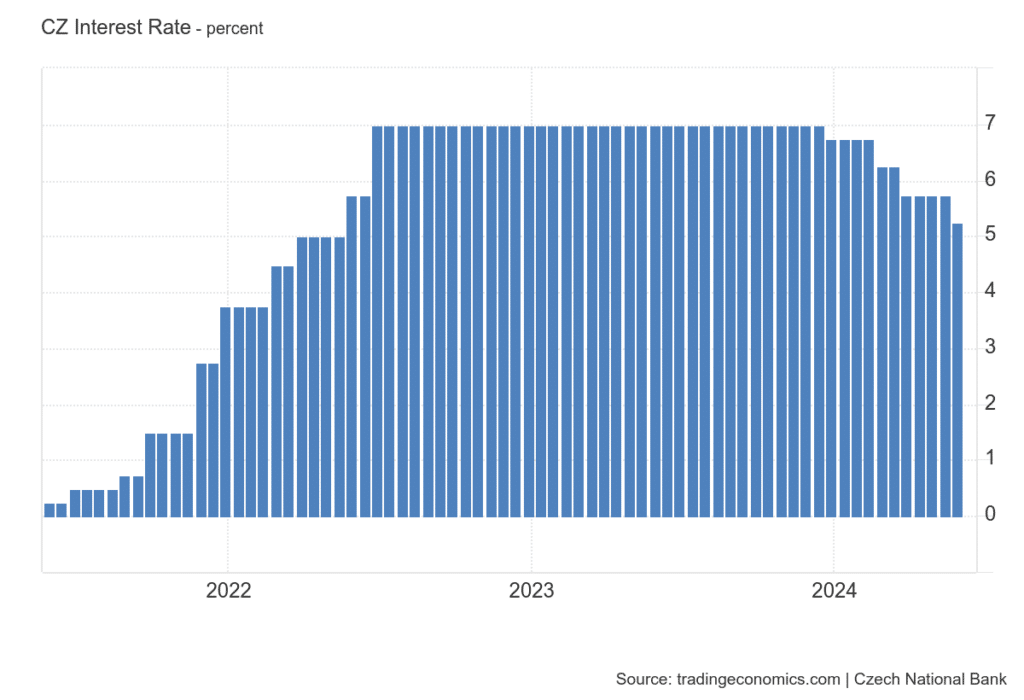

The Czech National Bank cut the rate by 50 basis points on Thursday, which was in line with market expectations. The move marked the third 50 basis point cut in a row. The CNB has met its inflation target of 2 % in the past 2 months. However, the Czech koruna strengthened during the press conference as the Board mentioned that it continues to see moderate inflation risks. Their fulfilment would mean that inflation would again reach the upper boundary of the target band. This is leading the central bank to persist with tighter monetary policy and will approach further rate cuts very cautiously.

Tuesday: RBA meeting and Australian retail sales (AUD), Swiss unemployment rate (CHF)

Sources:

Last week was relatively quiet. We focused mostly on Japan. Join us in recapping last week to keep you in the loop!

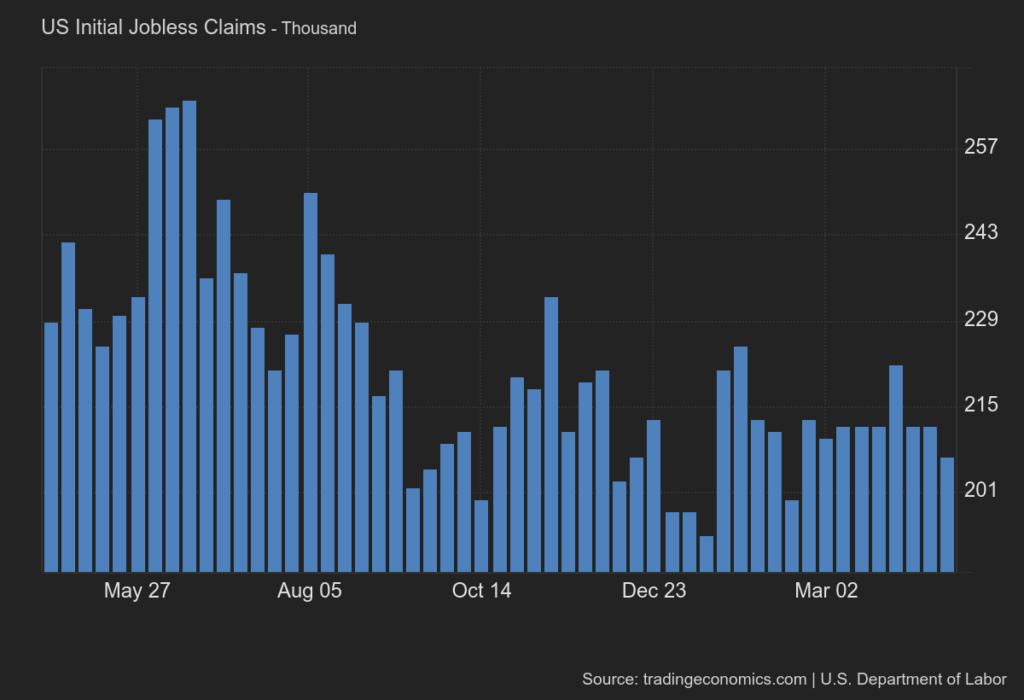

Thursday's jobless claims fell to 207,000. This was below market estimates, which had expected an increase to 214 thousand. At the moment, claims are at their lowest level in two months. This indicates a solid labor market and increases the room for the Fed to delay cutting interest rates.

Monday: German inflation rate (EUR)

Tuesday: unemployment rate and retail sales in Japan (JPY), Australian retail sales (AUD), inflation rate in France (EUR), German labour market (EUR), preliminary inflation rate and hdp in the Eurozone (EUR), Canadian hdp

This week we have a bit more to come. Most of our attention will be on the Fed meeting, which is expected to leave rates unchanged. So the focus will be on the press conference. The end of the week will bring data from the US labour market (NFP, unemployment rate).

Sources:

Monday's recap is here! Last week was marked by inflation. Join us in recapping what we've been watching to keep you in the loop.

On Tuesday, we also saw inflation from Canada, which was rather negative for the Canadian dollar. The core inflation rate rose to 2.9 % year-on-year. Core inflation, on the other hand, slowed to 2 % in March, the lowest level since 3/2021. Overall, the data should give the central bank more confidence to start cutting rates.

Tuesday: PMI index in Australia, Japan, Eurozone, UK, and US

Wednesday: australian inflation rate (AUD) and canadian retail sales (CAD)

Thursday: UK GDP (GBP), US jobless claims (USD)

Friday: tokyo inflation rate and Bank of Japan (JPY) monetary policy meeting

Sources:

The last trading week was more in the interest rate area. At the end of the week, we also saw an escalation of the Iran-Israel war. Join us in recapping it all together to get you ready for the new trading week.

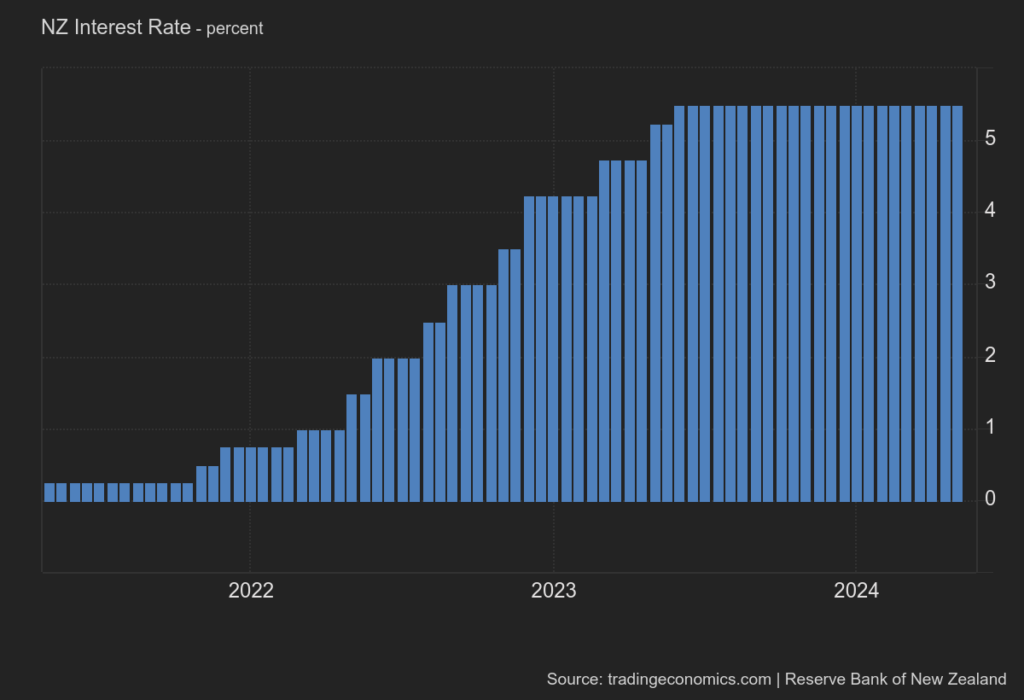

The Reserve Bank of New Zealand also left rates unchanged on Wednesday, as expected. The committee said rates will have to remain at higher levels for longer. Inflation expectations remain elevated. The central bank did not deliver any new surprises, but the NZD strengthened on the formulation that rates should remain higher for longer.

Monday: Swiss PPI (CHF), US retail sales (USD)

Tuesday: UK unemployment rate (GBP), Canadian inflation rate (CAD), Fed President J. Powell's speech (USD)

Sources: