Welcome to the regular Monday recap, which is extraordinary for an unexpected event that shocked the markets at the end of the week.

Read on to keep up to date!

The week started with positive retail sales data in the euro area.

The US dollar experienced volatility last week for the first time in a while. Late in the week, the markets were hit by news of the collapse of the 16th largest US bank! California banking regulators closed Silicon Valley Bank's parent company, SVB Financial Group, on Friday.

In the second half of the week, we watched the Bank of Canada meeting and incoming Canadian labour market data, to which the Canadian dollar weakened.

Earlier in the week, the Reserve Bank of Australia (RBA) raised its base rate by 25 basis points, which was also in line with market expectations.

In the current trading week, we will definitely turn our attention to the developments regarding the collapse of the US bank SVB.

Sources:

Welcome to our regular Monday recap of the most important fundamentals we focused on in the last trading week.

Included is an outlook of events we can expect to see this week.

Follow us to stay in the loop!

On Thursday, we focused on the incoming data from the Eurozone regarding inflation and unemployment, which was broadly positive for the euro.

We are starting to get somewhat stronger data out of the UK lately and the proof of this is last week's PMIs, which came out surprisingly well.

As far as US data is concerned, the week ended with only PMI data, which was positive for the USD on the whole.

Tuesday's data showed retail sales in Australia rose by 1.9% year-on-year in January 2023, beating market estimates of 1.5%.

On Tuesday we still got the latest data from retail sales in Japan, which rose by 6.3 % in January 2023.

On Tuesday (4:30), we turn our attention to the RBA meeting, where the RBA is expected to raise the base rate by 25 basis points.

There's a bit more to come that could bring volatility to the markets, so we'll be watching the announcement to keep you in the loop!

Sources:

Welcome to our regular Monday recap from last trading week, where we got some surprising data that brought volatility to the markets.

At the end of the week, we focused our attention on the current inflation rate in the euro area, which showed a lighter decline than the market had expected.

On Tuesday, we got surprisingly stronger UK PMI data, to which the British pound strengthened significantly.

The US economy grew by 2.7 % in Q4 2022, slightly less than the preliminary estimate.

The Reserve Bank of New Zealand raised its base rate by 50 bp at its first meeting of the year.

The first half of the week will bring a flurry of Canadian, Swiss and Australian GDP data that we will be waiting for.

Keep an eye on our discord room to stay up to date!

Sources:

Welcome to this week's regular Monday recap and outlook. Let's take a look together at what we've focused on, and what will be critical for us this week.

Read more to stay in the loop!

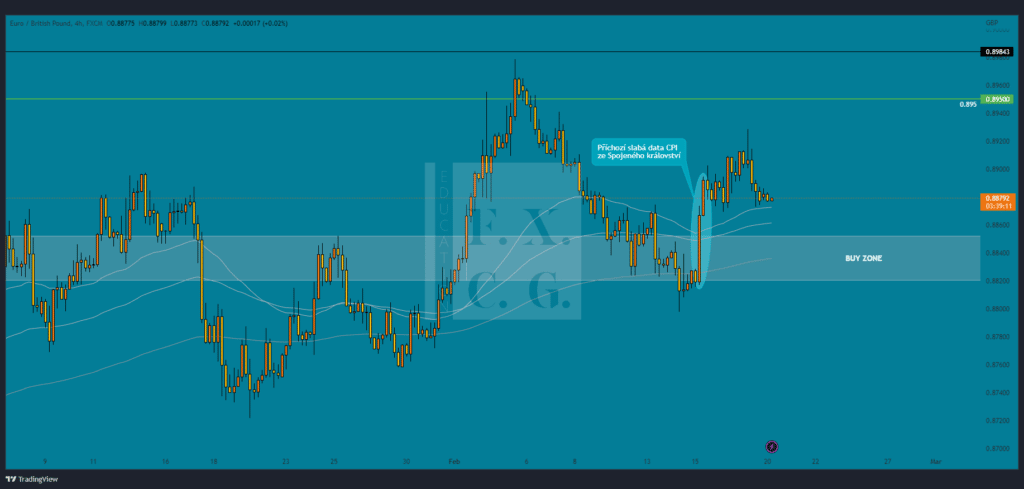

At the start of last week, we got some weaker data from the euro area, which caused the euro to weaken slightly.

Inflation is still in double digits but reflects a significant decline from the 10.5 % minimum in December. The pound has thus fallen sharply.

On Tuesday, the market was still preparing for US inflation, which was not as surprisingly positive as everyone might have expected.

And what's in store for the current trading week?

This week we are again expecting a bit more data that might surprise us. On Tuesday, we will focus our attention on the current inflation rate in Canada, which will be released at 14:30.

Sources:

Monday's recap is here! Read more about how stronger Canadian labour data impacted the Canadian dollar.

Read more to stay in the loop!

Over the past week we have again received some weaker data from the UK, which continues to reinforce our belief that the UK is heading into recession.

On Tuesday, we focused on Fed President Jerome Powell's speech reacting to the recent positive labour market data. Powell mentioned that he did not expect the data to come out so strong.

On Friday, we got surprising data from the Canadian labour market, which followed the US one the previous week.

The most important event we focused our attention on was Tuesday's RBA meeting, which raised the base rate as expected.

Earlier in the week we get UK labour market data (Tuesday 8:00) and the current US inflation rate (Tuesday 14:30), which could bring volatility to the market, and which we will focus on in detail.

Sources:

We bring you our regular Monday recap of the most important fundamental events that the markets focused on in the past trading week.

And that there was a lot. We had several central bank meetings that brought volatility to the markets.

Read on to find out more!

At Thursday's meeting, the European Central Bank raised interest rates by 50 basis points, as the market expected.

Thursday's meeting of the Bank of England also did not surprise significantly. The central bank voted to raise interest rates by 50 basis points to 4.0 %. This was the tenth rate hike in a row.

The icing on the cake of the week was Wednesday's Fed meeting, which raised the benchmark interest rate by 25 basis points as expected.

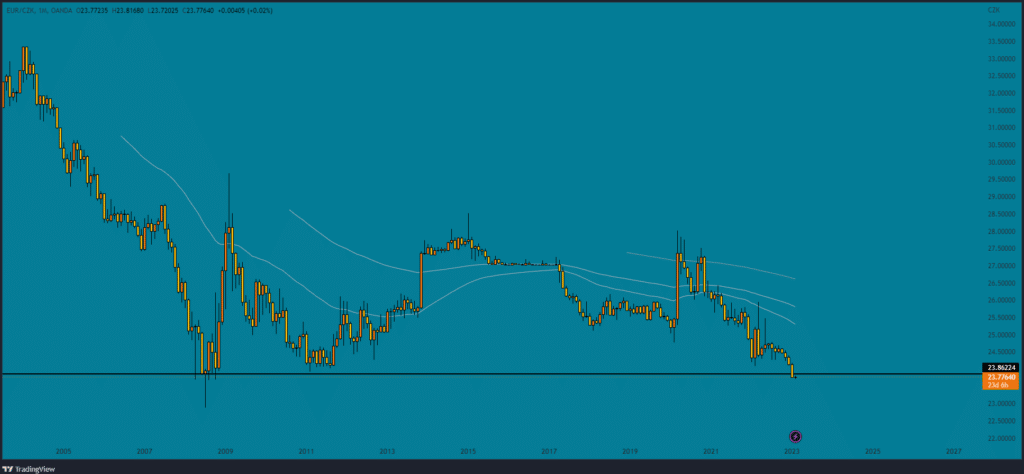

The koruna is the strongest against the euro since July 2008.

We won't see as much in the current week, but there are still some interesting events worth waiting for.

Sources:

Welcome to our last January summary of the fundamentals that we used to shape our business plans last week.

The week surprised with a few numbers and we could see higher volatility.

Read more to stay in the loop!

EUR

Last week we got quite positive data from the euro area.

USD

US PMI brought us slightly positive data for the US dollar after a long time.

CAD

On Wednesday, we closely followed the Bank of Canada meeting, which did not surprise us much.

And what's in store for the current trading week?

The current trading week will be marked by central bank meetings, on which we will focus our attention. The most important meeting will be on Wednesday (20:00) when the Federal Reserve (Fed) will meet. The markets are expecting a hike of only 25 basis points.

Sources:

Welcome to our regular Monday recap of the most important economic events we followed during the last trading week.

Read more to stay in the loop!

The euro experienced volatility last week thanks to speeches by ECB chiefs.

On Wednesday, we turned our attention to the current UK inflation rate, which came in as estimated.

Canada's core consumer price inflation declined to 5.4 % year-on-year in December 2022.

At its January meeting, the Bank of Japan unanimously kept its key short-term interest rate at -0.1 %.

Tuesday will see the latest PMI numbers from the euro area and the UK and the day will close with New Zealand inflation/cpi (22:45).

Sources:

The regular Monday Fundamental Summary is available! Included in the summary is a look at the events we will be focusing on during the week.

Unemployment remained stable in November.

On Wednesday, we were waiting for weaker data on US inflation, which almost came in as estimated.

The monthly Consumer Price Index (CPI) in Australia rose by 7.3 % in the year to November 2022, accelerating from October's reading of 6.9 %.

This trading week will bring us some more interesting events from the central banks.

Throughout the week, we will be watching incoming data on the current inflation rate, which will come in turn from Canada (Tuesday, 14:30), the United Kingdom (Wednesday, 8:00) and the euro area (Wednesday, 11:00).

Sources:

Welcome to our regular Monday recap of the fundamentals we've focused on over the past week.

Included is our look at this week, where we expect to kick off the New Year.

On Friday, we focused on the current inflation rate in the euro area, which was broadly positive for the euro.

PMI data from the UK did not bring much optimism to the pound last week.

Along with Canada, we also watched the US labour market numbers on Friday, which at first glance seem positive.

There is no central bank meeting this week. However, we will get some interesting data from the US and the UK.

Sources: