Welcome to the regular summary of the most important events that interested us during the last trading week.

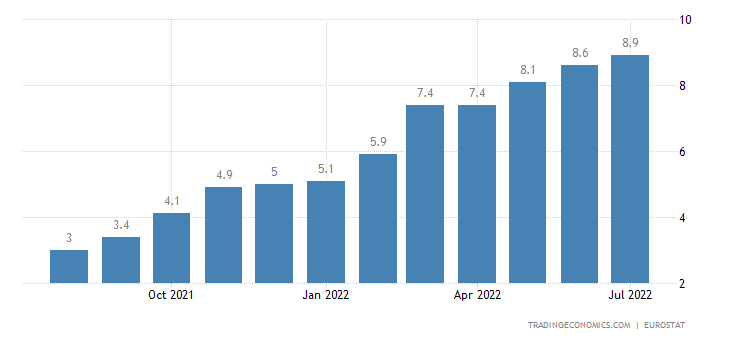

Inflation in the euro area continues to rise sharply.

For the third time, the unemployment rate in the UK is showing us stable results.

In the first half of the week we could see data on Canadian inflation, which remains high and the market expects a 75bp rate hike at the next Bank of Canada meeting.

Probably the most important event last week was the RBNZ meeting, where the central bank raised rates by 50 basis points.

In the current trading week we will be interested in incoming data from the UK, US and Eurozone

Sources:

Welcome to our regular recap of the most important events of the past week and the outlook for the current one.

The second week of August was very modest in terms of fundamentals. Still, we watched some interesting news worth remembering.

All eyes were on Wednesday's US inflation data.

The annual inflation rate in the US slowed more than expected to 8.5 % in July.

The Swiss unemployment rate thus reached 2 % in July 2022.

Last Wednesday, we also got the latest inflation figures for our country, where we again recorded higher numbers than last time.

The key for us will be Wednesday's Reserve Bank of New Zealand meeting, where the central bank is expected to raise interest rates by 50 basis points. That is, to 3 %.

Sources:

Welcome to the first August recap of the most important events we followed last week.

It was really busy and apart from the classic data we were also expecting three central bank meetings.

Let's see how it turned out.

During the last trading week, we had data coming in from the euro area that didn't come out so brightly.

The Bank of England raised rates by 50 basis points at its Thursday meeting, as the market had expected.

America offered us similar PMI and labour market data last week.

The services sector signalled its sharpest decline since May 2020 and the unemployment rate fell in July to its lowest level since February 2020.

Earlier last week, the Reserve Bank of Australia held its monetary policy meeting and also raised rates by 50bp, as expected.

The CNB left rates unchanged.

This week will be much poorer.

We can expect most of the incoming data to come from the US and the UK, with the latest US inflation numbers and Friday's GDP from the UK due on Wednesday.

Sources:

Last trading week offered us some interesting data worth noting.

This week we expect volatility in the markets again through the central bank meetings.

We didn't get much out of the Eurozone last trading week. It was more interesting at the end of the week when we got the latest GDP and CPI/inflation data.

On Wednesday, we watched the monetary policy meeting of the Fed, which is estimated to have raised rates by 75 basis points.

TIP: Watch the Fed press conference

On Tuesday, the Bank of Japan published the minutes of its last monetary policy meeting in July, at which it again left rates unchanged.

The current trading week is going to be a bit more varied again. Central banks will again be in our focus.

Tuesday: Reserve bank of Australia

Thursday: Bank of Englad, Czech National Bank

Sources:

Image source: https://www.federalreserve.gov/aboutthefed/aroundtheboard/history-buildings.htm

Last trading week offered us a lot.

Let's see together what interesting things happened and what surprised us!

The last trading week offered us appropriate volatility on the euro.

In the afternoon, the ECB decided at its monetary policy meeting to raise the base rate from 0 % to 0.5 %.

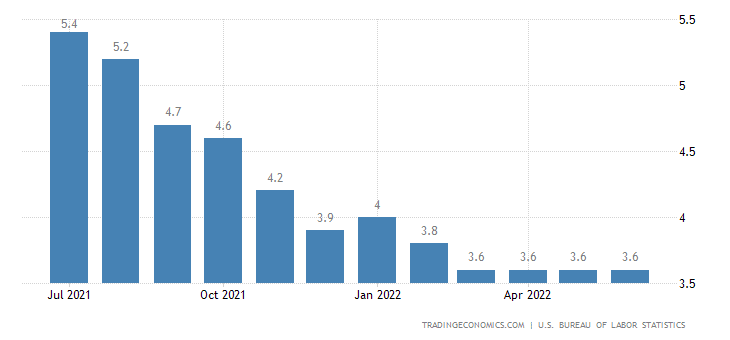

On Tuesday, we focused our attention on the labour market numbers. The July unemployment rate held steady and remains at near its lowest level.

Canada offered us inflation and retail sales data in the second half of last week, which turned out to be positive.

The monetary policy meeting of the Bank of Japan shows that the central bank still wants to keep monetary policy extra loose.

The current trading week will offer us a little less.

Our attention will be focused on Wednesday's Fed meeting, where a 75 bps rate hike is expected, accompanied by the FOMC press conference.

Sources:

Welcome to our regular Monday recap of what happened in the last trading week, which brought a number of interesting things.

In the middle of the week came the latest UK GDP data. The UK economy unexpectedly grew by 0.5 % month-on-month in May 2022, recovering from a 0.2 % contraction in April and beating market estimates.

On Thursday we could see an interesting "natural phenomenon" on the EUR/USD currency pair, where a currency parity was created, i.e. that 1 EUR = 1 USD. This parity last occurred in December 2002.

The Bank of Canada surprised the markets on Wednesday by raising its key interest rate by one percentage point (100 bp).

HINT: the full statement can be found here:

https://www.bankofcanada.ca/2022/07/fad-press-release-2022-07-13/

The Reserve Bank of New Zealand also raised rates on Wednesday by 50 basis points, as expected.

The Bank of Japan will meet at 5:00 on Thursday to decide on the current monetary policy settings.

The European Central Bank will also meet on the same day at 14:15, where we expect a 25 basis point rate hike.

Sources:

Welcome to our regular Monday recap and outlook.

There were some interesting events last week that you should not miss.

So read on to keep up to date.

Last week we saw some interesting data from the euro area that are worth noting.

Wednesday's retail services in the euro area showed that spending on food and tobacco products fell for the second month in a row, due to a sharp rise in prices.

We have seen some interesting things from the UK in the last week. The main event of the week was the resignation of British Prime Minister Boris Johnson after more than 50 MPs left the government.

The US unemployment rate was unchanged at 3.6 % in June 2022, the same as in the previous three months.

At its meeting on Tuesday, the Reserve Bank of Australia confirmed market expectations and raised the base rate by 50 basis points.

Apart from the data coming out of the UK (GDP) and the Australian labour market during the week, we will pay attention to the markets especially on Wednesday, when we should see two rate hikes

Sources:

Image source: www.bloomberg.com (photographer: Niklas Halle'n)

Welcome to our regular Monday roundup of the more uninteresting events we focused on in the last trading week.

Last week, the European Central Bank Forum on Central Banking 2022. We focused our attention mainly on Wednesday's panel, where 3 central bank representatives spoke:

Andrew Bailey - BOE Governor, Christine Lagarde - ECB President, Jerome Powell - Fed Chairman.

Here you will find the record:

The slowdown in UK manufacturing continues to be reflected in output growth approaching stagnation and new orders falling.

May retail sales in Australia grew by 0.9 %, the same as those in April. This beat market estimates, which were more in the region of 0.4 %. This was the fifth consecutive month of growth

We also saw retail sales from Switzerland. They fell by 1.6 % year-on-year.

Apart from the fact that today is a holiday in the US, we will focus our attention on Tuesday's meeting of the Reserve Bank of Australia, where a 50bp rate hike is expected.

A day later, on Wednesday, we will be interested in the US FOMC minutes, which will offer the FOMC's stance on monetary policy.

Follow our group to stay up to date!

Sources:

Welcome to Monday's recap of what was interesting in the last trading week, and what we'll be focusing our attention on this week.

The CNB surprised the markets! Perhaps for the last time...

Read on to find out more!

At the end of the week, we got the latest global manufacturing PMI (Purchasing Managers' Index) data, which came in even worse than expected.

Over the past week we have been receiving a number of interesting figures, mostly relating to UK inflation and retail sales.

Consumer inflation increased by 0.7 %. This continues to confirm stronger price pressures. There is nothing here to distract the BOE from further and more persistent policy tightening.

On Wednesday and Friday, Fed Chairman Jerome Powell testified before the Economic Committee in Washington about the economic outlook and recent monetary policy actions.

The most interesting event of last week was the Czech National Bank's interest rate decision.

It surprisingly raised the rate by 125 basis points on Wednesday afternoon.

This week we turn our attention to Wednesday and Thursday's GDP data coming out of the US, UK and Canada.

We can expect an onslaught of speeches by central bank speakers throughout the week or so, who will be in the spotlight.

Follow our telegram group to stay up to date!

Sources:

It's Monday, and that means another regular recap of what happened last week.

Last week we saw a big surprise from the central banks!

Read on to keep up to date!

On Thursday, we turned our attention to the BOE's interest rate decision, which the central bank raised by 25 basis points as expected, marking the fifth rate hike in a row.

On Wednesday, the Fed raised rates by 75 basis points. Although it had predicted a 50 bp hike. During the week, the forecasts of major institutions (WSJ, Goldman Sachs, JP Morgan) came out, which to some extent counted on a 75 bp increase. So it was not such a surprise.

Recording of the press conference:

At the end of the week, the Bank of Japan left rates unchanged, as expected.

The big surprise of the week was the Swiss National Bank (SNB) unexpectedly raising rates.

The current trading week will be much weaker. Still, it will bring some interesting data that will be worth mentioning.

The Reserve Bank of Australia will release its minutes of the monetary policy meeting on Tuesday.

The most important event we will focus on is Wednesday's CNB interest rate decision, which is expected to increase by 1 percentage point to 6.75 %.

Follow us to stay in the loop!

Sources: