High inflation requires further action by central banks!

Welcome to our regular recap of the important events we followed last week.

Read on to keep up to date

During the last trading week, we followed the data from the euro area, which were mainly related to inflation, PMI and the labour market.

Inflation in the euro area reaches new highs. This is putting increasing pressure on the ECB to act to raise rates to bring inflation under control.

We also saw an interesting fundamental last week in the USA.

Wednesday's manufacturing PMI came in slightly above market expectations. Suppliers see light at the end of the tunnel for resumption of supply of (semiconductor) components. Supply appears to be easing in Q2 and Q3. Prices continue to rise, but at a slower pace. New orders grew at a faster pace.

The Japanese yen weakened significantly again last week. BOJ Governor Kuroda is reportedly expected to appear before the Diet this week to present a report on monetary policy.

We probably won't hear anything significantly different than which way the BOJ is going, but it will be good to watch.

The BOJ thinks there is no need to tighten monetary policy at this point.

On Tuesday, we turn our attention to the interest rate decision in Australia. The market's prediction is that the Reserve Bank of Australia (RBA) will raise the base rate for the second time since November 2010, by a base 25 basis points.

Follow our telegram group to stay up to date!

Sources:

Welcome to our regular Monday summary of economic events worth pondering.

RBNZ confirmed market expectations!

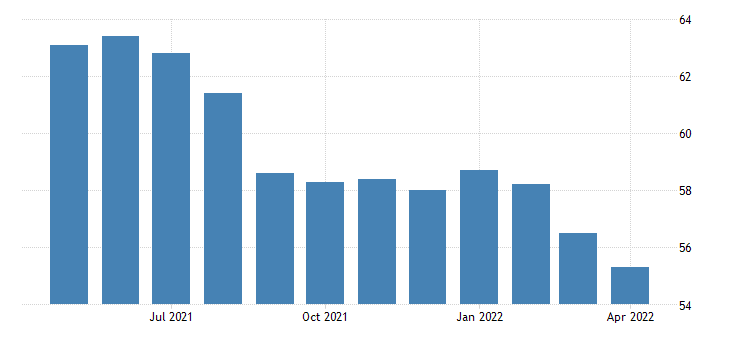

Last week the Eurozone offered us only the latest PMI data, which came in a bit worse than expected:

The UK also offered us the latest Purchasing Managers' Index (PMI) figures last week. And in a very similar vein:

On Wednesday, the minutes of the last Fed meeting, which took place on 3. and 4 May. The minutes show that a majority of Fed members judged that another 50 basis point rate hike was likely to be appropriate at the next few meetings.

The current trading week will bring us plenty of interesting events and data to watch.

The week will start with a special European Council meeting to discuss the evolving situation in Ukraine, defence, energy and security. The week will also see data coming out of the Eurozone on the Consumer Price Index, unemployment and retail sales.

Sources:

Welcome to our regular review of the most important economic events from the last trading week.

Markets globally expect central banks to raise rates to bring inflation under control.

Read more to stay in the loop!

Just on Monday, the European Commission published its economic forecast for 2023, where we could read about a reduction in the economic growth forecast.

Later in the week, the ECB published the minutes of its monetary policy meeting, in which members expressed concern about high inflation.

The British pound strengthened slightly last week, thanks to intensifying global pressure on interest rate hikes and an improving labour market.

Earlier in the week, we watched a speech by FOMC member Williams, who confirmed that a 50 basis point hike is meaningless in the upcoming meetings.

After several record years, housing markets in many parts of Canada have cooled off sharply over the past two months.

On Tuesday we saw the minutes of the BOA meeting on monetary policy.

the meeting shows that the RBA will want to hike by 25 basis points at the next meeting.

The Australian economy was supported by household and business balance sheets and its resilience was particularly evident in the labour market.

Wednesday will be marked by interest rates in New Zealand. It is expected that the RBNZ will want to raise the base rate by 50 basis points This will certainly be encouraging for the NZD and could bring enough volatility to the New Zealand currency.

Follow us to stay up to date!

Sources:

Welcome to Monday's summary of the most important economic events.

Although last week was modest on fundamentals, the CNB moved the markets!

Read more to stay in the loop!

Christine Lagarde (ECB President) signalled a gradual rise in interest rates without a ceiling in her speech on Wednesday.

The UK offered us a bit more new data. We focused our attention mainly on UK GDP, which did not turn out to be particularly optimistic:

The US dollar has had a fairly eventful week, rising again.

At the beginning of the week, we were able to watch the speeches of the members of the FOMC (Federal Open Market Committee - a body of the Fed), on which we focused our attention.

The domestic currency has had a really volatile week. Wednesday's appointment of Ales Michl as the new CNB Governor started a significant depreciation of the koruna.

The current trading week will definitely bring us a much bigger dose of interesting data from around the world.

On Tuesday, the RBA publishes the minutes of its monetary policy meeting, we get updates on the UK labour market and Eurozone GDP. The evening speech of the Fed chief - J. Powell - will definitely be interesting. At the end of the week we will also turn our attention to the Australian labour market.

Join us to stay up to date!

Sources

Welcome to our regular Monday recap of the most important events from the past week.

And that something was happening again! Central banks have added volatility to the market.

Read more to find out why.

The British pound experienced a slight decline after the Bank of England (BOE) raised rates by 25bp on Thursday, as expected. The current rate is thus the highest since February 2009 at 1 %.

The Fed also decided to raise interest rates on Wednesday, increasing them by 50 basis points. This is the second increase in a row.

The Canadian currency offered us only actual labour market data last week with a record low unemployment rate (5.2 %).

The Reserve Bank of Australia (RBA) made a "bold move" by raising rates higher than expected. That is, by 25 bp to the current level of 0.35 %. And more hikes are on the horizon.

We certainly won't see the same dose of economic data in this trading week that we experienced last week.

Despite this, we will turn our attention to a couple of numbers, which will mainly concern the current change in GDP in the UK and the US Consumer Price Index (CPI).

Join us to stay up to date!

Sources

It's Monday and that means we're bringing you our regular recap of what affected the markets last week.

The first half of the week was a bit weaker on fundamentals, but that changed on Wednesday when we started to get interesting numbers from Japan and the eurozone.

Read on to keep up to date!

The Bank of Japan (BOJ) left interest rates unchanged on Wednesday, as expected.

The Japanese currency has gone through a rough patch over the past 2 months, weakening significantly against other currencies.

The BOJ very confidently reiterated that it would keep monetary policy loose. They will not be tightening anytime soon. The bank says it is committed to achieving its 2% inflation target and will keep policy loose. However, there were concerns that the bank would falter precisely because of the political pressure of a falling yen.

BOJ Governor Haruhiko Kuroda said at his press conference that it is desirable for the currency to move steadily in line with economic fundamentals and that the current strong monetary easing needs to continue.

The Japanese Finance Minister believes that the current high volatility in the Japanese currency is undesirable and will take appropriate action if necessary.

Frankly, we are very curious how the BOJ will deal with this situation. The central bank hasn't raised rates since 2016 and so they remain in negative territory at -0.10 %. There is also some speculation in the markets about a JPY FX intervention. Central banks usually resort to intervention when conventional stimulus processes do not work to get the economy moving.

Our view is that the BOJ is very conservative in terms of moving rates. The JPY is considered a so-called safe haven in times of crisis due to the BOJ's monetary policy. Which we also saw at the beginning of the Russian invasion of Ukraine. We think that excessive rate hikes to boost the economy would slightly damage this prestige of the JPY.

On Wednesday, we could also see the actual quarterly GDP numbers in the US, which were not very good (current: - 1.4 % / previous: 6.9 %).

The euro area also brought interesting data at the end of the week:

Headline annual inflation may have matched estimates as it crept to a new record high, but the more worrying figure is that core inflation jumped above estimates in April.

This will continue to make the ECB very uncomfortable. So far, there are still little signs that inflation has cooled significantly.

Euro area growth was slightly slower than expected in Q1 as the Russia-Ukraine conflict weighed on activity since the end of February.

This week will be marked by central banks and their interest rates. On Tuesday, we will focus our attention mainly on the Australian currency, where rates are expected to rise to 0.25 %. Later on Tuesday evening, the Reserve Bank of New Zealand will release its Financial Stability Report, which will be accompanied by a press conference on Wednesday.

On Wednesday evening, we will also await the change in US interest rates, which are expected to rise by 50 basis points.

On Thursday, we will again see an interest rate decision from the UK. There is also the expectation of an increase here.

This week will definitely bring volatility to the markets, so be cautious and use SL. 😊

We wish you a successful start to the new week!

Sources

Welcome to our regular Monday recap of the most important economic events that affected the markets during the last trading week.

The start of last week was relatively modest for economic data. The second half of the week brought some interesting numbers, mostly from the euro area.

Read on to keep up to date!

The start of the week was kicked off by a statement from Reserve Bank of New Zealand (RBNZ) Governor Adrian Orr, who mentioned that the current challenge for the RBNZ will be a "soft landing" over the next few years without a recession, where fiscal support will be needed.

On Tuesday morning, the Reserve Bank of Australia (BOA) released the minutes of its monetary policy meeting.

The meeting shows that we can expect another rate hike in June.

The Australian economy remains resilient and spending is growing. Wage growth has accelerated as well.

Members noted that higher petrol prices would lead to higher inflation in the coming quarters.

Financial conditions need to remain accommodating.

The full minutes can be found here:

https://www.rba.gov.au/monetary-policy/rba-board-minutes/2022/2022-04-05.html

At the end of the week, we saw results from Canadian retail sales (excluding autos), which were slightly weaker than last month (current: 2.1 %, previous: 2.9 %).

The Canadian economy has reopened after the January and February quarantine. Signs of March growth are positive. What's worrisome is new vehicle sales, down 11 % compared to 2/2021.

Last week also offered us some interesting Consumer Price Index (CPI) and Purchasing Managers' Index (PMI) numbers from the euro area.

The details reveal that the surge in services comes as we see another reopening of the economy. Meanwhile, the downturn in manufacturing comes as supply chain disruptions continue to persist and we also see demand conditions cooling. The latter in particular is not an entirely positive sign.

Taking into account concerns about production conditions, weighed down by the Russia-Ukraine conflict and quarantine measures in China, this could lead to another challenging month despite these better figures.

The first half of this week will be rather modest for economic data. We will focus our attention on Thursday's Bank of Japan (BOJ) meeting, which will decide on the current interest rate settings. Later in the day, the latest US GDP numbers will be of interest.

We wish you a successful start to the new week!

Sources

We bring you our regular Monday summary of economic events that came out over the past week.

Last week was mostly in the hands of central banks, which brought changes in current interest rates.

The Reserve Bank of New Zealand (RBNZ) was the first to come out with its changes on Wednesday, surprising markets by raising interest rates by 50 basis points, up from the expected 25 bp.

The RBNZ further noted that it would continue to focus on ensuring that the current high inflation does not become locked into longer-term expectations.

The minutes show that the Committee decided to continue tightening monetary conditions at a pace that would best maintain price stability and promote maximum sustainable employment.

The full minutes can be found here:

https://www.rbnz.govt.nz/news/2022/04/monetary-tightening-brought-forward

Later, the Bank of Canada (BOC) also published its monetary policy report and also raised its rate by 50bp to 1 % as expected.

The BOC noted that maturing Government of Canada bonds on the bank's balance sheet will no longer be replaced as of April 25.

With the economy entering a demand overhang and inflation remaining well above target, the Governing Council judged that interest rates would need to be raised further.

The report shows that there is strong growth in Canada and the economy is moving into excess demand. Wage growth is back to its pre-pandemic level and continues to rise.

BOC Governor Tiff Macklem confirmed at his press conference that we are witnessing a very impressive economic recovery.

You can find the full recording of the press conference here:

On Thursday, the European Central Bank (ECB) was the latest to issue a monetary policy statement, leaving rates unchanged.

In principle, there has been no change in the political outlook. However, there have been some changes in future guidance, as the ECB emphasises flexibility in taking any future decisions. So, we will see how "flexible" the ECB will be in the future and whether we will move interest rates up.

Meanwhile, the ECB has kept rates at zero since 2016.

The start of the current trading week will be slow due to the Easter holiday celebrations. The second half of the week will be more interesting as it will bring some interesting data on retail sales from Australia, Canada and the UK, which will be accompanied by a change in the Eurozone consumer price index.

We wish you a wonderful Easter!

Sources

Welcome to our regular recap of what happened over the past week.

The Reserve Bank of Australia (RBA) earlier this week left the cash rate unchanged at 0.10 %, as also expected. Anyway, we could see minor changes in the RBA's rhetoric. The RBA is moving in a more aggressive direction and dropping the stance of being patient. This leads to assumptions that the RBA may in the near term raise rates. Before raising rates, however, the RBA wants to see that inflation is within the target range of 2 to 3 %.

The economy remains resilient and its strength is reflected in the labour market. Spending is starting to rise as wage growth has accelerated.

Keeping rates unchanged and a slight change in the RBA's rhetoric helped the Aussie currency to strengthen.

Read the full statement:

https://www.rba.gov.au/media-releases/2022/mr-22-11.html

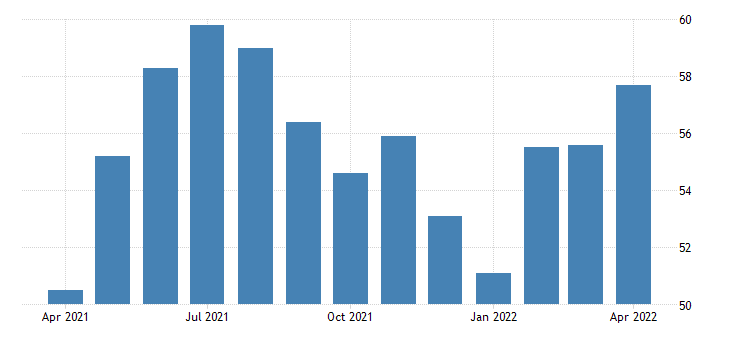

Last week also brought interesting numbers on the euro. Earlier in the week we were able to see new data on the purchasing managers' indices (PMIs), which were almost unchanged as expected:

Looser restrictions under Covid helped to push services activity in the euro area to a four-month high.

In the second half of the week, we could expect new data from the labour market and the publication of the ECB monetary policy meeting report.

Retail sales improved slightly in February - actual: 0.3 % / previous 0.2 %

It is clear from the ECB minutes that a large number of members see that the current trend of rising inflation in the euro area urgently requires further action.

Full report:

https://www.ecb.europa.eu/press/accounts/2022/html/ecb.mg220406~8e7069ffa0.en.html

Last week also saw the release of the latest UK Purchasing Managers' Index (PMI) numbers, which were slightly more positive:

UK economic growth continued to accelerate in March, following the Omicron-induced slowdown at the turn of the year, and business activity grew at its fastest pace.

Construction activity also continues to grow strongly.

The main event of last week was the so-called FOMC minutes on Wednesday, which only concern the US dollar.

The minutes show that many participants are in favour of raising rates by another 50 basis points. The Fed had already raised rates by 25 basis points on 16 March.

This gives the US dollar bullish signals for the future.

Full entry:

https://www.federalreserve.gov/monetarypolicy/fomcminutes20220316.htm

Last week, we received mainly new data from Canada concerning the labour market.

The new results show us that Canada's unemployment rate is steadily declining, and that's a good thing.

Unemployment rate - current: 5.3 % / previous: 5.5 %

The current trading week will be mainly marked by interest rate decisions coming out of New Zealand, Canada and the Eurozone. During the week we will also get a number of data regarding consumer price change (CPI) from the UK and the US. There will also be new data from the Australian labour market later in the week.

Keep an eye on our regular issues to keep track!

Sources

We bring you the regular Monday summary of economic events we followed in the last trading week, which was rich in statistical data.

Read on to stay in the loop!

The US currency has had a really rich week in terms of economic events. On Wednesday we could observe the growth of the US quarterly GDP, which was considerable (current: 6.9 %, previous: 2.3 %).

On the same day, the latest figures were released, which concerned the March ADP unemployment rate in the USA (current: 455 thousand). The ADP National Employment Report is a measure of monthly changes in nonfarm private employment.

The market is satisfied with the jobs situation at the moment. There is evidence that the Fed has changed its rhetoric to say that a hike to get inflation under control will be good for the long-term health of the labor market.

The end of the week brought us data concerning the so-called US NFP (nonfarm payrolls). These measure the change in the number of people employed during the previous month, excluding agriculture. Job creation is the main indicator of consumer spending, which makes up the bulk of economic activity.

The labour market remains strong and wage growth continues.

Friday's US unemployment rate showed us again that the labour market is starting to recover and strengthen (current: 3.6 %, previous: 3.8 %).

The US President's comments - J. Biden confirmed the situation when he said that more American workers now have real power to get better wages.

Wednesday's news from the Eurozone showed us that the unemployment rate in the Eurozone is on a downward trend (current: 6.8 %, previous: 6.9 %). The unemployment rate is thus at a record low. This is due to more favourable labour market conditions, which continue to underline the recovery from the pandemic.

The British pound had an interesting week in terms of economic news. In the second half of the week, the UK GDP news came out:

Late in the week, data was released regarding the Purchasing Managers' Index (PMI), which generally gives us a current view of the health of the economy (current: 55.2, previous: 58).

UK manufacturing growth slowed to a 13-month low as output and new orders grew at a reduced pace, while new export business fell for a second month. Inflationary pressures also affected overall activity.

The Australian currency has had a somewhat quiet week. At least as far as economic data is concerned.

At the beginning of the week we could only see new data concerning Australian retail sales. It turned out only slightly more positive (actual: 1.8 %, previous: 1.6 %) and thus was not particularly bullish for the Australian currency.

Similar to the Australian currency (AUD), the Canadian dollar (CAD) had a quieter week.

On Thursday (31 March) we could see the results of the monthly GDP, which increased only slightly (current: 0.2 %, previous: 0.1 %).

This week we will focus mainly on the Reserve Bank of Australia, which will decide on Tuesday on the interest rate change. Expectations for a hike are not very high. The RBA is leaving rates at 0.10 % from November 2020.

The second half of the week will offer us some economic data, mainly related to unemployment in Canada and retail sales in the Eurozone.

Keep an eye on our regular issues to keep track!

Sources