The last trading week was more in the interest rate area. At the end of the week, we also saw an escalation of the Iran-Israel war. Join us in recapping it all together to get you ready for the new trading week.

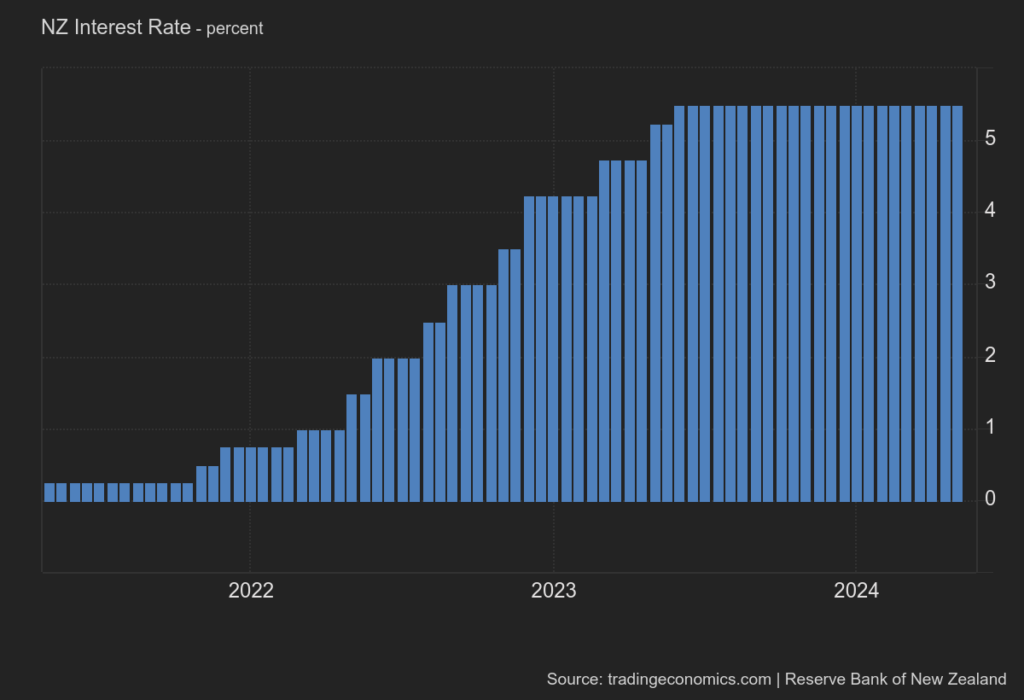

The Reserve Bank of New Zealand also left rates unchanged on Wednesday, as expected. The committee said rates will have to remain at higher levels for longer. Inflation expectations remain elevated. The central bank did not deliver any new surprises, but the NZD strengthened on the formulation that rates should remain higher for longer.

Monday: Swiss PPI (CHF), US retail sales (USD)

Tuesday: UK unemployment rate (GBP), Canadian inflation rate (CAD), Fed President J. Powell's speech (USD)

Sources:

Monday's recap of last week is here! Join us as we recap what we've been focusing on and what the current trading week has in store for us.

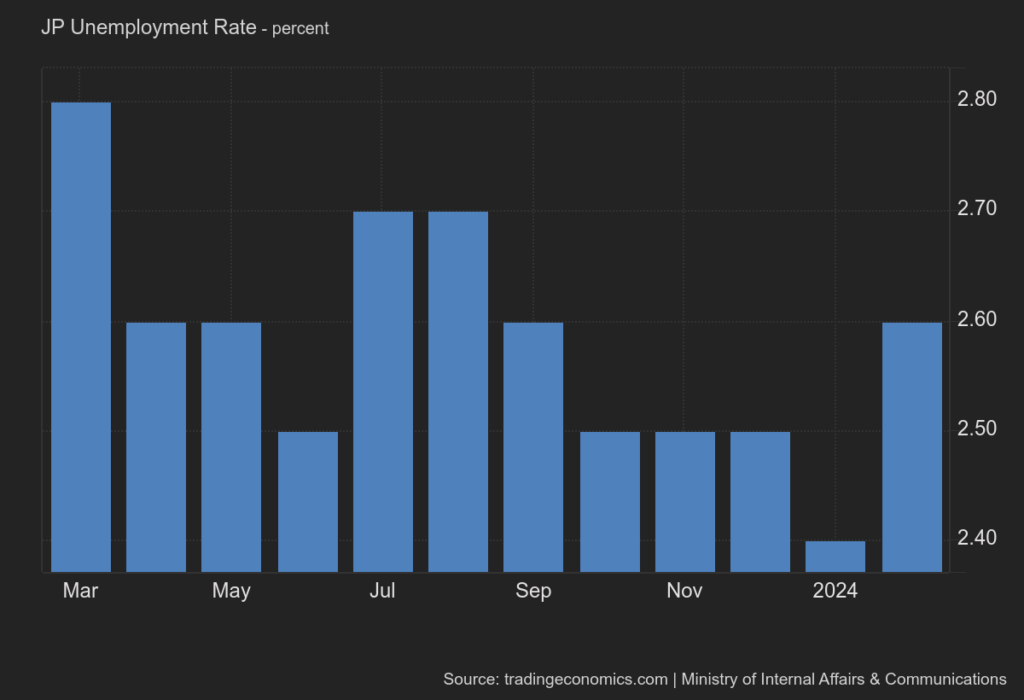

We received a number of data from Japan at the end of the week. Retail sales rose 4.6 % y/y, an acceleration from January's increase. Tokyo inflation was unchanged y/y at 2.6 % and we saw a small slowdown in the core reading. However, inflation is still above the Bank of Japan's target. The unemployment rate hit its highest level since September 2023. It's very much a combination for the JPY. The market is likely to focus more on inflation. Recently, we have seen mentions of intervention. That said, we will be very wary of any commentary that could move the JPY.

Monday: ISM PMI (USD), PMI (CAD)

Tuesday: PMI (AUD), RBA minutes (AUD), retail sales (CHF), German inflation rate (EUR), PMI (GBP)

Wednesday: Preliminary Eurozone inflation rate (EUR), ADP employment change (USD), PMI (USD), Powell's Fed speech (USD)

Sources:

The whole of last week was mostly about monetary policy meetings of central banks, where we got some surprising information. Come along with us for a recap of the highlights to get you up to speed for the new trading week!

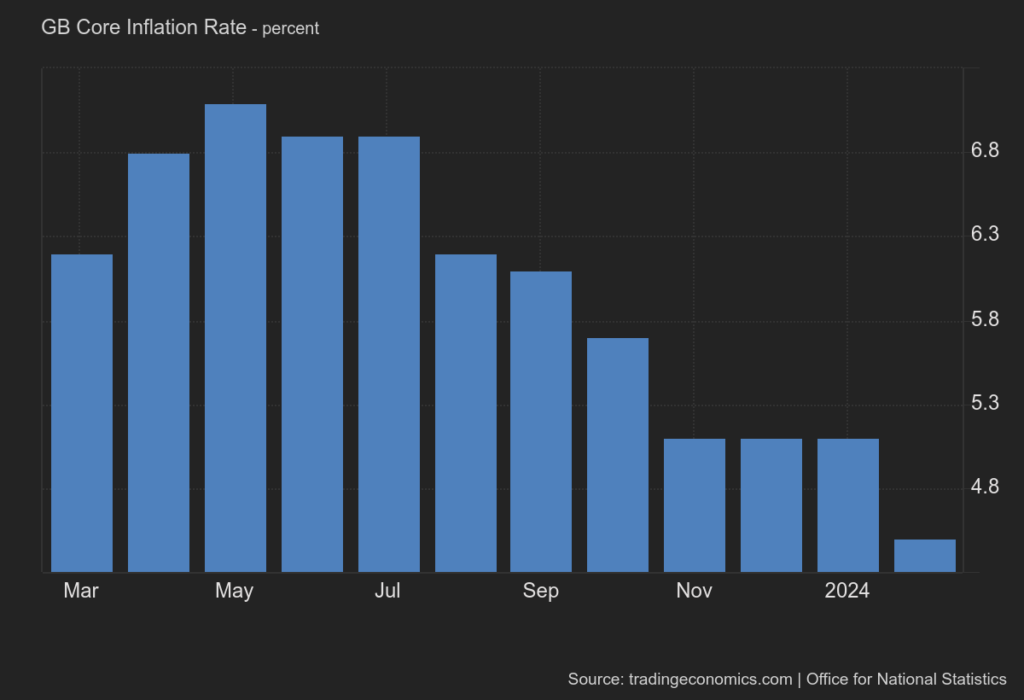

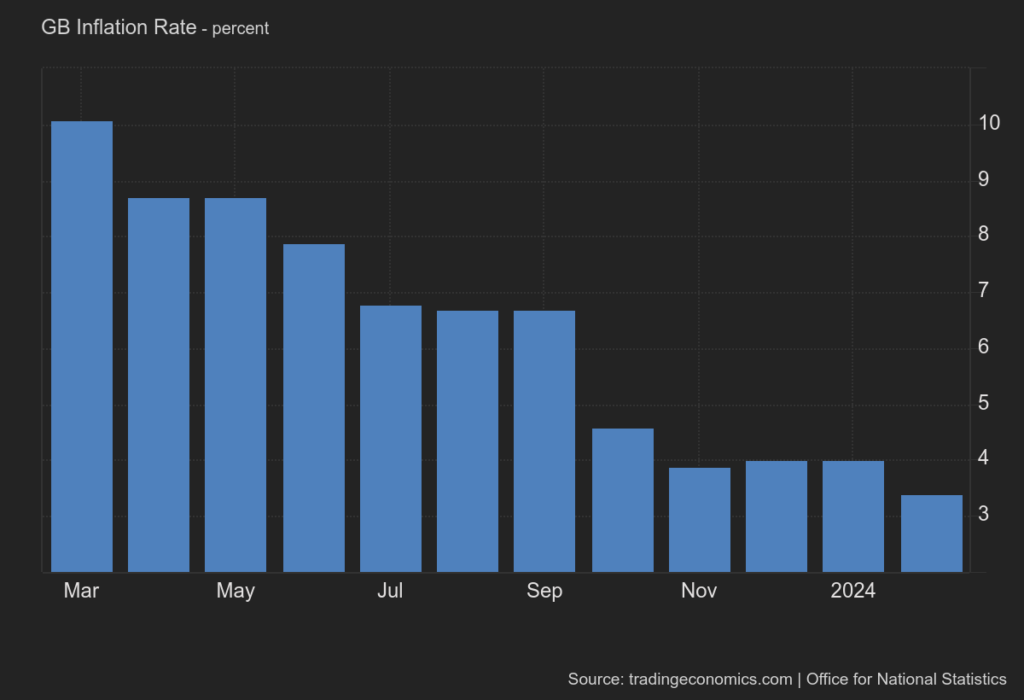

Wednesday's UK inflation rate also showed a decline. The core inflation rate fell to 3.4 % year-on-year in February, taking it to its lowest level since 9/2021. Core inflation fell to 4.5 %, taking it to its lowest level since 1/2022. This is negative news for the pound.

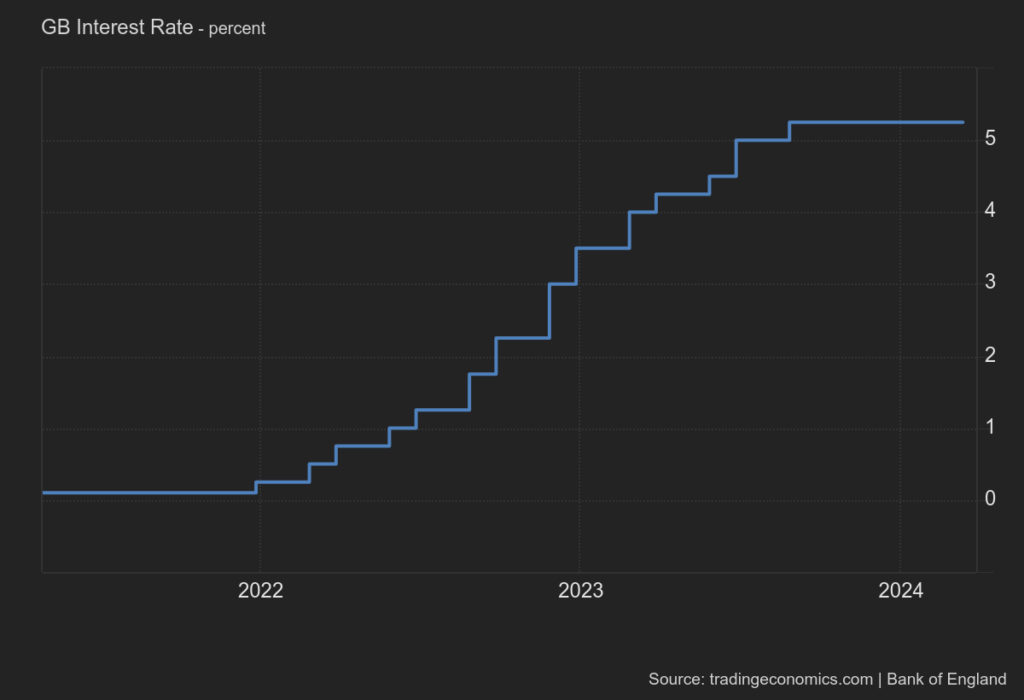

However, we focused more attention on Thursday's meeting of the Bank of England, which is estimated to have left rates unchanged at 5.25 %. One policymaker voted for a 25bp rate cut. BoE Governor Bailey said conditions were favourable for the central bank to start cutting interest rates. So here we could see a dovish stance and it is negative for the pound. Add to that falling inflation and the pound has not had a good week.

Tuesday: GDP - Spain (EUR)

Wednesday: inflation - Spain (EUR)

Sources:

The recap of the week is here! Join us in recapping the highlights of the past week. This week will be packed with fundamentals, so stay tuned!

Within the euro area, data came to us during the week mainly on inflation. The core inflation rate in Germany fell to 2.5 % in February, in line with estimates. This was the lowest reading since June 2021 and close to the ECB's target. The inflation rate in Spain fell to its lowest level in six months (2.8 %). Core inflation also fell slightly year-on-year to 3.5 %. Broadly unchanged from estimates. The inflation rate in France fell to 3 % in February. This was the lowest reading since 1/2022. On a month-over-month basis, however, we could see an increase of 0.8 %. This is the fastest growth since 8/2023.

In terms of retail trade, the Spanish retail sector declined to 0.3 % in January 2024, a deterioration compared to the previous period. Although this was the fourteenth consecutive month of growth, it was the weakest in the series.

Overall, this is negative news for the EUR, except for the month-on-month inflation in France, which is a bit of a thorn in the side.

Monday: Euro area inflation rate (EUR)

Tuesday: BOJ meeting (JPY), RBA meeting (AUD), inflation in Canada (CAD)

This week will be mostly about monetary policy meetings of central banks. There are 6 meetings on the agenda. Tuesday's Bank of Japan is expected to finally end its negative rate policy and raise rates by 10bp.

Sources:

We are currently planning to enhance our market analyses with additional interesting features. We will keep you informed, there is a lot to look forward to!

Another Monday recap is here! Join us as we recap what impacted the markets last week to keep you in the loop!

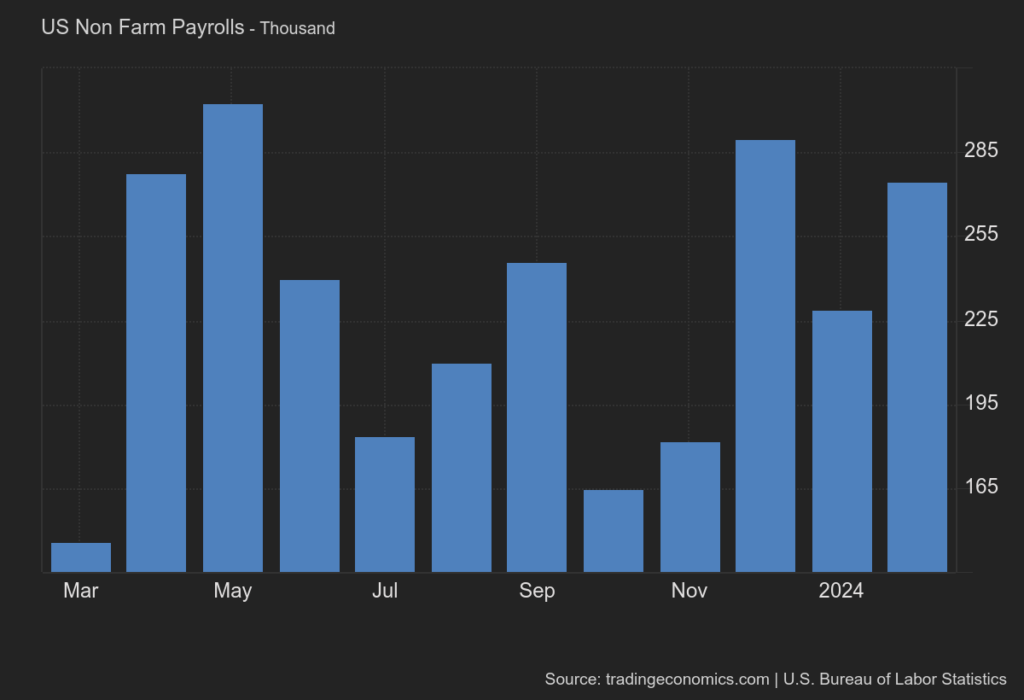

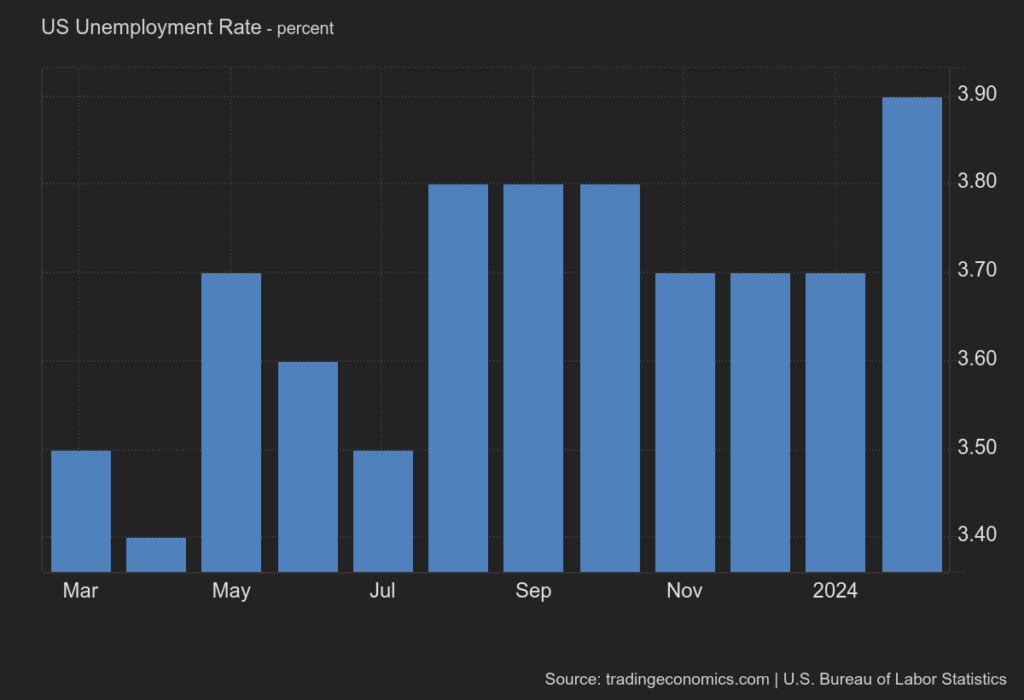

The end of the week was interesting for us mainly thanks to the data from the US labour market, on which the USD weakened. The US economy created 275,000 new jobs in February, which beat market estimates. However, as far as the unemployment rate is concerned, it was not that good. In fact, the unemployment rate rose to 3.9 % in February, reaching the highest level since January 2022.

At first glance, the numbers seemed good, but the details were not so good. The market focused on the unemployment rate and the USD weakened.

Tuesday: PPI in Japan, UK labour market, US inflation

Wednesday: UK GDP

Thursday: Swiss PPI, Spanish inflation

Sources:

Welcome to the first Fundamental Summary in March. Join us as we recap the most important events that impacted the markets at the turn of the month. Stay in the loop!

During the week, we received mostly inflation data from the euro area. France's annual inflation rate slowed to 2.9 % in February, the lowest since January 2022. Germany's inflation also posted a decline from 2.9 % to 2.5 in February, the lowest inflation rate since June 2021. Inflation also fell in Spain, where it slowed to 2.8 %.

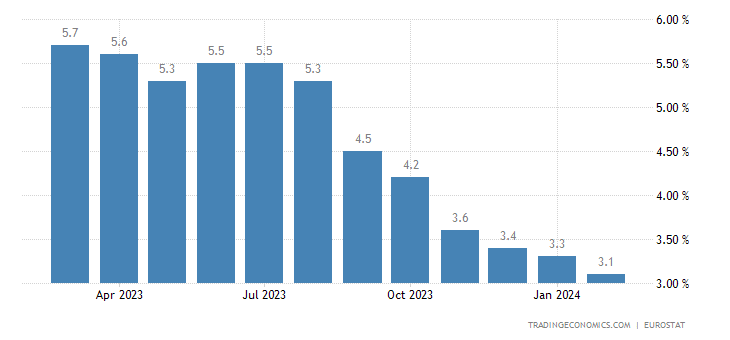

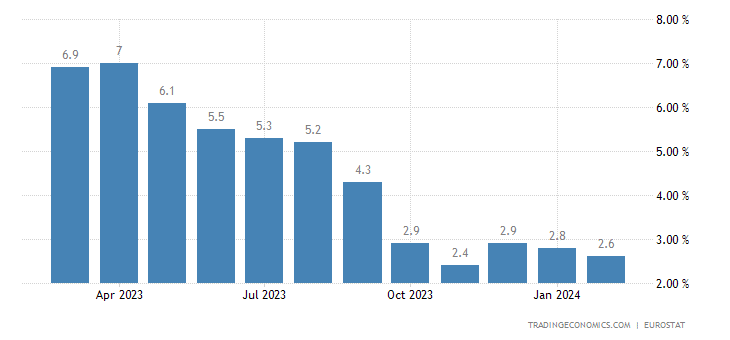

For the euro area as a whole, the annual core inflation rate fell to 3.1 %, slightly above market estimates but still the lowest since March 2022. The core inflation rate fell to 2.6 %.

Overall, the data are lower, and this is reassuring for the European Central Bank (ECB). Nothing should change in terms of the June rate cut. Negative for the euro.

At the end of the week, we focused on the unemployment rate, which, unlike inflation, was positive. The unemployment rate fell to 6.4 %, the lowest on record. This tells us that labour market conditions are holding up well. Positive for the euro.

Looks like we're in for quite a busy week. Monday's Swiss inflation rate should give us more clarity towards a March rate cut, where there is currently about a 50% chance.

Sources:

We have had a rather interesting trading week. Let's recap together the highlights of our focus.

The core inflation rate in the euro area fell to 2.8 % in January. Similarly, we could see a slight reduction in core CPI to 3.3 %. Nothing surprising, all as estimated. It will be some way to go for the ECB to get core inflation into the target range. Negative for the EUR.

Furthermore, according to preliminary estimates, we could observe a slight decrease in the manufacturing sector (PMI) to 46.1 points. Industrial production has declined for the 11th month in a row, which is not good. The positive news was services, which rose to 50 points. This represents an expansion in the sector and is the highest reading in 7 months.

Other currencies we had in our sights: USD, CAD, NZD...

Monday 26 February: scheduled speeches by the Bank of England and ECB President Christine Lagarde

Tuesday 27 February: inflation rate in Japan

Sources:

The new Monday summary is out! Let's recap what happened last week.

On Tuesday, we focused on UK labour market data, which was positive for the pound. The unemployment rate fell in Q3 2023 to its lowest rate since the period between November 2022 and January 2023.

The US Dollar was volatile last week as it got quite a bit of data from the US that we turned our attention to.

First we got the inflation rate, which fell to 3.1 % year-on-year.

The annual inflation rate in Switzerland slowed to 1.3 in January. This is the lowest since October 2021.

The big surprise was domestic inflation in the Czech Republic, which fell sharply to 2.3 %. This was still below market estimates, which had expected a reduction from 6.9 % to 2.9 %.

This week will be a bit weaker, but we will still get some interesting data coming in the middle of the week.

Monday, February 19: Canada and USA holiday

Tuesday, February 20: RBA meeting minutes, Canada - CPI, New Zealand - PPI. On Tuesday, we'll focus on the Canadian inflation rate, which comes in at 14:30.

Sources:

Monday's recap is out! Join us as we recap the highlights of what happened over the past week.

Last week, we received mostly PMI and retail sales data from the euro area, which turned out to be negative for the euro.

Compared to the worse Eurozone PMIs, we saw better data from the UK, which was positive for the Pound.

On Thursday we turned our attention to the traditional new US unemployment claims, which were very surprising and positive for the USD. The number of Americans who filed for unemployment benefits fell to 218k.

A Canadian rode the wave of more positive news from the US labour market at the end of the week. The unemployment rate dropped from 22 months in January. highs to 5.7 %. This beat market expectations and the result eased concerns that high interest rates were slowing the Canadian economy.

The Czech koruna lost ground during the week. The unemployment rate in the Czech Republic rose to 4 %. This is the highest since April 2021 and above the market estimate.

The new trading week will start slowly as Japan has a holiday on Monday. More interesting data will come on Tuesday, where we will focus on the UK labour market (8:00) and Swiss inflation (8:30). In the afternoon, we will turn our attention to the current inflation rate in the US (14:30).

Sources:

Monday's recap is out! Join us as we recap the highlights of the fundamentals that influenced the markets over the past week.

The euro was under pressure on Monday and Tuesday due to speeches by a couple of ECB politicians. According to Nagel, inflation is heading in the right direction, that was a pretty dovish comment from a hawk.

At the first monetary policy meeting of the year, the Bank of England is estimated to have left its key interest rate unchanged at 5.25 % (for the fourth consecutive time). The pound (GBP) strengthened.

The most important fundamental awaited us on Wednesday evening. The Fed left rates unchanged at 5.5 %, as the market expected.

On Wednesday morning we got the latest Australian inflation data which was negative for AUD. The core annual inflation rate came in at 4.1 %, which was still below market expectations.

An interview with Jerome Poewell (FED) will be aired at 1am on Monday first thing in the morning to discuss inflation risks and the economy. After last week's meeting, we probably won't get any surprises. Anyway, America responded with military action to the 3 US soldiers killed this week. So the risks to the markets remain elevated.

Sources: