Welcome to reading the regular Monday Fundamental Summary that we followed during the last trading week.

Last week was particularly rich in statistical data, which came mainly in the second half of the week.

Read on to find out more!

On Wednesday, data from the UK came in regarding the year-on-year change in Consumer Price Index (CPI). The index measures the change in the price of goods and services from the consumer's perspective, making it one of the key indicators of inflation. The index is thus once again reaching all-time highs, which will only continue to put pressure on the Bank of England (BOE) to start tightening policy again in the coming months.

At the end of the week, changes in UK retail sales came in for the UK currency. These turned out to be rather more pessimistic than expected (actual: -0.3 %, previous: 1.9 %).

It looks like the "cost of living crisis" is becoming more apparent.

On Wednesday, we saw comments from Fed Chairman Jerome Powell, who addressed the topic of digital currencies. Powell mentioned that there will have to be new rules and laws to deal with digital currencies, as the existing regulations are not ready for this. This is rather preliminary and general information for now and there is nothing new going on. For now, the Fed is exploring the benefits that digital currency could bring.

Later that day, Loretta Mester, the president of the Cleveland Fed, spoke, advocating a more aggressive policy. In her view, it was better to be more aggressive now because it would happen later anyway. So the mood here is that the Fed is going to prepare for further rate increases and up to 50 base points are in play.

The Japanese currency weakened for the second week in a row against other currencies traded on the forex market. The decline came when the Bank of Japan decided earlier this month to leave rates unchanged. However, the Japanese currency was not helped by the earthquake that struck northeastern Japan in the Fukushima area two weeks ago.

You can read more in the last release of the most interesting economic events.

Gōshi Kataoka (BOJ board member) said in his speech on Thursday that the risks to the Japanese economy are skewed to the downside. The downward pressure on it is increasing.

Kataoka also said that the BOJ is prepared to take appropriate action as needed in light of the pandemic's impact on the economy.

Full minutes of the March meeting:

https://www.boj.or.jp/en/announcements/release_2022/k220318a.pdf

This week will again be richer in statistical data. On Tuesday, we will expect results on February retail sales in Australia. In the middle of the week, we will have data from the US, which will mainly concern the US GDP.

The second half of the week will bring interesting GDP data coming out of the UK and Canada.

The most interesting will be the end of the week, when we will expect changes in the Eurozone Consumer Price Index (CPI) and the change in the US unemployment rate, accompanied by the change in the number of people employed during the previous month, excluding agriculture (Nonfarm payrolls).

Thus, we expect that the current trading week may also bring quite high volatility on the aforementioned currencies.

So keep an eye on our regular issues to keep track!

Sources

The start of a new trading week is here. That's why we have prepared another article in our regular series of summaries of economic events that affected our trading during the past week!

The first half of the week did not offer us much interesting data. However, this was corrected at the end of the week.

The week started with new figures concerning the current GDP development in the euro area.

The change in quarter-on-quarter and year-on-year GDP was almost as expected and quite positive for the euro:

The euro area economy was growing moderately at the end of 2021. The world's current focus is still on the war in Ukraine, thus dictating sentiment for the euro.

The second half of the week brought the promised volatility to the euro, thanks to the informal meeting of EU leaders held on Thursday and Friday.

Also on Thursday, the European Central Bank left its current key policy rates unchanged at its monetary policy meeting. Rates have remained at zero since 2016.

Read also: Latest Euro developments - ECB and EU leaders meeting

The US currency did not see any interesting data until Thursday.

First, the US CPI (Consumer Price Index) reports came out, which were positive for the US Dollar as expected.

Later, the balance sheet of the US federal budget came out, which was not very optimistic...

The February US federal budget deficit was USD 217 billion, compared to the expected USD 49 billion.

It's not a number that will completely corner the markets, but at least we know where we stand. Anyway, when you add in the prospective costs that will fall on defense, energy, and inflation dampening, it at least makes a good case for another deeper deficit.

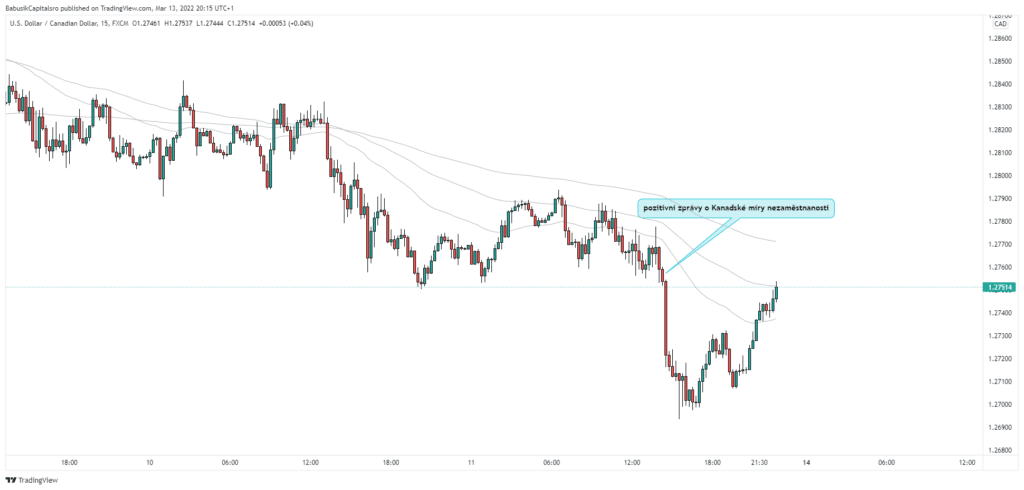

At the end of the week we could finally see some interesting data from the labour market in Canada.

The actual change in employment came out really positive (366.6 thousand actual vs. 160 thousand expected). This is the biggest jump since October 2020. Furthermore, the unemployment rate is expected to fall from 6.5 % to 6.2 %.

In January, the Canadian labour market recovery suffered a setback due to the Omicron option, with temporary layoffs in service industries and increased absenteeism. However, things now seem to be moving in the right direction.

Overall, the news was much better than expected, and a sharp rebound from the omicron. Expectations of a Bank of Canada (BOC) hike at the next meeting remain in favor of another 25 bps.

The positive news also helped the "Canadian", which started to strengthen against the dollar.

This week will have appropriate volatility. On Wednesday and Thursday, the markets will await the announcements regarding interest rate changes from the US and the UK. The Bank of Japan will then close the week with its interest rate statement.

Throughout the week, however, we will be watching incoming economic data from Canada regarding retail sales and the Eurozone Consumer Price Index.

Keep an eye on our regular issues to keep track!

Sources

We bring you our regular Monday dose of summaries of the most interesting economic events that have had an impact on the currencies we trade in the past trading week!

ECB Executive Board member Fabio Panetta kicked off the week with an online seminar focused on inflation in the euro area.

Panetta mentioned that it would not be wise to commit to future policy actions in advance. The role of the ECB is clear: we will take all necessary measures and use all our tools to strengthen confidence and stabilise financial markets. This is the duty of a central bank in times of need.

Panetta's full speech can be found here:

https://www.ecb.europa.eu/press/key/date/2022/html/ecb.sp220228~2ce9f09429.en.html

In the second half of the week, we saw new economic data regarding the Consumer Price Index (CPI) and the change in unemployment.

The year-on-year change in the euro area Consumer Price Index climbed to a current value of 5.8 %, compared with the previous value of 5.1 %. This implies a bullish signal for the euro.

Inflation in the eurozone is rising to new highs, and this only adds to the pressure on the ECB to deliver a firmer message at next week's meeting.

Thursday's data on the change in the unemployment rate was also favourable for the euro (current: 6.8 %, previous: 7.0 %). The unemployment rate is falling again and this only confirms the further improvement in labour market conditions.

On the same day, the ECB also issued its expected monetary policy statement, followed by a press conference.

The Governing Council expects the ECB's key interest rates to remain at current or lower levels until inflation reaches 2 %.

The full statement can be found here:

https://www.ecb.europa.eu/press/pr/date/2022/html/ecb.mp220203~90fbe94662.en.html

The US dollar also had a relatively rich week for fundamentals.

At the beginning of the week, the latest Purchasing Managers' Index numbers came in, which were slightly more positive than expected (current: 58.6, previous: 57.6).

Chairman of the Federal Reserve - Jerome Powell mentioned in testimony before the House Financial Markets Committee on Thursday that The Fed must step back from highly stimulative monetary policy.

Rising mortgage rates are likely to start cooling demand for housing, and housing is a significant component of inflation. Powell also mentioned that the U.S. economy is very strong, but the labor market is extremely tight.

The speech suggests that the Fed could raise rates by 25 basis points, but would raise them by 50 basis points if necessary.

Record of the output:

The second half of the week brought a number of data regarding the change in the US Purchasing Managers' Index (PMI), which came out positive for the USD:

Faster production growth was supported by an increase in new sales. A solid increase in demand from foreign clients also contributed to total new orders.

Chris Williamson's chief business economist, IHS said service-sector companies reported a strong rebound in business activity during February as measures to contain the virus were eased to their weakest level since November. The data show that Omicron had only a modest and short-term impact on the economy.

On the other hand... The conflict in Ukraine, however, is leading to further upward movements in energy and broader commodity prices, which will further add to US inflationary pressures

The end of the week was also enriched by data from the US labour market. The unemployment rate fell by 3.8 % in February (previous 4 %), confirming the downward trend. However, the US labour market remains tight.

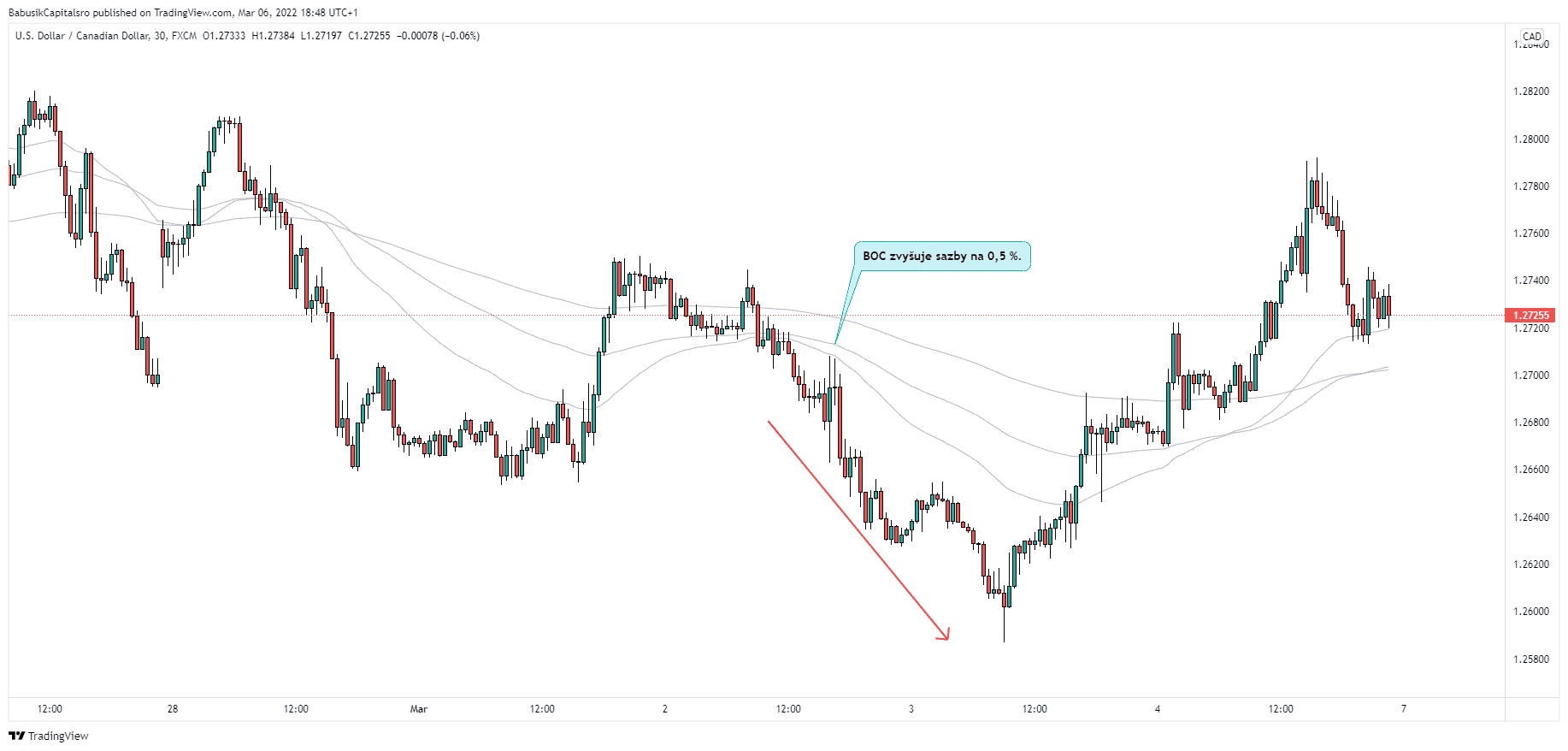

The Canadian dollar was the driver throughout last week, with interesting economic results coming in.

At the beginning of the week we were waiting for the result of the month-on-month GDP, which was a bit worse than expected (currently 0 %, previous: 0.6 %).

However, the markets were waiting for Wednesday's Bank of Canada (BOC) statement regarding the interest rate change.

Bank of Canada raised rates by 25 basis points to 0.50 %as expected and continues in the reinvestment phase. Furthermore, rates are expected to continue to rise at the next meetings!

As in other countries, Russia's invasion of Ukraine remains a major source of uncertainty. As a result, financial market volatility has increased.

BOC Governor - Tiff Macklem told the conference that Russia's invasion of Ukraine will cause further supply disruptions and the invasion will hit economic activity.

The full report can be found here:

https://www.bankofcanada.ca/2022/03/fad-press-release-2022-03-02/

Europe is still facing a war in Ukraine that has no end in sight. Neither are the negotiations to end this war.

As a result, many European currencies have become risky for the markets.

This week, the European Central Bank (ECB) will decide on a change in the interest rate, which has been at 0 % since 2016.

The ongoing war in Ukraine will be an integral part of the high volatility in the markets.

Keep an eye on our other reports to stay up to date!

Sources

We bring you another regular recap of the most interesting events from last week that affected our trading in the currency markets!

The beginning of the last trading week was in a rather classic trading spirit. However, that changed on Thursday when the Russian Federation attacked Ukraine at 4am CET. Panic and fear of what was going to happen took over the markets.

What impact has this had on currencies?

Read below.

Right from the start of the week, the first data came from the euro area, mainly concerning the change in the Purchasing Managers' Indices (PMI). These came out broadly positive and became a bullish signal for the euro, as higher readings are considered positive for the currency.

Manufacturing PMI - current: 58.4/previous: 58.7

Composite PMI - current: 55.8/previous: 52.3

Services PMI - current: 55.8/previous: 51.1

In the middle of the week, data were also released on the change in the Consumer Price Index (CPI), which measures the price of goods and services from the consumer's perspective and is thus becoming one of the key ways of measuring purchasing trends and inflation. The current number came out unchanged (5.1 %) and has become rather neutral for the currency.

The US currency has had a somewhat busier week. Following Monday's American holiday, dubbed "Presidents Day", which Americans celebrate every third Monday in February, new economic data came in, again relating to the Purchasing Managers' Index (PMI). As with both of the aforementioned currencies, this data came in more positive than expected for the US Dollar.

Manufacturing PMI - current: 57.5/previous: 55.5

Composite PMI - current: 56.0/previous: 51.1

Services PMI - current: 56.7/previous: 51.2

The second half of the week then brought new numbers regarding US quarter-on-quarter GDP, which were slightly stronger than the previous one (current: 7.0 %, previous: 4.9 %).

At the end of the week, the US Fed published its monetary policy report.

The Fed noted that it is firmly committed to achieving the monetary policy target given to it by Congress. However, the economy's path going forward will depend on the course of the virus and related measures to limit its spread.

Read the full report here:

https://www.federalreserve.gov/newsevents/testimony/powell20210223a.htm

More varied data came for the New Zealand currency in the second half of the week, which focused mainly on the change in New Zealand interest rates and retail sales numbers.

The Reserve Bank of New Zealand (RBNZ) raised its cash rate for the third consecutive time by 25 basis points (current rate: 1 %, previous rate: 0.75 %) as expected. The more hawkish commentary, which was a surprise, also certainly helped to strengthen the New Zealand dollar.

The RBNZ says further tightening is needed and RBNZ Governor Adrian Orr mentioned at his press conference that a further 50 basis point rate hike cannot be ruled out in the future.

That was enough hawkish commentary to cause the NZD to strengthen further.

The full statement can be found here:

https://www.rbnz.govt.nz/monetary-policy/monetary-policy-statement/mps-february-2022

In the second half of the week, data regarding New Zealand retail sales were released, which positively surprised and gave the New Zealand currency further impulses to strengthen (current: 8.6 %, previous: -8.1 %).

24 February - a day that made history!

On Thursday, February 24, 2022, the world and financial markets woke up to a new morning. A relatively classic week turned into hell and uncertainty for everyone.

The day after the Russian national holiday, named "Defender of the Fatherland Day", at 4 a.m. CET, Russian Federation troops attacked Ukraine.

This day will go down in history, as a war in Europe, in modern history.

This dramatic event did not only leave Europe, which watched helplessly at first, cold, but also gave unexpected volatility to the financial and currency markets, which experienced a big shock.

A number of European currencies (PLN, HUF, CZK) experienced a proper depreciation as a result of the big shock and uncertainty.

However, there were also currencies that began to strengthen in response to the situation. This was especially true for the Japanese yen (JPY) and gold. These instruments are usually considered to be the so-called "safe haven" in times of uncertainty.

Earlier this week, GDP numbers from Australia and Canada are due. The markets will also be waiting for Tuesday and Wednesday's interest rate announcements coming from Australia and Canada.

However, it is necessary to be on guard, because beyond these classic economic data, the whole world and the markets will be watching how the escalating situation around the war in Ukraine will develop.

Sources

Welcome to our regular recap of the most interesting fundamental events that influenced our trading last week.

The beginning of the week was somewhat weak from the position of fundamentals... But this changed at the end of the week when the markets were hit by the news of the Russian invasion of Ukraine.

A somewhat quiet Monday on the European currency was stirred up by the exit of the President of the European Central Bank (ECB) - Christine Lagarde, who again addressed topics related to inflation. Lagarde sees the likelihood that current price pressures will subside before they have time to settle...

She added that the chances of inflation stabilising at our target had increased. However, there were no signs that inflation would be persistently and significantly above our target over the medium term, which would require measurable tightening.

However, inflation will remain high in the near future and the ECB sees the risks to the economic outlook as broadly balanced in the medium term.

The euro remained less volatile after a significant increase the previous week. This remained unchanged after the exit and it went into a slight consolidation.

The second half of the week held some interesting speeches for the US currency by members of the US Federal Open Market Committee (FOMC), on behalf of the various Federal Reserve Presidents in San Francisco, Atlanta and Cleveland.

Inflation was again the main topic in the panel discussions.

Here we have several statements by FOMC members:

President of the San Francisco branch of the Federal Reserve Mary Daly told CNN in an interview that she is in favor of a rate hike in March, but the Fed cannot be overly aggressive in raising rates.

President of the Federal Reserve Bank of Atlanta Raphael Bostic says that we may be on the verge of a decline in inflation and there is evidence to suggest that inflation is falling.

Fed President in Cleveland Loretta Mester expects inflation to ease on the basis that the Fed will take "appropriate action".

It is clear from the discussions that most members believe that inflation will be better and that the Fed will take appropriate measures to bring inflation under control. Raising interest rates may be on the agenda. So the question is: what is "appropriate action"?

At the end of the week, the Fed released its Monetary Policy Report, containing discussions on the conduct of monetary policy, economic developments and future prospects.

You can read the full report here:

https://www.federalreserve.gov/monetarypolicy/mpr_default.htm

However, the Japanese yen experienced a decent rise on Friday, reacting to the White House press conference.

The US believes that Putin has decided to invade Ukraine and has announced these plans to the Russian military.

This news was followed by big moves in the markets and the forex market all the money is pouring into the yen, like a calm harbor.

Defense officials expect a horrific and bloody campaign that will begin with two days of electronic warfare bombing, followed by an invasion with the possible goal of regime change. The North Atlantic Council has been briefed on this new report.

If people fear the coming of an economic catastrophe, they flee with their capital to safe havens where they can weather the troubles without much loss. Outside of the classic haven of precious metals (gold), a mature economy with developed capital markets and a stable political backdrop is the best choice. For this reason, the Japanese yen is the currency of choice in times of uncertainty.

What's in store for the current trading week?

Next week will be richer in economic data. The first half of the week will see data on GDP from the euro area and the Consumer Price Index (CPI) of the UK and Canada.

However, the markets will be breathlessly watching the current events and developments in Ukraine, as it is believed that Russia may attack at any moment.

There is a certain assumption that traders will have in their outlook mainly currency pairs that contain the Japanese yen and gold.

That's why he follows us, to keep you in the loop!

Sources:

We bring you a regular recap of the fundamentals that influenced the markets in the past trading week.

The markets were anxiously awaiting Wednesday's long-awaited data from the US and Canada, mainly concerning the interest rate change.

At the beginning of the trading week, the data on the Purchasing Managers' Index (PMI) marking sentiment in the UK manufacturing sector came in slightly negative compared to the previous results:

Composite PMI: 53.4 versus 53.6

Manufacturing PMI: 56.9 vs. 57.9

Services PMI: 53.3 versus 53.6

The British pound began to weaken slightly on the basis of these results.

The bigger expected event of the week was the announcement of Canadian interest rates, which were left unchanged by the Bank of Canada (BOC) at 0.25 %.

However, this was a disappointment to the markets as the markets were pricing in a 70% probability of an increase and the Canadian dollar began to weaken. The Board of Governors prospectively expects rates to have to rise.

Full statement by the Bank of Canada:

https://static.bankofcanada.ca/uploads/pdf/mpr-2022-01-26.pdf

On the same day (Wednesday) the markets were also waiting for the announcement of the change in US interest rates, which the Fed left unchanged as expected at the current level of 0.25 %.

Jerome Powel (Chairman of the US Federal Reserve) mentioned that there is room for a rate hike without hurting jobs. Labour market conditions are consistent with maximum employment and there is currently a very strong consensus that it will soon be time to raise rates.

At the end of the week, the markets were still waiting for the US GDP results, which came out really positive for the US dollar: 6.9 % versus 2.3 %.

These events caused the US dollar to strengthen strongly in the second half of the week.

The start of this week will be weaker on economic data. We expect only GDP results from the euro area. On the other hand, we expect increased volatility on Tuesday and Thursday through interest rate announcements in Australia, the UK and the Eurozone. Also of interest will be the incoming PMI data from the US and the UK.

Sources:

Welcome to Monday's regular summary of fundamentals, which was mostly rich in data on Japanese and EU monetary policy.

At the beginning of the week (18.1.) we watched the incoming data on the interest rate change in Japan.

The Bank of Japan decided to keep the short-term interest rate at -0.10 %, which was also expected. Haruhiko Kuroda (BOJ Governor) stated in his press conference that he will ease monetary policy without hesitation if needed. There were no substantive and hawkish words and Kuroda rather stuck to the "mantra" from previous press conferences where interest rates have not moved from -0.10 % since 2016.

Thursday (20 January) was interesting because of the publication of the ECB's report on the monetary policy meeting held on 15 and 16 December 2021. ECB Governing Council member Isabel Schnabel assessed financial market developments since the previous meeting, which took place on 27 and 28 October 2021. It is evident that uncertainty about the future path of rates has increased, which has contributed to volatility in the markets. It has been stressed by a number of governors that the ECB should be more willing to adjust policy in either direction to stabilise inflation.

The full report of the meeting can be found here:

https://www.ecb.europa.eu/press/accounts/2022/html/ecb.mg220120~7ed187b5b1.en.html

At the end of the week, we were waiting for the December British Retail Sales data, but it was not very encouraging (currently - 3.7 %).

This week will again bring us interesting data in the field of interest rates. Wednesday will be particularly important, where we will see these data from the US and Canada. In addition, fundamental data will be coming in during the week regarding the British PMI and CPI in Australia and New Zealand.

The markets have properly woken up after the holidays, and so nothing but increased volatility can be expected on these coming days.

Sources:

Welcome to our regular Monday recap of the most interesting economic events that affected our trading last week, which brought a bit more than the first week of the New Year.

People are starting to wake up and recover from the New Year celebrations and so are the markets.

Tuesday (11 January) was mostly in the Fed's sights. During the day, we could see several speeches by members of the US Federal Open Market Committee (FOMC). One of the speakers was Esther George (President of the Federal Reserve Bank of Kansas City), who spoke about the outlook for economic and monetary policy in her window. Loretta Mester (President and CEO of the Federal Reserve Bank of Cleveland) would support a March 2022 rate hike if the U.S. economy remains on track.

At the end of the day, Fed Chairman Jerome Powell mentioned that the US economy has been expanding at a very fast pace in recent years and that the labour market is strong...

Other Fed officials are calling for more aggressive balance sheet normalization. Powell's comments suggest that he disagrees with this thinking and there was a slight weakening of the USD during his speech.

Powell's entire speech:

A day later, on Wednesday (12 January), we were interested in the latest data from the US Consumer Price Index (CPI), which is key for measuring inflation and purchasing trends.

The current value was slightly better than the previous one (0.6 % compared to 0.5 %).

On Tuesday, before a series of speeches by Fed members, ECB President Christine Lagarde gave a speech on the pressure of rising prices, which must be taken very seriously. The ECB expects inflation to fall this year and return below the 2 % target in 2023 and 2024.

At the end of the week, we expected new data from the UK regarding manufacturing output, which came out positive: 1.1 % actual vs. 0.1 %.

This week will be rich in fundamentals. On Tuesday, the Bank of Japan will comment on monetary policy and release new data on interest rate changes. On Thursday, the ECB will release its monetary policy meeting report. We expect increased volatility in the JPY and EUR markets on these days.

Sources:

Pictured: Federal Reserve Chairman Jerome Powell

The second trading week of 2022 is here and we bring you a regular recap of the most interesting economic data and events that took place last week.

On Tuesday and Thursday (4.1. and 6.2.) we focused our attention on data from Great Britain, which mainly concerned PMI indices:

Manufacturing PMI (Tuesday): 57.9 vs. 58.1

The report confirms continued growth in UK manufacturing towards the end of last year. Output and new orders both rose in December, although price pressures remain elevated.

Composite PMI (Thursday): 53.6 % vs. 57.6

This is the lowest reading since February for activity in services.

In Wednesday's Federal Open Market Committee (FOMC) meeting minutes, we learned that inflation continues to be well above the Fed's 2% target and the structural factors that have kept inflation low may reemerge once the effects of the pandemic subside.

Participants continued to highlight the uncertainties associated with the length of time it will take to resolve the supply chain situation.

On employment, most participants noted that the US labour market was very tight.

On Friday, we got data on US Nonfarm Payrolls, which measures the change in the number of people employed during the previous month, excluding agriculture. The household survey showed a very sunny picture of the labor market with unemployment falling and the employment to population ratio improving.

On Friday, we were also waiting for CPI (Consumer Price Index) data from the euro area, which measures the change in the price of goods and services from the consumer's perspective. Currently 5.0 % versus the previous 4.9 %.

We expect the first half of the week to be weaker on data. On Tuesday, we will expect ECB President Christine Lagarde to speak and later in the day, Fed Chair Jerome Powell to speak about the economic outlook and recent monetary policy actions before the Joint Economic Committee in Washington.

We will focus our attention mainly on the second half of the week, which will be a bit richer in economic data. On Thursday, the December PPI (Producer Price Index) and Initial Jobless Claims (which measures the number of individuals who filed for unemployment insurance for the first time during the past week) will come from the US.

On Friday, we expect data from the UK, which will focus on manufacturing production and the afternoon speech by ECB President Christine Lagarde.

Sources:

We bring you the first overview of the most interesting economic events we followed at the turn of the year!

We hope that you enjoyed the Christmas holidays and the New Year celebrations abundantly and to your liking. 😊

Now is the time to get back in front of your computers and keep an eye on what economic events may affect your trading.

We wish you pleasant reading and many profitable deals in 2022!

Last trading week was pretty poor for economic data thanks to the Christmas holidays and New Year celebrations. Still, a few results caught our attention.

Right on Monday (26 December) we focused our attention on the incoming Japanese annual retail sales data, which came out slightly more positive than the previous one (1.9 % actual vs. 0.9 % previous). Retail sales measure the change in the inflation-adjusted total value of sales at the retail level. It is a leading indicator of consumer spending, which accounts for the majority of total economic activity.

A day later, we got data on U.S. Pending Home Sales. The National Association of Realtors (NAR) Pending Home Sales report measures the change in the number of homes under contract to be sold but still waiting to close on the transaction, excluding new construction. This report does not have that much impact on currency, but it is interesting for a general overview of the US economy.

The first trading week of the New Year is usually slower to get going. This means we expect less volatility and frequency of economic news.

Earlier in the week, we will focus on UK PMI data and US Nonfarm payrolls data.

We can't wait for a good dose of economic events this year will bring!

Sources: